Cracking a skill-specific interview, like one for International Trade Policy Analysis, requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in International Trade Policy Analysis Interview

Q 1. Explain the difference between absolute and comparative advantage in international trade.

Absolute advantage and comparative advantage are both concepts explaining why countries trade, but they focus on different aspects of production. Absolute advantage refers to a country’s ability to produce a good or service using fewer resources (labor, capital, land) than another country. Think of it as being simply *better* at producing something. For example, if Country A can produce 100 cars with 100 workers, while Country B needs 200 workers to produce the same amount, Country A has an absolute advantage in car production.

Comparative advantage, however, is a more nuanced concept introduced by David Ricardo. It states that even if a country has an absolute advantage in producing *all* goods, it still benefits from specializing in producing and exporting the goods in which it has a *relatively* higher productivity compared to other goods. It’s about *opportunity cost*. Imagine Country A can produce 100 cars *or* 50 trucks with its resources, while Country B can produce 50 cars *or* 25 trucks. Country A has an absolute advantage in both, but its opportunity cost of producing one car is 0.5 trucks (it gives up half a truck to make a car). Country B’s opportunity cost is 2 trucks per car. Country A has a comparative advantage in car production because its opportunity cost is lower. It should specialize in cars and trade with Country B for trucks, even though it’s better at making both.

In essence, absolute advantage focuses on *efficiency* while comparative advantage focuses on *opportunity cost* and maximizing overall production through specialization and trade.

Q 2. Describe the impact of tariffs on domestic industries and consumers.

Tariffs, taxes imposed on imported goods, have significant impacts on both domestic industries and consumers. For domestic industries, tariffs act as a protective barrier, increasing the price of competing imports. This makes domestic goods relatively more attractive to consumers, potentially boosting domestic production and employment in the protected industry. However, this protection can also lead to inefficiency, as domestic firms lack the pressure to innovate and become more competitive in the global market. They may become complacent, leading to higher prices and lower quality in the long run.

For consumers, tariffs translate directly into higher prices for imported goods. This reduces consumer choice and purchasing power. Consumers might end up paying more for lower quality goods if domestic industries aren’t incentivized to improve. It’s also important to consider that higher prices on imported inputs can increase production costs across other industries, leading to a ripple effect throughout the economy. For example, a tariff on steel could raise prices for car manufacturers, affecting the entire automotive industry. Ultimately, the net effect on consumers depends on the size of the tariff, the elasticity of demand for the affected goods, and the responsiveness of domestic producers.

Q 3. What are the key principles of the World Trade Organization (WTO)?

The World Trade Organization (WTO) is an intergovernmental organization regulating international trade. Its key principles are:

- Non-discrimination: This principle, embodied in the Most-Favored-Nation (MFN) treatment and National Treatment, ensures that all WTO members are treated equally. MFN means any trade advantage given to one member must be extended to all others. National treatment means imported goods should be treated no less favorably than domestically produced goods.

- Reciprocity: Trade liberalization should be mutually beneficial, with countries lowering tariffs and other barriers to trade in a balanced way. This encourages cooperation and prevents unfair trade practices.

- Transparency: Members must make their trade policies and regulations clear and predictable, allowing other countries to understand and adapt to the rules of the game. This reduces uncertainty and fosters a stable trading environment.

- Predictability: The WTO’s rules provide a stable and predictable framework for international trade. This encourages long-term investment and economic growth.

- Dispute Settlement: The WTO has a mechanism for resolving trade disputes between members. This helps to prevent trade wars and ensure that the rules are enforced.

These principles underpin the WTO’s goal of creating a fair and open trading system that benefits all members.

Q 4. How do non-tariff barriers affect international trade?

Non-tariff barriers (NTBs) are government regulations, policies, or practices that restrict international trade without directly imposing tariffs. They can significantly impede the flow of goods and services across borders. Examples include:

- Sanitary and Phytosanitary (SPS) measures: Regulations designed to protect human, animal, or plant life and health. While legitimate, these measures can be used as trade barriers if they are more stringent than necessary.

