Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Tax Compliance Auditing interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Tax Compliance Auditing Interview

Q 1. Explain the difference between tax evasion and tax avoidance.

Tax evasion and tax avoidance are often confused, but they represent distinct actions with significantly different legal ramifications. Tax evasion is the illegal non-payment or underpayment of tax. It involves actively concealing income, inflating deductions, or using other deceptive practices to deliberately reduce one’s tax liability. Think of it like this: it’s akin to stealing from the government.

Tax avoidance, on the other hand, involves using legal methods to minimize one’s tax burden. This could involve making smart investment choices, strategically timing transactions, or taking advantage of legal deductions and credits. It’s like playing the game within the rules to win.

Example: Evasion might involve creating a fake business to claim false deductions. Avoidance could be contributing to a tax-advantaged retirement plan like a 401k to reduce taxable income. The key difference is legality – evasion is illegal and punishable, while avoidance is perfectly legal and encouraged.

Q 2. Describe your experience with SOX compliance related to tax processes.

In my previous role at a publicly traded company, I was heavily involved in ensuring SOX (Sarbanes-Oxley Act) compliance regarding our tax processes. This involved meticulously documenting all tax-related internal controls, ensuring these controls were operating effectively, and performing regular testing to identify any weaknesses. We used a combination of automated controls within our ERP system and manual controls performed by the tax team.

Specifically, my responsibilities included:

- Designing and implementing control activities around the accuracy and completeness of tax data input into our ERP system.

- Developing and testing key controls over the tax provision process, focusing on the accuracy of calculations and appropriate disclosures.

- Participating in the annual SOX audit, providing supporting documentation and responding to auditor inquiries related to tax processes.

- Regularly reviewing and updating the tax control documentation to reflect any process changes or improvements.

My efforts contributed to the successful completion of our annual SOX audits, demonstrating the effectiveness of our tax control environment.

Q 3. How do you ensure the accuracy and completeness of tax filings?

Ensuring the accuracy and completeness of tax filings is paramount. My approach is multi-faceted and involves a combination of robust internal controls, thorough data validation, and continuous monitoring. This includes:

- Data Validation: We utilize automated reconciliation processes comparing data from different sources (e.g., general ledger, payroll, and external sources) to identify inconsistencies. Any discrepancies trigger a review process.

- Control Testing: Regular testing of our internal controls helps to ensure they are effective in preventing errors and fraud.

- Reconciliations: We perform detailed reconciliations between tax returns and underlying accounting records to validate accuracy.

- Peer Review: A second set of eyes on the tax returns before filing ensures that nothing has been overlooked.

- Technology Utilization: Utilizing tax software and data analytics tools to improve data accuracy and minimize human error.

For example, if there’s a large variance between reported income and tax calculations, we immediately investigate the root cause to correct any errors before filing.

Q 4. What are the key components of a robust tax control environment?

A robust tax control environment is built on several key pillars. Think of it as a strong foundation supporting a house – each component is vital for the whole structure’s stability.

- Clear Segregation of Duties: Different individuals should be responsible for different parts of the tax process to prevent fraud and error.

- Documented Processes: Well-defined and documented processes ensure consistency and accountability across the board.

- Strong Internal Controls: This includes controls over data input, processing, and reporting, as well as authorization controls for tax-related transactions.

- Regular Monitoring and Review: Continuously monitoring key tax metrics and reviewing the effectiveness of internal controls allows for the identification and correction of any issues.

- Technology and Automation: Using tax software and other technologies to improve efficiency and accuracy.

- Independent Review: An independent review of the tax processes helps to identify any potential control weaknesses.

A strong control environment not only minimizes the risk of errors but also protects the organization from penalties and legal issues.

Q 5. Explain your understanding of the Internal Revenue Code (IRC) relevant to your experience.

My understanding of the Internal Revenue Code (IRC) is extensive and deeply relevant to my work. While I can’t claim to know every section of the IRC, I have a solid grasp of the sections most relevant to my experience, including:

- Sections related to corporate income tax: This encompasses areas like deductions, credits, depreciation methods, and accounting rules relevant to calculating corporate tax liability.

