Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Tax Audit Management interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Tax Audit Management Interview

Q 1. Explain the different types of tax audits.

Tax audits can be categorized in several ways, depending on the triggering event and scope. Broadly, we can distinguish between:

- Field Audits: These involve an on-site examination of a taxpayer’s records and operations by a tax auditor. This is the most comprehensive type of audit, requiring a physical visit to the taxpayer’s premises to review documentation, interview personnel, and verify information. For example, a field audit might be triggered by a large discrepancy between reported income and industry benchmarks.

- Desk Audits (Office Audits): Conducted remotely, desk audits utilize information already submitted by the taxpayer. The auditor reviews the submitted tax returns and supporting documents without requiring an on-site visit. This type of audit is often used for smaller discrepancies or routine compliance checks. A desk audit might be initiated after a computer-assisted review flags unusual deductions on a tax return.

- Correspondence Audits: These are the least intrusive. They involve communication primarily through letters or emails, requesting clarification or additional documentation on specific aspects of a tax return. For instance, a correspondence audit might focus on a particular deduction claimed without requiring extensive additional documentation.

- Tax Assessments/Review by Tax Officials: Sometimes, tax authorities will conduct reviews or assessments of a taxpayer’s activities even without a formal audit process. This might involve examining industry trends or benchmarking to assess a taxpayer’s liability.

The type of audit selected depends on factors such as the complexity of the taxpayer’s operations, the potential risk of non-compliance, and the resources available to the tax authority.

Q 2. Describe your experience with risk assessment in tax audits.

Risk assessment is crucial in tax audits. It helps prioritize audits based on the likelihood of non-compliance and the potential tax revenue at stake. My approach involves a multi-faceted assessment:

- Data Analysis: I leverage data analytics tools to identify unusual patterns or anomalies in tax filings, such as unusually high deductions compared to industry norms or inconsistencies across different tax years. This often reveals high-risk areas requiring deeper scrutiny.

- Industry Benchmarking: Comparing a taxpayer’s financial performance and tax filings against industry averages helps identify potential red flags. For example, consistently low profit margins compared to industry peers might suggest underreporting of income.

- Compliance History: Past audit findings and compliance history play a vital role. Taxpayers with a history of non-compliance are naturally flagged as higher risk.

- Internal Controls: Evaluating the strength of a taxpayer’s internal controls to ensure accurate and reliable financial record-keeping is also considered. Weaknesses in controls increase the likelihood of errors or intentional misreporting.

For example, in a recent audit of a manufacturing company, data analysis revealed unusually high depreciation expenses compared to similar firms. This triggered a more in-depth investigation, which uncovered errors in asset valuation leading to a significant tax adjustment.

Q 3. How do you identify and address potential tax fraud?

Identifying tax fraud requires a combination of analytical skills and investigative techniques. My approach focuses on:

- Red Flags Identification: I look for inconsistencies in financial statements, unusual transactions, unexplained cash flows, and discrepancies between reported income and known assets. Examples include significant cash deposits without clear sources, round-number transactions, or inconsistencies between bank statements and tax returns.

- Data Mining and Analytics: Advanced data analytics techniques can identify patterns indicative of fraud, such as unusual relationships between different data points. For instance, correlation analysis can highlight improbable linkages between seemingly unrelated transactions.

- Third-Party Verification: I independently verify information reported by the taxpayer by contacting banks, suppliers, and other relevant parties. This helps establish the accuracy and legitimacy of claimed transactions and deductions.

- Interviewing and Interrogation Techniques: Carefully conducted interviews with key personnel can reveal crucial information, even if initially undisclosed. Skilled questioning techniques help uncover discrepancies and inconsistent statements.

A recent case involved a retail business where data analysis uncovered inconsistencies in sales records. Further investigation revealed a sophisticated scheme to underreport sales by using dummy invoices and cash transactions. The evidence collected led to significant penalties and legal repercussions for the business owners.

Q 4. What are the key steps involved in a tax audit?

A typical tax audit follows a structured process:

- Planning and Scoping: Defining the audit’s scope, objectives, and resources based on the risk assessment.

- Data Collection: Gathering relevant financial records, tax returns, and supporting documentation from the taxpayer.

- Data Analysis and Verification: Examining records for accuracy, consistency, and compliance with tax laws. This often involves detailed analysis of financial statements, reconciliations, and supporting schedules.