- Technical barriers to trade (TBTs): Standards, testing procedures, and certification requirements that can make it difficult for foreign goods to meet a country’s import regulations.

- Quotas: Limits on the quantity of a particular good that can be imported.

- Embargoes: Complete bans on trade with a particular country or for specific goods.

- Administrative barriers: Complex customs procedures, licensing requirements, and bureaucratic hurdles that create delays and increase the cost of importing goods.

NTBs often have a more subtle but equally damaging effect on trade than tariffs, and they can be harder to identify and challenge under international trade rules.

Q 5. Explain the function and impact of anti-dumping duties.

Anti-dumping duties are tariffs imposed on imported goods that are sold at a price below their normal value (often below the cost of production) in the importing country. This practice, known as dumping, is considered a form of unfair trade because it can harm domestic industries by undercutting their prices and potentially leading to bankruptcies.

The function of anti-dumping duties is to offset the price advantage of the dumped goods, allowing domestic producers to compete on a more level playing field. The WTO allows countries to impose these duties, but they must demonstrate that dumping is occurring and that it is causing material injury to the domestic industry. The investigation process usually involves a detailed analysis of pricing, costs, and the impact on the domestic industry. If dumping and injury are established, the anti-dumping duty is typically calculated to bring the price of the imported good up to its normal value.

The impact of anti-dumping duties is complex. While they can protect domestic industries from unfair competition, they can also raise prices for consumers and reduce competition. They can also escalate trade tensions, as countries may retaliate by imposing similar duties on other goods. The effectiveness and fairness of anti-dumping measures are often debated.

Q 6. Discuss the role of regional trade agreements (RTAs) in shaping global trade patterns.

Regional Trade Agreements (RTAs), such as free trade areas (FTAs) or customs unions, are agreements between two or more countries to reduce or eliminate tariffs and other trade barriers among themselves. They play a crucial role in shaping global trade patterns by creating preferential trading relationships within a region.

RTAs can lead to increased trade and investment within the region, as firms benefit from lower trade costs and easier access to larger markets. This can foster economic growth and specialization, with member countries focusing on producing goods and services where they have a comparative advantage. However, RTAs can also lead to trade diversion, where imports from outside the region are replaced by imports from within the region, even if the latter are more expensive. This could reduce global efficiency if the less efficient regional producers benefit.

The proliferation of RTAs has significantly influenced global trade, with some regions experiencing higher levels of integration than others. The existence of multiple overlapping RTAs can create complexity in trade policy, requiring careful management to avoid conflicts and inconsistencies.

Q 7. Analyze the impact of currency fluctuations on international trade.

Currency fluctuations significantly impact international trade by affecting the relative prices of goods and services. A country’s currency appreciating (becoming stronger) makes its exports more expensive for foreign buyers and imports cheaper for domestic consumers. Conversely, a depreciating currency (becoming weaker) makes exports cheaper and imports more expensive.

For example, if the US dollar appreciates against the Euro, European consumers will find US goods more expensive, while US consumers will find European goods cheaper. This can lead to a decrease in US exports to Europe and an increase in US imports from Europe. A depreciating dollar would have the opposite effect. The impact on the trade balance (difference between exports and imports) is complex and depends on various factors, including the price elasticity of demand for exports and imports. Highly elastic goods (where demand changes significantly with price) will be more affected than inelastic goods.

Businesses engaged in international trade actively manage currency risk through hedging strategies, such as using forward contracts or options to lock in exchange rates. Understanding and predicting currency movements is crucial for making sound business decisions in international markets. Unpredictable currency swings can create instability and uncertainty for exporters and importers.

Q 8. Explain the concept of trade balance and its significance.

The trade balance, also known as the balance of trade, is the difference between the monetary value of a nation’s exports and imports over a specific period. A positive trade balance, or trade surplus, means a country exports more than it imports, while a negative trade balance, or trade deficit, indicates it imports more than it exports.