- International tax provisions: Understanding tax treaties, foreign tax credits, and transfer pricing regulations is vital for managing international tax obligations.

- Sections related to various types of income: I understand the tax treatment of ordinary income, capital gains, dividends, and interest income as it applies to different entities.

- Penalties and compliance requirements: A clear understanding of penalties for non-compliance and the relevant disclosure requirements is crucial.

My knowledge enables me to navigate complex tax issues, interpret relevant regulations, and advise on compliance strategies. I regularly consult the IRC and stay updated with any changes through professional resources and continuing education.

Q 6. Describe your experience with tax provision processes.

I have extensive experience in tax provision processes, from the initial data gathering to the final financial statement reporting. My role involves:

- Data Collection and Analysis: Gathering and analyzing financial data from various sources to calculate taxable income.

- Tax Calculation: Applying relevant tax rates and regulations to calculate the company’s tax liability.

- Balance Sheet and Income Statement Impacts: Determining the impact of tax calculations on the balance sheet and income statement.

- Tax Disclosure: Preparing the necessary disclosures for financial statements according to Generally Accepted Accounting Principles (GAAP) and other regulatory requirements.

- Variance Analysis: Analyzing variances between actual tax results and prior-year provisions.

I’m proficient in using specialized tax software to streamline the process and ensure accuracy. For example, I’ve managed the tax provision process for several large corporations across various jurisdictions, effectively minimizing risks and ensuring compliance.

Q 7. How do you identify and assess tax risks within an organization?

Identifying and assessing tax risks within an organization is a critical part of my role. My approach is systematic and involves several steps:

- Risk Assessment: Identifying potential tax risks by analyzing the organization’s business operations, financial transactions, and the relevant tax laws and regulations.

- Tax Risk Profile: Developing a tax risk profile that considers the likelihood and impact of each identified risk.

- Documentation Review: Reviewing relevant tax documentation (e.g., tax returns, supporting schedules, contracts) to identify potential areas of concern.

- Data Analysis: Analyzing financial and operational data to identify trends and patterns that may indicate higher risk areas.

- Compliance Testing: Conducting testing procedures to assess the effectiveness of internal controls in mitigating tax risks.

- Mitigation Strategies: Developing and implementing strategies to mitigate identified risks, including improved internal controls, enhanced processes, and training programs.

For example, a company engaging in international transactions faces significant transfer pricing risks. I would analyze the company’s intercompany agreements, identify any potential areas of non-compliance, and recommend appropriate adjustments to mitigate these risks.

Q 8. What methodologies do you use to conduct a tax compliance audit?

Tax compliance audits employ a structured approach combining various methodologies. The most common is a risk-based audit, where we identify areas of highest risk for non-compliance. This involves analyzing the taxpayer’s industry, past filings, and current financial statements to pinpoint potential issues. We might focus on specific transactions or accounts based on this risk assessment.

Another approach is a compliance testing methodology. This involves selecting a sample of transactions and thoroughly reviewing them for accuracy and adherence to tax laws and regulations. For example, we might audit a sample of expense reports to verify that they are properly documented and appropriately classified for tax purposes.

Finally, we utilize data analytics to identify patterns and anomalies that might signal non-compliance. This involves using specialized software to sift through large datasets, looking for unusual activity. Imagine, for example, using software to flag unusually high payments to vendors who might be related parties.

The selection of methodology depends heavily on the size and complexity of the taxpayer’s business, the industry’s inherent risk, and the audit’s objectives.

Q 9. How do you handle discrepancies found during a tax compliance audit?

Discrepancies found during a tax compliance audit require a systematic approach. The first step is to clearly document the discrepancy, noting the specific item, the difference identified, and the source documentation used. We carefully review the supporting documentation to understand the reason for the discrepancy.