- Audit Testing: Performing various tests (e.g., substantive tests, compliance tests) to verify the accuracy of specific transactions or assertions.

- Issue Identification and Documentation: Identifying and documenting any discrepancies or non-compliance found during the audit.

- Communication with Taxpayer: Discussing findings with the taxpayer, addressing their questions and allowing them to provide explanations or supporting evidence.

- Audit Report Preparation: Preparing a comprehensive report summarizing the audit findings, conclusions, and recommendations.

- Follow-up: Monitoring the implementation of any agreed-upon adjustments or corrective actions.

Each step requires meticulous attention to detail and adherence to auditing standards to ensure the fairness and objectivity of the process.

Q 5. Explain your experience using data analytics in tax audits.

Data analytics plays an increasingly important role in modern tax audits. I’m proficient in using various data analytics tools and techniques, including:

- Data Extraction and Transformation: Efficiently extracting data from various sources (e.g., ERP systems, tax software, databases) and transforming it into a suitable format for analysis.

- Statistical Analysis: Utilizing statistical methods to identify unusual patterns, outliers, and anomalies in the data.

- Data Visualization: Creating insightful visualizations (e.g., dashboards, charts, graphs) to present audit findings clearly and concisely.

- Predictive Modeling: Developing predictive models to identify potential high-risk taxpayers and areas of non-compliance before a formal audit.

For example, in a recent audit of a large corporation, I used data mining techniques to identify unusual expenses that were flagged as potentially non-deductible. This allowed us to focus our audit efforts efficiently and effectively, leading to a quicker and more comprehensive assessment.

Q 6. How do you handle disagreements with taxpayers during an audit?

Disagreements with taxpayers are a common occurrence during audits. My approach to handling disagreements emphasizes professionalism, transparency, and a collaborative spirit:

- Clear Communication: I strive to clearly articulate the audit findings, the rationale behind them, and the relevant tax laws. I maintain open communication channels to ensure the taxpayer understands the issues.

- Documentation: All aspects of the disagreement are meticulously documented, including the taxpayer’s arguments, supporting evidence, and the auditor’s responses. This creates a clear audit trail.

- Negotiation and Compromise: Where possible, I strive to reach a mutually agreeable resolution through negotiation and compromise. This may involve adjusting audit findings based on new evidence or additional clarification.

- Escalation Procedure: If a resolution cannot be reached through negotiation, I follow the established escalation procedures, which may involve higher-level management or legal counsel.

In one instance, a disagreement arose regarding the deductibility of certain expenses. Through careful review of the taxpayer’s documentation and discussions, we found a misunderstanding of the relevant tax regulations. This led to a compromise that was satisfactory to both parties.

Q 7. What are your skills in tax law and regulations?

My expertise in tax law and regulations is extensive, encompassing various areas including:

- Federal and State Tax Codes: A deep understanding of the complexities of the Internal Revenue Code and relevant state tax laws is paramount. This includes familiarity with various tax forms, regulations, and compliance requirements.

- Tax Accounting Principles: A strong grasp of Generally Accepted Accounting Principles (GAAP) and their relevance to tax reporting is essential for accurate tax audits.

- Tax Treaties and International Taxation: Experience in international tax matters, including transfer pricing, foreign tax credits, and cross-border transactions is valuable in globalized economies.

- Tax Litigation and Dispute Resolution: Knowledge of tax court procedures and litigation strategies is beneficial in resolving disputes effectively.

I regularly update my knowledge through professional development courses, conferences, and subscriptions to legal and tax publications, ensuring I remain current with changes in tax legislation and judicial precedents. This continuous learning keeps my skills sharp and my expertise relevant.

Q 8. Describe your experience with tax compliance software.

My experience with tax compliance software spans over a decade, encompassing a wide range of platforms. I’m proficient in using both large-scale enterprise resource planning (ERP) systems integrated with tax modules, such as SAP and Oracle, and specialized tax software like Thomson Reuters ONESOURCE and Avalara. I’m comfortable navigating complex data structures, generating reports, and performing data analysis within these systems. For example, in a recent engagement, I used ONESOURCE to identify and reconcile discrepancies in a client’s sales tax filings, resulting in significant savings through accurate reporting. My skills extend beyond simply using the software; I understand the underlying tax principles and can leverage the software’s capabilities to optimize tax compliance strategies. I’m also adept at configuring and customizing these platforms to meet specific client needs, ensuring seamless integration with existing workflows.