Its significance lies in its reflection of a country’s economic health and its relationship with the global economy. A persistent large trade deficit can signal underlying economic vulnerabilities, such as excessive consumption or weak domestic production. Conversely, a large surplus can sometimes indicate that a country’s exports are heavily subsidized or that its domestic market is comparatively underdeveloped. It’s crucial to note that the trade balance is just one indicator among many, and should be analyzed within the broader context of a country’s economic performance, including its GDP growth, inflation rate, and employment levels. For instance, a country might have a trade deficit but be experiencing robust economic growth due to strong domestic demand and investment. Think of it like a household budget: a deficit isn’t inherently bad if it’s financed responsibly and contributes to overall prosperity.

Q 9. What are the potential benefits and drawbacks of free trade agreements?

Free trade agreements (FTAs) are treaties between two or more countries that reduce or eliminate tariffs, quotas, and other trade barriers. These agreements aim to foster greater economic integration and cooperation.

Potential Benefits:

- Increased trade and economic growth: Reduced barriers lead to increased exports and imports, boosting economic activity and creating jobs.

- Lower prices for consumers: Increased competition from foreign producers drives down prices, offering consumers a wider variety of goods and services at more affordable rates.

- Greater efficiency and specialization: Countries can specialize in producing goods and services where they have a comparative advantage, leading to greater efficiency and productivity.

- Enhanced innovation and technological advancement: Competition fosters innovation as businesses strive to improve their products and services to remain competitive.

Potential Drawbacks:

- Job displacement: Domestic industries may face increased competition, leading to job losses in sectors unable to compete with imports. This requires retraining and adaptation initiatives.

- Increased income inequality: The benefits of free trade may not be evenly distributed, potentially exacerbating income inequality between different groups within a country.

- Environmental concerns: Increased trade can lead to increased pollution and environmental degradation if not managed sustainably. Trade agreements often include provisions for environmental protection, but their effectiveness varies.

- Potential for exploitation: Without proper regulations, FTAs can lead to exploitation of labor in countries with weaker labor standards.

For example, the North American Free Trade Agreement (NAFTA), now USMCA, led to increased trade between Canada, Mexico, and the United States but also sparked debates about job losses in certain sectors. Effective FTAs require careful consideration and management of both benefits and drawbacks.

Q 10. How does the theory of gravity model explain trade flows between countries?

The gravity model in international trade posits that the volume of trade between two countries is directly proportional to the size of their economies (measured by GDP) and inversely proportional to the distance between them. Think of it like gravity: larger masses attract each other more strongly, and the closer they are, the stronger the attraction. Similarly, larger economies are expected to trade more with each other, and geographically closer countries tend to trade more due to lower transportation costs and stronger cultural ties.

The basic formula can be expressed as:

Trade Volumeij = k * (GDPi * GDPj) / Distanceij

where:

Trade Volumeijrepresents the trade volume between country i and country j.GDPiandGDPjrepresent the GDPs of countries i and j, respectively.Distanceijrepresents the distance between countries i and j.kis a constant representing other factors influencing trade, like cultural affinity, common language, and trade agreements.

While a simplified model, it provides a useful framework for understanding trade patterns. Factors beyond size and distance, such as trade policies and transportation infrastructure, can also significantly influence trade flows. For example, the large trade volume between the United States and Canada is explained by both their large economies and their geographical proximity.

Q 11. Describe the different types of trade restrictions and their economic effects.

Trade restrictions are government policies designed to limit or control the flow of goods and services across international borders. These restrictions can have significant economic effects.

Types of Trade Restrictions:

- Tariffs: Taxes imposed on imported goods, increasing their price and making them less competitive with domestically produced goods. They generate revenue for the government but can reduce overall trade and welfare.

- Quotas: Limits on the quantity of a specific good that can be imported. They restrict supply, potentially leading to higher prices and reduced consumer choice.

- Embargoes: Complete bans on trade with a specific country or for a specific good, often used as a political or economic sanction.

- Non-tariff barriers: These include regulations, standards, and administrative procedures that make it more difficult or expensive to import goods. Examples include complex customs procedures, sanitary regulations, or labeling requirements.