If the discrepancy is a simple error, like a mathematical miscalculation, we will work with the client to correct it. However, for more significant issues, a more thorough investigation is needed. This could involve requesting additional documentation, interviewing personnel, or potentially consulting with tax specialists in relevant areas.

Once the cause of the discrepancy is understood, we will propose a course of action. This may involve adjustments to the tax return, recommending changes to internal controls, or suggesting additional procedures for compliance in the future. We always strive to provide constructive feedback while ensuring accuracy and adherence to regulations. A straightforward example: a discrepancy in depreciation calculations might be addressed by revising the depreciation schedule using the correct method and providing supporting calculations.

Q 10. Explain your experience with tax reconciliation procedures.

Tax reconciliation is a crucial part of a comprehensive audit. My experience encompasses various reconciliation methods, including reconciling book income to taxable income. This process involves comparing financial records maintained by the company (book income) with the information reported on their tax return (taxable income). The differences need careful investigation and explanation.

For example, we might find differences due to temporary or permanent book-tax differences. A temporary difference might be related to accelerated depreciation for tax purposes but straight-line depreciation for book purposes. A permanent difference could arise from items not deductible for tax but includable in book income, such as penalties or municipal bond interest. Each difference is documented meticulously to determine its tax impact.

Another area of my expertise is reconciling various tax accounts, such as sales tax, property tax, and payroll tax accounts with the amounts reported to the relevant tax authorities. This process ensures consistency and completeness in tax filings and helps prevent potential penalties.

Q 11. What software or tools do you utilize for tax compliance audits?

My toolkit for tax compliance audits includes a variety of software and tools. Data analytics platforms such as Alteryx and Tableau are vital for analyzing large datasets and identifying trends and anomalies. These tools allow us to efficiently process vast amounts of data, something that would be almost impossible manually.

We also use specialized tax software like Corptax or GoSystem, to perform tax calculations, prepare returns, and analyze tax provisions. These are indispensable for accuracy and efficiency.

Furthermore, document management systems help maintain an organized audit file. These help track documents, communications, and findings throughout the audit process, ensuring nothing is overlooked and allowing for seamless team collaboration. Finally, Microsoft Office Suite remains a critical tool for generating reports, communicating findings, and preparing presentations.

Q 12. How do you prioritize tasks and manage your time during a tax audit?

Effective time management is crucial in tax audits. I employ several strategies. First, a comprehensive audit plan is developed at the outset. This outlines the scope of the audit, specific procedures to be performed, timelines, and responsible parties.

I prioritize tasks based on their risk and impact. High-risk areas are addressed first to identify and resolve potential material misstatements quickly. I also utilize project management tools, often task management software or even a simple spreadsheet to track progress and deadlines.

Regular communication and team meetings are crucial for keeping the project on track. This ensures everyone understands their responsibilities and allows for prompt resolution of any unexpected issues or challenges that arise. Think of it like managing a complex puzzle: you need to start with the crucial pieces and assemble them methodically.

Q 13. Describe your experience with documenting audit findings.

Thorough documentation of audit findings is paramount. This forms the basis for the audit report and serves as evidence of the audit work performed. My approach is to use a standardized format for documenting each finding. This typically includes: a description of the issue, the supporting evidence, the impact on tax liability, and the recommended corrective action.

I maintain a comprehensive audit file, which includes all relevant documentation, such as client records, supporting schedules, correspondence with the client, and internal working papers. Everything is meticulously organized and cross-referenced to ensure the audit trail is clear and easily followed.

For example, if we found a discrepancy in the deduction for charitable contributions, the file would include copies of the donation receipts, calculations supporting the correct deduction, and a note explaining the adjustment made to the tax return. Clear and comprehensive documentation is not just about meeting regulatory requirements; it’s about defending our work and ensuring the accuracy of our findings.

Q 14. How do you communicate complex tax issues to non-technical audiences?

Communicating complex tax issues to non-technical audiences requires simplifying technical jargon and using clear, concise language. I achieve this by using analogies and real-world examples that resonate with the audience.