Q 9. How do you manage a team of tax auditors?

Managing a team of tax auditors requires a blend of technical expertise, leadership skills, and effective communication. I foster a collaborative environment where each team member feels valued and empowered. My approach involves clearly defining roles and responsibilities, setting realistic goals and deadlines, and providing regular feedback and mentorship. We utilize project management tools to track progress and identify potential bottlenecks. I believe in delegating tasks effectively based on individual strengths and providing opportunities for professional development. For instance, I’ve mentored junior auditors on advanced tax research techniques, leading to improved accuracy and efficiency in their audits. Regular team meetings serve as platforms for knowledge sharing and problem-solving, ensuring everyone stays informed and aligned on project objectives. Open communication and constructive feedback are paramount in creating a high-performing and motivated team.

Q 10. How do you prioritize tasks during a tax audit?

Prioritizing tasks during a tax audit involves a systematic approach. I typically begin by understanding the overall audit objectives and the client’s specific needs. Then, I apply a risk-based approach, focusing first on areas with the highest potential for tax risk or material misstatement. This may involve examining high-value transactions, complex tax structures, or areas identified through data analytics. For instance, if a client operates in multiple jurisdictions, we might prioritize audits of states with higher tax rates or more stringent regulations. Time sensitivity is another key factor; tasks with approaching deadlines take precedence. We use project management tools to create detailed work plans, assigning tasks with clear deadlines and monitoring progress regularly. Regular communication with the client helps to ensure we are addressing their most pressing concerns. This multi-faceted approach guarantees that critical areas are addressed efficiently and effectively, maximizing the impact of our audit efforts.

Q 11. What is your experience with different tax systems?

My experience encompasses various tax systems, including US federal and state tax systems, international tax systems (specifically, those of the UK and Canada), and Value Added Tax (VAT) systems prevalent in the European Union. I am familiar with the nuances of each system, including differing tax rates, regulations, and reporting requirements. This understanding extends beyond merely knowing the rules; I understand the practical implications of these differences for businesses operating across jurisdictions. For example, I’ve assisted clients in navigating the complexities of foreign tax credits and the intricacies of transfer pricing regulations. This broad-based knowledge allows me to effectively manage audits involving multi-jurisdictional operations, ensuring complete and accurate compliance across all relevant tax systems.

Q 12. Explain your approach to documentation and reporting in tax audits.

Documentation and reporting are cornerstones of a successful tax audit. My approach emphasizes thoroughness, accuracy, and auditability. We maintain detailed work papers for every audit step, including evidence supporting our findings, methodologies, and conclusions. This includes documentation of all communication with the client, internal discussions, and any external consultations. We utilize a standardized format to ensure consistency and ease of review. Our reports are clear, concise, and well-organized, presenting our findings in a non-technical manner when possible, with supporting schedules and exhibits where necessary. For example, we might use charts and graphs to visually represent key findings, making the information easily digestible for the client. This meticulous documentation not only ensures the quality of our work but also protects against potential disputes or challenges.

Q 13. How do you ensure the accuracy and completeness of your audit findings?

Ensuring the accuracy and completeness of audit findings is paramount. We employ a multi-layered quality control process. This includes peer reviews of audit work papers, independent verification of calculations and data, and comprehensive testing of our findings. We utilize data analytics to identify anomalies and potential inconsistencies in the data. For example, we might use regression analysis to identify unusual patterns in expense reports or compare a client’s tax returns to industry benchmarks. Our audit methodology relies on clearly defined audit procedures and rigorous adherence to professional standards. Before finalizing any report, we conduct a thorough review to ensure all relevant aspects have been considered and that our conclusions are adequately supported by the evidence. This meticulous approach to quality control guarantees that our audit findings are reliable and trustworthy.

Q 14. How do you maintain confidentiality during a tax audit?

Maintaining confidentiality is critical in tax audits. We adhere to strict confidentiality agreements and comply with all applicable laws and regulations protecting client data. Access to sensitive information is restricted to authorized personnel only, and we utilize secure systems and protocols for data storage and transmission. Our internal policies and procedures strictly forbid the discussion of client information outside of the designated audit team. This commitment to confidentiality extends to all aspects of our work, from initial client engagement to final report delivery. We treat all client data with the utmost care and respect, understanding the sensitive nature of the information we handle and the importance of protecting our client’s reputation and interests.