Economic Effects:

The effects of trade restrictions are complex and can vary depending on the specific type of restriction, the size of the affected market, and the responsiveness of consumers and producers to price changes. Generally, restrictions lead to:

- Higher prices for consumers: Reduced supply and competition drive up prices for consumers.

- Reduced consumer choice: Restrictions limit the availability of goods and services from other countries.

- Protection of domestic industries: Restrictions can protect domestic industries from foreign competition, at least temporarily.

- Potential for retaliation: Trade restrictions by one country may lead to retaliatory measures by other countries, resulting in trade wars that harm everyone involved.

- Inefficient resource allocation: Protection can lead to the inefficient allocation of resources, as domestic industries may not be as productive as foreign competitors.

For example, imposing tariffs on steel imports may protect domestic steel producers, but it also raises steel prices for consumers and may lead to retaliatory tariffs on other goods.

Q 12. What are the key provisions of the General Agreement on Tariffs and Trade (GATT)?

The General Agreement on Tariffs and Trade (GATT), signed in 1947, was a multilateral agreement aimed at reducing tariffs and other trade barriers. While replaced by the World Trade Organization (WTO) in 1995, its key provisions laid the foundation for the modern global trading system.

Key provisions included:

- Most-favored-nation (MFN) treatment: This principle requires countries to grant the same trade concessions to all other GATT members. It prevents discriminatory trade practices.

- National treatment: Imported goods should be treated no less favorably than domestically produced goods once they enter the market.

- Tariff binding: Countries committed to binding their tariffs at agreed-upon levels, making it difficult to raise them unilaterally.

- Dispute settlement mechanism: A system for resolving trade disputes between member countries provided a framework for addressing disagreements and enforcing the rules.

- Transparency and predictability: GATT promoted transparency in trade policies and aimed to create a more predictable trading environment.

GATT’s success in reducing tariffs significantly contributed to the growth of international trade in the post-World War II era. However, it faced challenges in addressing non-tariff barriers and other complex trade issues, which led to the creation of the WTO.

Q 13. Discuss the role of subsidies in international trade.

Subsidies are government financial assistance provided to domestic producers, often to enhance their competitiveness in international markets. They can take many forms, including direct cash payments, tax breaks, low-interest loans, and government procurement preferences.

Role in International Trade:

Subsidies can have a significant impact on international trade. They can:

- Increase domestic production: Lowering production costs allows domestic firms to produce more and potentially compete more effectively with foreign firms.

- Distort trade patterns: Subsidies can artificially inflate exports and undermine fair competition, as subsidized goods can be sold at below-market prices.

- Lead to trade disputes: Other countries may view subsidies as unfair trade practices and may retaliate with their own trade restrictions, escalating into trade wars.

- Create inefficiencies: Subsidies can prevent the efficient allocation of resources, as they may support industries that would otherwise be uncompetitive.

- Cause welfare losses: While subsidies benefit domestic producers, they often result in higher costs for consumers and potentially lower overall welfare compared to a scenario with free and fair competition.

Agricultural subsidies are a prime example. Developed countries’ substantial agricultural subsidies have been a major source of tension in international trade negotiations, often leading to complaints from developing countries whose agricultural producers struggle to compete.

Q 14. Explain the concept of trade diversion and trade creation.

Trade creation and trade diversion are two key effects of forming a customs union or free trade area, both types of regional trade agreements (RTAs).

Trade Creation: This occurs when the formation of an RTA leads to the replacement of higher-cost domestic production with lower-cost imports from other RTA members. This increases efficiency and overall welfare. Think of it as substituting expensive domestic goods with cheaper imports from a partner country within the trade agreement. It leads to an increase in overall trade and welfare.

Trade Diversion: This happens when the formation of an RTA leads to the replacement of lower-cost imports from outside the RTA with higher-cost imports from within the RTA. This occurs because tariffs are eliminated on goods from within the agreement but remain on goods from outside the agreement. This reduces overall efficiency and potentially welfare. Imagine choosing a more expensive product from your trade partner than a cheaper, better option from another country outside the agreement simply because the tariff on the trade partner’s product is now zero.