Instead of using technical terms, I explain the concepts in plain English, avoiding jargon as much as possible. Visual aids like charts and graphs can also greatly assist in explaining complex information. I focus on explaining the ‘why’ behind the tax issue, explaining the implications of the findings in a way that is relevant to the audience’s interests and responsibilities.

For instance, instead of saying, “The taxpayer’s basis in the asset was incorrectly determined under IRC Section 1012,” I would explain, “The value of the asset used for tax purposes was calculated wrong, leading to an incorrect tax amount.” This simpler explanation makes the concept understandable without resorting to technical terminology.

Q 15. What is your approach to continuous improvement in tax compliance?

Continuous improvement in tax compliance is a journey, not a destination. My approach centers on a cyclical process of assessment, implementation, monitoring, and refinement. It’s akin to perfecting a recipe – you constantly tweak it based on results.

- Assessment: This involves regular reviews of our current compliance procedures, identifying areas for potential improvement through data analysis, risk assessments, and internal audits. We look at efficiency, accuracy, and the effectiveness of our controls.

- Implementation: Based on the assessment, we implement changes. This might involve adopting new technology, updating internal processes, or providing additional training to our team. For instance, we might implement a new automated system for reconciling tax accounts.

- Monitoring: We closely monitor the impact of implemented changes. This involves tracking key metrics, such as the time taken for compliance tasks or the error rate. Key performance indicators (KPIs) are crucial here.

- Refinement: The monitoring phase reveals areas needing further improvement. This iterative process allows for constant optimization. For example, if a new software implementation doesn’t improve efficiency as expected, we’ll analyze why and adjust our approach.

This cyclical process ensures that our tax compliance function is always evolving and adapting to the ever-changing regulatory landscape and technological advancements.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe a time you identified a significant tax compliance issue. What was your approach to resolution?

During an audit of a large manufacturing client, we uncovered a significant discrepancy in their depreciation calculations. They had been using an accelerated depreciation method for certain assets that wasn’t appropriate given their tax status. This could have led to substantial underpayment of taxes over several years.

My approach to resolution was methodical:

- Documentation: We meticulously documented the discrepancy, including the specific assets, the incorrect depreciation method used, and the relevant tax regulations. We compared their methods to the Internal Revenue Code and relevant case law.

- Communication: We communicated our findings clearly and professionally to the client’s senior management and tax team. We emphasized the potential risks and the importance of prompt correction.

- Collaboration: We worked collaboratively with the client to determine the best course of action. This included recalculating depreciation using the correct method and preparing amended tax returns.

- Mitigation: We helped the client develop internal controls to prevent similar errors in the future. This involved revising their depreciation policies and providing staff training. We also worked to understand the root causes of the error to avoid similar issues in the future.

- Disclosure: We ensured full disclosure to the relevant tax authorities, following all proper procedures for amending tax returns.

The collaborative approach resolved the issue successfully, minimizing the financial and reputational impact on the client while maintaining compliance.

Q 17. Explain your familiarity with various tax forms (e.g., 1040, 1120, etc.).

My familiarity with tax forms extends across various contexts, from individual to corporate filings. I have extensive experience with forms like:

- Form 1040 (U.S. Individual Income Tax Return): I’m proficient in understanding and analyzing all schedules related to this form, including those for business income, capital gains, and itemized deductions.

- Form 1120 (U.S. Corporation Income Tax Return): I have a deep understanding of its various schedules and the nuances of corporate tax accounting, including depreciation, amortization, and the treatment of various deductions.

- Form 1065 (U.S. Return of Partnership Income): I am comfortable navigating partnership tax rules and the allocation of income and deductions among partners.

- Form 1041 (U.S. Income Tax Return for Estates and Trusts): I understand the intricacies of estate and trust taxation, including the distribution of income and the fiduciary responsibility involved.

- Other relevant forms: My knowledge also encompasses forms related to international tax, excise taxes, payroll taxes, and state and local taxes. The specific forms will be directly relevant to the client’s specific situation.