Q 15. Describe a time you had to deal with a challenging tax audit.

One particularly challenging audit involved a multinational corporation with complex intercompany transactions and a highly decentralized accounting system. The initial documentation was fragmented and inconsistent, making it difficult to trace the flow of goods and services across different subsidiaries. The challenge wasn’t just the sheer volume of data, but the lack of clear audit trails and discrepancies in reporting methods.

My approach involved a phased strategy. First, I prioritized identifying key risk areas, focusing on high-value transactions and jurisdictions with stricter regulations. We then implemented a robust data analytics approach, leveraging advanced data visualization techniques to identify anomalies and patterns in the data. This allowed us to pinpoint specific transactions requiring further investigation, efficiently reducing the audit scope. We worked closely with the client’s accounting team, engaging in collaborative discussions to address the identified discrepancies and provide constructive feedback. Through this process, we uncovered several instances of misclassification of income and expenses, leading to a significant adjustment in the company’s tax liability. The successful resolution, despite the initial complexity, highlighted the importance of thorough planning, collaborative investigation, and a data-driven approach. This project enhanced my proficiency in handling large-scale audits with complex international elements.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you stay up-to-date on changes in tax laws and regulations?

Staying current in the ever-evolving tax landscape requires a multi-faceted approach. I subscribe to several reputable tax publications and journals, including the Journal of Taxation and Tax Notes Today. I actively participate in professional development programs and conferences organized by organizations like the AICPA and relevant state CPA societies. These conferences often feature prominent tax experts and offer insights into recent legislative changes and court rulings. Furthermore, I maintain active memberships in professional organizations to access updated guidance, webinars, and continuing professional education (CPE) courses. Finally, I leverage online resources and tax software platforms, which provide access to regularly updated tax codes, regulations, and interpretations. This holistic approach ensures that my knowledge remains current and allows me to promptly adapt my strategies to evolving tax laws and regulations.

Q 17. Explain your understanding of sampling techniques in tax audits.

Sampling techniques are crucial in tax audits, particularly when dealing with large datasets. They allow auditors to efficiently assess the overall accuracy of financial records without needing to examine every single transaction. The choice of sampling method depends on the audit objective and the characteristics of the population being audited.

- Random Sampling: Every item in the population has an equal chance of being selected. This is useful when the population is homogenous.

- Stratified Sampling: The population is divided into sub-populations (strata), and a random sample is drawn from each stratum. This is beneficial when the population is heterogeneous, ensuring representation from all segments.

- Monetary Unit Sampling (MUS): Each monetary unit in the population has an equal chance of being selected. This is particularly useful for identifying overstatements and material misstatements.

For example, in an audit of sales tax, stratified sampling might be used. The population is divided into strata based on sales amount (high, medium, low), and a sample is drawn from each stratum to assess the accuracy of tax calculations across different sales volumes. The sample results are then projected to the entire population to estimate the overall tax liability. Careful consideration of the sampling method and sample size is critical to ensure the audit results are reliable and statistically valid.

Q 18. What is your experience with various audit methodologies?

My experience encompasses various audit methodologies, including substantive testing, compliance testing, and systems-based audits.

- Substantive testing focuses on verifying the accuracy of financial statements through direct examination of transactions and supporting documentation. This might involve comparing invoices to sales records or independently reconciling bank statements.

- Compliance testing assesses adherence to tax laws and regulations. This often involves reviewing tax returns, supporting documentation, and ensuring compliance with relevant tax codes.

- Systems-based audits evaluate the effectiveness of internal controls relevant to taxation. This involves understanding the client’s accounting system, testing controls to assess their operating effectiveness, and assessing the risk of misstatements.

I am proficient in using both manual and automated audit techniques. Data analytics tools allow for efficient processing and analysis of large datasets, identifying anomalies and patterns that might indicate potential tax risks. I have experience working with various audit software packages and adapting my approach to each client’s unique circumstances and system infrastructure.

Q 19. How do you assess the materiality of tax discrepancies?

Materiality refers to the magnitude of a misstatement that, individually or in aggregate, could reasonably be expected to influence the decisions of users of the financial statements. Assessing materiality is a crucial step in every tax audit. It involves considering both quantitative and qualitative factors.