The net effect of an RTA on welfare depends on the balance between trade creation and trade diversion. If trade creation outweighs trade diversion, the RTA is likely to be welfare-enhancing. However, if trade diversion is significant, the RTA may reduce overall welfare. The extent of trade creation and diversion depends on various factors, including the pre-existing trade patterns, the size of the tariffs, and the differences in production costs between countries.

Q 15. How do trade policies affect economic growth and development?

Trade policies, encompassing tariffs, quotas, and subsidies, significantly influence economic growth and development. Open trade policies, generally characterized by low tariffs and minimal trade barriers, tend to stimulate economic growth by increasing competition, fostering specialization, and driving innovation. This increased competition leads to lower prices for consumers, increased efficiency among producers, and a wider variety of goods and services. Countries can specialize in producing goods and services where they have a comparative advantage, leading to higher overall output and economic efficiency.

For example, consider the impact of China’s entry into the World Trade Organization (WTO). The reduction in trade barriers allowed China to integrate into the global economy, leading to substantial economic growth and poverty reduction. However, this growth wasn’t uniform across all sectors and regions.

Conversely, protectionist policies, such as high tariffs or import quotas, can shield domestic industries from foreign competition. While this may protect jobs in the short term, it can lead to inefficiency, higher prices for consumers, and reduced innovation. Protectionism can stifle competition, preventing businesses from improving productivity and lowering prices, ultimately hindering long-term economic growth. The automotive industry in many developed countries has seen periods of protectionism, which often resulted in higher prices and less competitive products compared to those from countries with more open markets.

The impact of trade policies on development is also complex. While open trade can foster growth, it’s crucial to consider factors like a country’s institutional capacity, infrastructure, and human capital. Countries with weak institutions may find it difficult to benefit from trade liberalization, potentially leading to increased inequality and vulnerability to external shocks.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the challenges of enforcing international trade agreements?

Enforcing international trade agreements presents numerous challenges. One major hurdle is the lack of a truly supranational authority with the power to compel compliance. The WTO’s Dispute Settlement Body (DSB) plays a crucial role, but its decisions are ultimately dependent on the willingness of member states to comply. Many countries prioritize national interests, potentially overriding international obligations.

Another challenge lies in the complexity of trade agreements themselves. They often involve numerous provisions and exceptions, making it difficult to monitor compliance and enforce rules consistently. For instance, determining whether a particular subsidy constitutes unfair trade practice under WTO rules can involve extensive investigation and legal argumentation.

Differences in legal systems and enforcement capabilities across countries further complicate matters. What constitutes a violation in one country may not be considered a violation in another. Moreover, the ability of countries to effectively monitor and investigate alleged violations varies considerably depending on their resources and institutional capacity. A small developing country might lack the resources to investigate and address potential violations effectively compared to a larger, more developed nation.

Finally, the rise of non-tariff barriers, such as sanitary and phytosanitary regulations or technical barriers to trade, adds another layer of complexity to enforcement. These regulations, while often justified on grounds of public health or safety, can be used as disguised protectionist measures, making it difficult to differentiate legitimate concerns from protectionist actions.

Q 17. Discuss the impact of technological advancements on international trade.

Technological advancements have profoundly reshaped international trade. The internet and digital technologies have significantly reduced the costs of communication and information exchange, facilitating cross-border trade and investment. E-commerce, for example, has revolutionized how goods and services are traded internationally, enabling small businesses to reach global markets with relative ease.

Improved transportation technologies, such as containerization and faster shipping, have decreased transportation costs and transit times, making international trade more efficient and cost-effective. This has enabled businesses to source inputs from around the world and reach wider consumer markets. The development of mega-container ships has drastically reduced the cost of shipping goods across oceans.

However, technological advancements also present challenges. The automation of production processes, for instance, can lead to job displacement in some countries and increased competition in global markets. The digital divide also exacerbates inequalities, as countries with limited access to technology may fall further behind in the global economy. Furthermore, the increasing prevalence of digital platforms raises issues related to data privacy, intellectual property protection, and antitrust concerns, particularly in the context of international trade. Countries are grappling with how to regulate these aspects within the framework of existing trade agreements.