My experience includes not just completing these forms but also understanding the underlying tax regulations that govern their proper completion. I also utilize tax software which helps in automating and streamlining the preparation process significantly.

Q 18. How do you stay current with changes in tax laws and regulations?

Staying current with ever-evolving tax laws and regulations is paramount. I employ a multi-faceted approach:

- Professional Development: I actively participate in continuing professional education (CPE) courses and webinars offered by reputable organizations like the AICPA and relevant state societies of CPAs. This ensures I’m up-to-date on the latest changes and interpretations.

- Tax Publications and Journals: I subscribe to and regularly review leading tax journals and publications, such as the Journal of Taxation and Tax Notes. This provides in-depth analysis of current issues.

- Tax Software and Databases: I utilize professional tax software and databases, which provide timely updates and ensure I have access to the latest tax laws, forms, and regulations. These sources are consistently updated to incorporate the most recent changes.

- Networking: I actively engage in networking with other tax professionals through industry conferences and professional organizations. The exchange of ideas and experiences helps keep me informed about new developments and best practices.

- Government Websites: I regularly consult the IRS website and relevant state tax agency websites for official announcements, guidance, and updates.

This proactive approach ensures I can provide clients with the most accurate and timely tax advice.

Q 19. What are the key challenges you foresee in tax compliance in the next few years?

Several key challenges are likely to shape the tax compliance landscape in the coming years:

- Increasing Complexity of Tax Laws: The tax code is becoming increasingly complex, requiring greater expertise and sophisticated technology to navigate effectively. The introduction of new tax legislation, particularly in areas such as international taxation, will add to this complexity.

- Technological Advancements and Data Analytics: The rapid advancement of technology, including AI and machine learning, will necessitate the implementation of more robust and sophisticated data analytics capabilities to improve compliance and risk management. This necessitates professional development and adaptation.

- Globalization and Cross-Border Transactions: Increased globalization and cross-border transactions present unique challenges in ensuring compliance with various international tax laws and regulations. Understanding BEPS (Base Erosion and Profit Shifting) initiatives is increasingly vital.

- Cybersecurity Threats: The rising threat of cyberattacks necessitates the implementation of robust cybersecurity measures to protect sensitive tax information and ensure data privacy. Data security and protection are becoming more important than ever.

- Talent Acquisition and Retention: Attracting and retaining skilled tax professionals with the necessary expertise will be crucial for organizations to effectively manage their tax compliance obligations. The demand for skilled tax professionals will continue to increase.

Successfully navigating these challenges will require a proactive and adaptable approach, leveraging technology and expertise to maintain compliance.

Q 20. Describe your experience with international tax compliance.

My experience with international tax compliance encompasses advising clients on a variety of cross-border transactions, including:

- Foreign Tax Credits: I have assisted clients in claiming foreign tax credits to avoid double taxation on income earned in foreign countries.

- Foreign Income Reporting: I’m experienced in preparing and filing various international tax forms required to report foreign income and assets, such as Form 8938 and Form 5471.

- Transfer Pricing: I have a strong understanding of transfer pricing regulations and have advised clients on the proper documentation and methodologies for setting transfer prices between related entities in different jurisdictions.

- Permanent Establishments: I’ve advised clients on determining whether they have a permanent establishment in a foreign country and the tax implications thereof.

- Tax Treaties: I have expertise in interpreting and applying various bilateral tax treaties to minimize the international tax burden for clients.

My experience extends to various countries and tax systems, and I understand the nuances of each jurisdiction’s laws.

Q 21. How familiar are you with transfer pricing regulations?

I’m very familiar with transfer pricing regulations. These regulations aim to prevent multinational companies from artificially shifting profits to low-tax jurisdictions. My understanding encompasses:

- Comparable Uncontrolled Price (CUP) Method: This involves comparing the price charged between related parties to the price charged between unrelated parties for similar goods or services.