Quantitatively, materiality is often determined by applying a percentage threshold to a relevant financial benchmark (e.g., total revenue, total assets). However, qualitative factors are just as important. A small misstatement might be considered material if it relates to a highly regulated area or involves fraudulent activity.

My approach involves a multi-step process: First, I identify the relevant financial benchmarks. Next, I determine preliminary materiality thresholds based on industry standards and professional judgment. Subsequently, I evaluate qualitative factors and adjust the threshold if necessary. Finally, after the audit procedures are completed, I compare the identified misstatements to the materiality thresholds to determine whether they are material. If a misstatement is deemed material, it requires appropriate adjustments and disclosures.

Q 20. Describe your experience with internal controls relevant to taxation.

Effective internal controls are crucial in preventing and detecting tax errors and fraud. My experience includes reviewing and assessing the design and operating effectiveness of various internal controls related to taxation. This involves understanding the client’s accounting processes, revenue recognition methods, expense allocation procedures, and overall tax compliance system.

I evaluate controls over areas such as transaction authorization, segregation of duties, and reconciliations. For example, a strong control over purchase transactions includes a robust approval process for invoices, matching invoices to purchase orders and receiving reports, and regular reconciliation of accounts payable. Weaknesses in these controls increase the risk of material misstatements and require remediation recommendations. My assessment reports detail identified control strengths and weaknesses, providing management with recommendations for improvement and promoting enhanced tax compliance and risk mitigation.

Q 21. How do you handle audit deadlines and pressure?

Managing audit deadlines and pressure requires careful planning, prioritization, and effective communication. My approach involves creating a detailed audit plan at the outset, outlining key milestones and responsibilities. This plan is regularly reviewed and updated to account for unexpected developments.

I utilize project management techniques, such as task assignments, deadlines, and progress tracking, to maintain a clear overview of the audit process. When facing tight deadlines, I prioritize critical audit procedures and leverage technology to enhance efficiency. Open and consistent communication with the client’s management team is vital to managing expectations and addressing any roadblocks promptly. Furthermore, I build a strong team dynamic, fostering collaboration and mutual support to ensure successful and timely completion of the audit, even under pressure.

Q 22. What is your experience with tax audit planning?

Tax audit planning is the proactive process of preparing for a potential tax audit. It involves analyzing a client’s financial records, identifying potential areas of risk, and developing a strategy to address any discrepancies or potential issues. Think of it as preventative medicine for your finances. Instead of reacting to an audit’s findings, we aim to minimize the likelihood of problems by thoroughly reviewing everything beforehand.

My approach involves a detailed review of the client’s tax returns for the past three to five years, focusing on areas like depreciation calculations, expense classifications, and compliance with relevant tax laws. I also consider the client’s industry and specific circumstances, as certain industries face more scrutiny than others. For example, a construction company might require a deeper dive into cost segregation studies than a retail business. This analysis allows us to identify potential red flags early on and develop a mitigation strategy. This strategy could involve adjusting accounting procedures, improving record-keeping, or even proactively seeking guidance from the tax authorities if we foresee a potential issue. The goal is to present a clear, organized, and defensible position to the auditors if an audit occurs.

Q 23. How do you communicate effectively with clients and management during a tax audit?

Effective communication is paramount during a tax audit. With clients, I focus on transparency and building trust. I explain the audit process in plain language, avoiding jargon, and keep them updated on progress regularly. I treat them as partners in this process, ensuring they understand what information is needed and why. For example, if the auditors request clarification on a specific expense, I will first explain it to the client, ensuring they are comfortable with the information being shared.

With management, I maintain clear and concise reporting, highlighting key findings and potential implications. This involves regular updates on the audit’s progress, potential financial impacts, and any necessary actions. I emphasize proactive risk management and present potential solutions rather than simply identifying problems. Think of it as a collaborative problem-solving exercise with the goal of achieving the best possible outcome for the company.

Q 24. What software and tools are you proficient with for tax audits?

Proficiency in various software and tools is critical for efficient and accurate tax audits. I’m experienced with industry-leading tax preparation software such as TaxAct, Lacerte, and ProSeries. I also use data analytics tools like Alteryx and Tableau to analyze large datasets and identify trends, anomalies, and potential risks. These tools enable me to streamline the audit process, ensuring the timely and accurate identification of potential issues.