- Cost Plus Method: This method adds a markup to the cost of goods or services to determine a transfer price. This markup represents a reasonable profit for the supplier.

- Resale Price Method: This involves determining the transfer price based on the resale price of the goods or services, less a reasonable markup for the reseller.

- Transactional Net Margin Method (TNMM): This method compares the net profit margin of a controlled transaction to the net profit margin of comparable uncontrolled transactions.

- Documentation Requirements: I understand the importance of maintaining comprehensive transfer pricing documentation to support the chosen transfer pricing methodology, demonstrate compliance with the regulations, and to aid in responding to potential audits.

I’ve assisted clients in developing and implementing robust transfer pricing policies, preparing documentation, and responding to tax authority inquiries related to transfer pricing.

Q 22. What are your experiences with data analytics in tax compliance?

Data analytics has revolutionized tax compliance. My experience involves leveraging various tools and techniques to identify trends, anomalies, and potential risks within large datasets. This includes using statistical modeling to analyze financial transactions, employing data visualization to pinpoint areas of concern, and using machine learning algorithms to detect patterns indicative of non-compliance. For example, I used predictive modeling to identify potentially fraudulent expense reports by analyzing historical data on expense claims, employee roles, and approval workflows. This significantly reduced the time spent on manual review and improved the accuracy of our compliance assessments.

Specifically, I’m proficient in using tools like Alteryx and Tableau to cleanse, transform, and visualize large financial datasets. I’ve also worked with programming languages like Python and R to develop custom scripts for data analysis and reporting, automating tasks such as data extraction, validation, and reconciliation. This automation allows for faster and more efficient compliance checks than manual processes. In one particular instance, we used Python to create a script that automatically flagged transactions exceeding a pre-defined threshold, which helped us to identify and address several previously overlooked issues.

Q 23. Describe your understanding of corporate tax returns.

Corporate tax returns are complex documents designed to report a company’s financial performance and tax liability to the relevant tax authorities. They require a meticulous understanding of tax laws, accounting principles, and specific industry regulations. The process involves collecting financial data from various sources, analyzing the information to determine applicable deductions and credits, and accurately calculating the tax owed. A key component is ensuring proper adherence to the relevant tax code, like the Internal Revenue Code (IRC) in the US or equivalent regulations in other jurisdictions. These returns encompass various schedules and forms to detail different aspects of a business’ financial activity, such as income, expenses, assets, and liabilities.

My understanding extends beyond simple preparation. I’m adept at identifying and addressing potential tax risks, ensuring the accuracy and completeness of the data provided, and optimizing the tax position of the company within the bounds of the law. This includes understanding the implications of different accounting methods and the potential impact of tax planning strategies.

Q 24. How do you manage and mitigate risks related to tax audits by the IRS?

Managing and mitigating tax audit risks involves a proactive, multi-layered approach. It starts with robust internal controls, ensuring that all financial transactions are properly documented and accounted for. This includes maintaining accurate records, implementing strong segregation of duties, and regularly reviewing financial statements. Another crucial step is thorough tax planning, ensuring that all applicable deductions and credits are claimed appropriately and in accordance with the relevant tax laws. This involves staying abreast of changes in tax legislation and consulting with tax experts when necessary.

Proactive risk management also involves regular self-assessment and identifying potential areas of weakness. This could involve analyzing past tax returns for potential errors, reviewing industry best practices, and conducting internal audits. In the event of an IRS audit, a well-organized record-keeping system, detailed supporting documentation, and a clear understanding of the tax laws are essential. Open communication and prompt responses to IRS inquiries are also crucial for a successful resolution. For example, having a dedicated audit response team ready with well-organized documents can significantly reduce the stress and length of an audit.

Q 25. Explain your experience with the development and implementation of tax policies and procedures.

I’ve been actively involved in developing and implementing tax policies and procedures for various organizations. This often begins with a thorough assessment of the current processes, identifying any weaknesses or inefficiencies. I then work collaboratively with stakeholders, including finance, legal, and operations teams, to develop policies that are both compliant and practical. This involves clear communication of the policies to employees, regular training sessions to ensure understanding, and the establishment of a clear reporting structure for tax-related issues.

Implementing these policies requires careful monitoring and periodic review to ensure their effectiveness and ongoing compliance. This often includes using automated tools and systems to track tax-related data and generate reports. For instance, I once implemented a new system that automated the reconciliation of sales tax payments, reducing errors and freeing up staff for other tasks. The success of this implementation was measured by a reduction in errors, a faster reconciliation process, and improved overall compliance.

Q 26. What are your strengths and weaknesses in Tax Compliance Auditing?

My strengths lie in my analytical abilities, attention to detail, and my proactive approach to risk management. I’m highly organized and possess strong problem-solving skills, enabling me to effectively navigate complex tax issues. My experience with data analytics allows me to efficiently analyze large datasets and identify potential risks before they escalate. I also possess strong communication skills, enabling me to effectively communicate complex tax concepts to both technical and non-technical audiences.

One area I’m actively working on improving is my familiarity with international tax regulations. While I possess a solid understanding of domestic tax law, expanding my knowledge in the international arena would enhance my ability to serve a broader range of clients. I’m addressing this through continued professional development and seeking opportunities to work on international tax projects.

Q 27. Describe your experience with tax controversy and dispute resolution.

My experience with tax controversy and dispute resolution includes representing clients in audits, providing technical support during IRS examinations, and negotiating settlements with the tax authorities. This involves a deep understanding of tax law, a strong command of relevant case law, and an ability to effectively communicate and present complex information. It is crucial to remain objective, build a strong case supported by documented evidence, and to understand and leverage available negotiation strategies.

I’ve been involved in several instances where we successfully negotiated a reduction in the initial assessment by the IRS through meticulous documentation and compelling arguments. We were able to demonstrate that some of the initial findings were based on misinterpretations of the relevant laws, and through collaborative discussion we reached a resolution that was favorable to the client while remaining fully compliant.

Q 28. How would you handle pressure and tight deadlines during a tax audit?

Handling pressure and tight deadlines during a tax audit requires a structured approach and effective time management. I prioritize tasks based on urgency and importance, focusing on critical deadlines first. I use project management tools to track progress and ensure that all deadlines are met. Effective communication with the team and stakeholders is crucial, keeping everyone informed of progress and any potential challenges. Breaking down large tasks into smaller, manageable steps helps prevent feeling overwhelmed. Finally, maintaining a clear head and focusing on the task at hand, coupled with delegating where appropriate, helps to manage stress effectively and ensure timely completion.

I also recognize the importance of self-care during periods of high stress. Ensuring adequate rest and breaks is essential to maintain focus and productivity. Taking short breaks to recharge can actually improve overall efficiency and prevent burnout.

Key Topics to Learn for Tax Compliance Auditing Interview

- Understanding Tax Laws and Regulations: Grasp the fundamental principles of relevant tax codes and regulations. This includes familiarity with both federal and state tax laws, depending on the specific role.

- Internal Controls and Risk Assessment: Learn how to evaluate a company’s internal controls related to tax compliance and identify potential areas of risk. Understand how to apply risk-based auditing techniques.

- Data Analysis and Interpretation: Develop proficiency in analyzing large datasets related to financial transactions to detect anomalies and potential non-compliance issues. Practice interpreting complex financial statements.

- Audit Procedures and Methodology: Familiarize yourself with various audit procedures, such as testing of controls, substantive testing, and sampling techniques. Understand different audit methodologies and their applications.

- Tax Compliance Documentation and Reporting: Learn how to effectively document audit findings and prepare comprehensive reports. Understand the importance of clear and concise communication of audit results.

- Tax Controversy and Dispute Resolution: Gain an understanding of tax controversy procedures and dispute resolution methods. This includes knowing how to address discrepancies and potential tax liabilities.

- Relevant Accounting Standards (GAAP/IFRS): Demonstrate a solid understanding of Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), as these form the basis for tax compliance.