Furthermore, my experience with document management systems allows for efficient organization and retrieval of client data. This includes both electronic and physical records. I’m proficient in using these systems to easily navigate and reference important information needed for both client interaction and communicating with the auditing team. The integration of these software solutions allows for a streamlined and comprehensive audit process.

Q 25. Explain your understanding of tax evasion vs. tax avoidance.

Tax evasion and tax avoidance are often confused, but they are distinctly different. Tax evasion is the illegal non-payment or underpayment of tax. It involves deliberately concealing income, claiming false deductions, or otherwise falsifying information on tax returns to reduce one’s tax liability. This is a serious crime with potential legal consequences, including fines and imprisonment. Think of this as outright deception.

Tax avoidance, on the other hand, is the legal use of tax laws to minimize one’s tax liability. It involves structuring transactions or utilizing legal deductions and credits to reduce the amount of tax owed. This is perfectly legal and is often a legitimate business strategy. Think of this as smart financial planning within the legal framework. The line between the two can be blurry, but intent is key. A deliberate attempt to hide income is evasion; proactively using legal loopholes is avoidance. My work centers around helping clients navigate the complexities of tax laws to achieve the latter, not the former.

Q 26. How do you ensure the quality control of your audit work?

Quality control is fundamental to ensuring the accuracy and reliability of our audit work. My approach incorporates multiple layers of review. First, I follow a meticulous methodology, ensuring each step is documented and reviewed before proceeding. This includes thorough cross-referencing of data, detailed calculations, and supporting documentation. Second, I implement peer reviews where a senior colleague independently reviews a significant portion of my work, ensuring accuracy and consistency. This independent review acts as a crucial check and balance against human error.

Finally, we use robust quality control checklists and internal procedures, ensuring compliance with professional standards and best practices. These procedures also ensure consistency across all audits and help to minimize the risk of overlooking critical details. A culture of continuous improvement helps us identify areas for improvement and refine our processes for greater accuracy and efficiency.

Q 27. Describe your experience with different types of tax returns.

My experience encompasses a wide range of tax returns, including individual income tax returns (Form 1040), corporate income tax returns (Form 1120), partnership returns (Form 1065), and S corporation returns (Form 1120-S). I’ve also worked extensively with various state tax returns, understanding the nuances of different state tax codes. I understand the specific requirements for each return type and am adept at navigating the complexities of different tax laws and regulations.

For example, I understand the differences between the depreciation methods allowable for different entities and the impact of various deductions and credits. This broad experience allows me to approach each audit with a comprehensive understanding of the relevant tax laws and regulations, ensuring a thorough and effective audit process. Understanding the specifics of different business structures is critical for accurate and efficient audit work.

Q 28. How do you handle ethical dilemmas in tax audits?

Ethical dilemmas can arise in tax audits. For instance, a client may ask you to overlook a questionable expense, or you may discover an error that could negatively impact the client’s tax liability. My approach is guided by professional ethics and adherence to tax regulations. In such situations, I would first document the dilemma thoroughly. Second, I would discuss the situation with the client, explaining the implications of their actions and the ethical considerations involved. I would aim to find a solution that complies with both the law and ethical standards.

If a resolution cannot be reached, and I believe a serious ethical violation has occurred, I would refer the matter to my supervisor or the appropriate regulatory authorities. Maintaining the highest ethical standards is not only essential for upholding professional integrity but also for protecting my client’s long-term interests and ensuring the integrity of the tax system. Sometimes, the best course of action is to take a difficult path which upholds honesty and transparency.

Key Topics to Learn for Tax Audit Management Interview

- Understanding Tax Laws and Regulations: Grasp the intricacies of relevant tax codes, their amendments, and interpretations. This includes familiarity with both federal and state regulations as applicable.

- Audit Planning and Methodology: Learn various audit approaches, risk assessment techniques, and the development of comprehensive audit plans. Understand how to efficiently allocate resources and manage timelines.

- Data Analysis and Interpretation: Develop strong skills in analyzing large datasets, identifying anomalies, and drawing meaningful conclusions. Practice interpreting financial statements and other supporting documentation.

- Sampling Techniques and Statistical Analysis: Understand and apply appropriate sampling methods to select representative samples for audit testing. Be prepared to discuss statistical concepts and their relevance to audit conclusions.

- Audit Documentation and Reporting: Master the creation of clear, concise, and well-organized audit documentation. This includes preparing comprehensive audit reports that effectively communicate findings and recommendations.

- Communication and Collaboration: Practice effective communication strategies for interacting with clients, colleagues, and management. This includes presenting findings confidently and constructively.

- IT Skills and Audit Software: Develop proficiency in relevant audit software and data analytics tools. Be prepared to discuss your experience with different technologies used in tax audit management.

- Ethical Considerations and Professional Standards: Understand and apply professional ethics and standards relevant to tax audit management. Be prepared to discuss situations requiring ethical judgment.

- Problem-Solving and Critical Thinking: Practice applying your analytical skills to complex tax scenarios. Be prepared to discuss your approach to identifying and resolving issues efficiently and effectively.

Next Steps

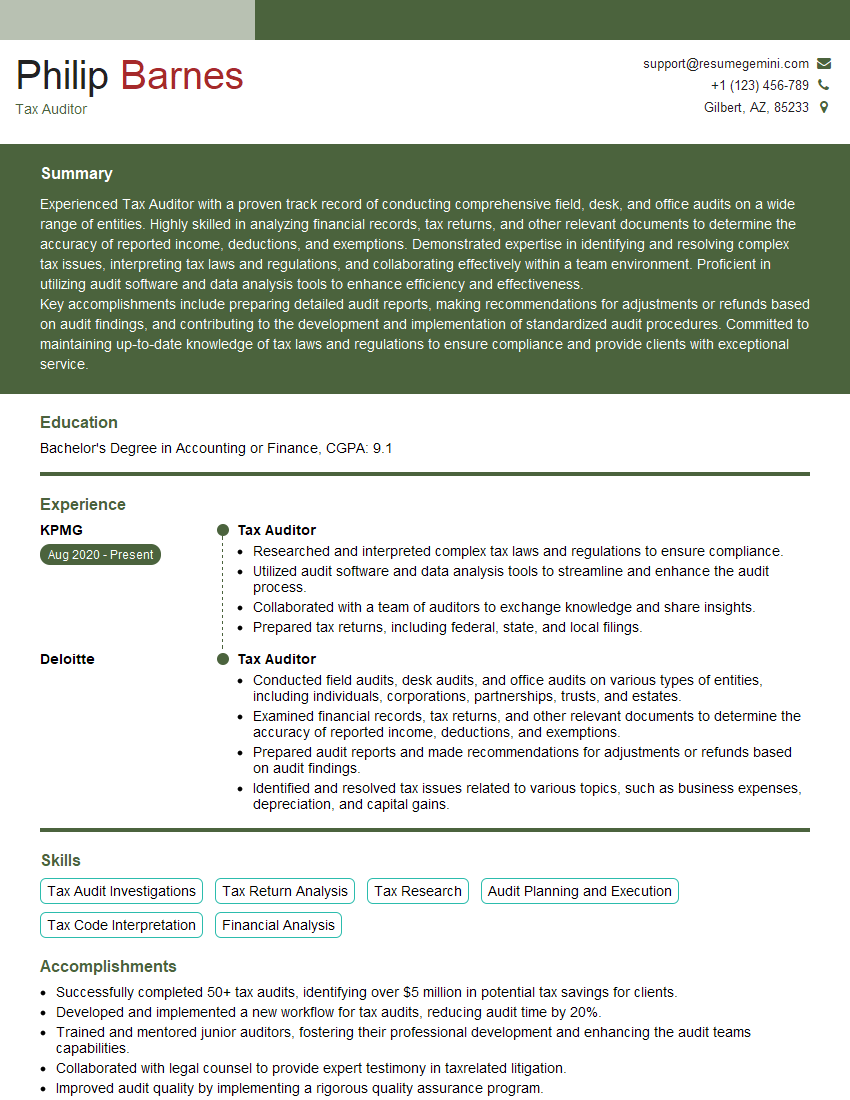

Mastering Tax Audit Management opens doors to exciting career opportunities and significant professional growth. To maximize your job prospects, a strong, ATS-friendly resume is essential. ResumeGemini can help you craft a compelling resume that showcases your skills and experience effectively. We provide examples of resumes tailored to Tax Audit Management to guide you in creating a standout application. Take the next step in your career journey – build a resume that makes a lasting impression.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.