- Software and Technology: Familiarize yourself with commonly used tax software and data analysis tools. Be prepared to discuss your experience with relevant technologies.

- Professional Ethics and Standards: Understand the importance of adhering to professional ethics and standards in tax compliance auditing. This includes maintaining confidentiality and objectivity.

Next Steps

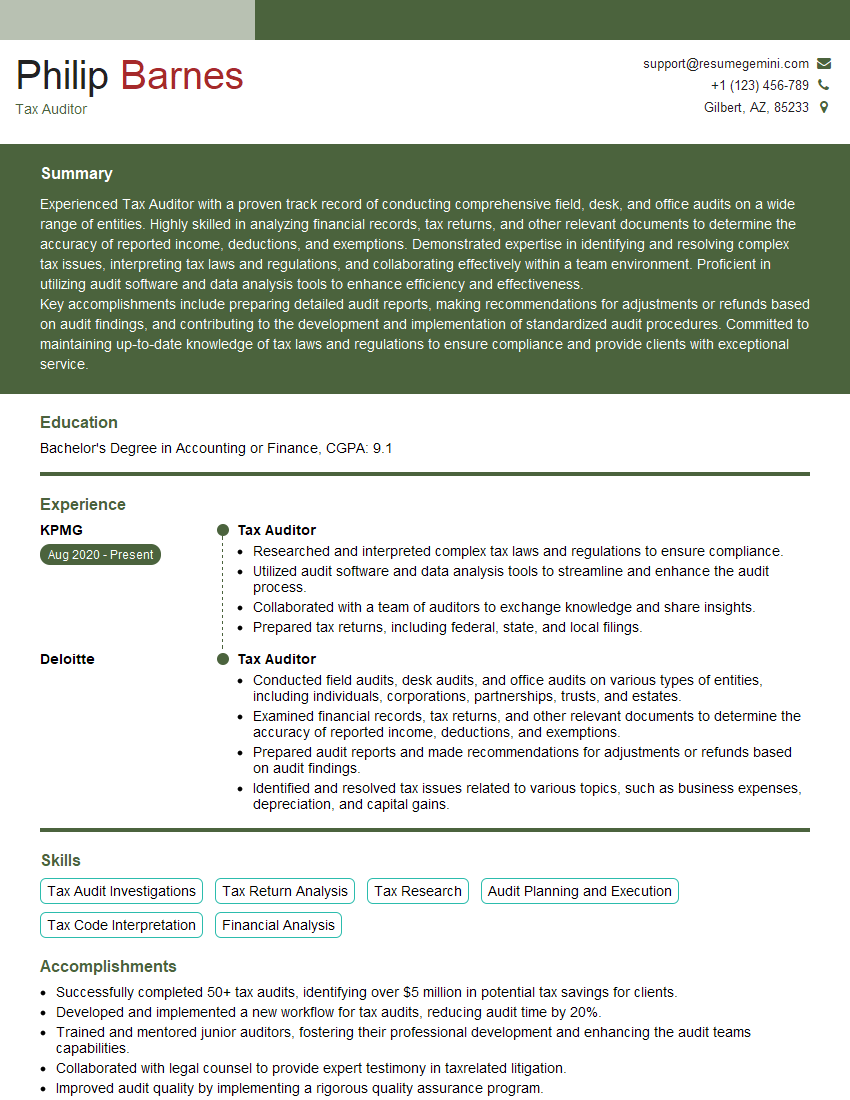

Mastering Tax Compliance Auditing opens doors to rewarding careers with excellent growth potential. This specialized skillset is highly sought after, leading to increased earning potential and opportunities for advancement within reputable organizations. To significantly boost your job prospects, crafting a strong, ATS-friendly resume is crucial. ResumeGemini is a trusted resource to help you build a professional resume that effectively highlights your skills and experience. Examples of resumes tailored to Tax Compliance Auditing are available to guide you, ensuring your application stands out.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.