Q 18. Explain the role of intellectual property rights in international trade.

Intellectual property rights (IPRs) – patents, trademarks, copyrights, and trade secrets – play a crucial role in international trade. They incentivize innovation by granting creators exclusive rights to their inventions and creative works. This protection encourages investment in research and development, leading to the creation of new technologies, products, and services that fuel international trade.

Strong IPR protection is essential for attracting foreign direct investment (FDI). Companies are more likely to invest in countries with robust IPR regimes because they can be confident that their innovations will be protected. This enhances a country’s competitiveness in the global market and creates opportunities for technology transfer and economic growth.

However, there are ongoing debates regarding the balance between IPR protection and access to knowledge and technology, particularly in developing countries. Excessive IPR protection can raise prices, limit access to essential medicines and technologies, and hinder innovation by restricting the use of existing technologies as building blocks for new ones. The debate around affordable generic medications is a prime example. The TRIPS agreement (Trade-Related Aspects of Intellectual Property Rights) within the WTO attempts to establish a minimum standard of IPR protection, but its implementation and interpretation continue to be a source of tension in international trade negotiations.

Q 19. How do environmental regulations impact international trade?

Environmental regulations are increasingly impacting international trade. Countries are implementing stricter environmental standards to address climate change, pollution, and resource depletion. This can create trade tensions if regulations differ significantly across countries. For instance, if one country imposes stringent emission standards on imported goods, it may face challenges from exporting countries that have less stringent regulations.

The potential for ‘carbon leakage’ is a major concern. This occurs when businesses relocate production to countries with less stringent environmental regulations, negating the environmental benefits of stricter standards in the importing country. This underscores the need for international cooperation in establishing common environmental standards to create a level playing field and prevent regulatory arbitrage.

Some argue that environmental regulations constitute non-tariff barriers to trade. While many regulations are justified on grounds of public health or environmental protection, they can inadvertently restrict trade. The challenge lies in finding a balance between environmental protection and the facilitation of international trade. This often involves negotiations and the development of international environmental agreements that promote sustainable trade practices and minimize trade restrictions.

Examples include the debate around carbon tariffs, designed to level the playing field for domestic producers facing competition from producers in countries with less stringent climate policies, and the implementation of sustainable sourcing standards in global supply chains, driving companies to adopt more environmentally friendly practices. The growing demand for sustainable products also creates new market opportunities for businesses complying with stricter environmental standards.

Q 20. What are the various methods for measuring the impact of trade policies?

Measuring the impact of trade policies requires a multifaceted approach, utilizing various econometric techniques and data analysis methods. There’s no single perfect method, and the choice of method depends on the specific policy being analyzed and the available data.

One common approach is to use **gravity models** which analyze bilateral trade flows based on factors like GDP, distance, and trade agreements. These models can be used to estimate the impact of a specific trade policy, such as a tariff reduction, on bilateral trade flows. By comparing actual trade flows with those predicted by the model without the policy change, one can estimate the impact of the policy.

Another method involves **computable general equilibrium (CGE) models**. These sophisticated models simulate the entire economy to assess the effects of a trade policy change on various sectors, income distribution, and overall economic welfare. They consider complex interactions between different parts of the economy, giving a more comprehensive picture of the policy’s impacts. However, CGE models require substantial data and computational resources and are subject to the assumptions built into the model.

**Difference-in-differences (DID) estimation**, a quasi-experimental approach, compares the change in an outcome variable (e.g., employment, wages) in a treatment group (affected by the trade policy) with that in a control group (not affected). This helps isolate the policy’s specific impact while controlling for other factors.

Finally, **detailed case studies** can provide valuable insights into the real-world impacts of trade policies, complementing quantitative analysis. Case studies are particularly useful for understanding qualitative aspects, such as the effects on specific industries, companies, or communities.

Q 21. Discuss the implications of trade wars on global markets.

Trade wars, characterized by escalating tariffs and trade restrictions between countries, have significant negative implications for global markets. They disrupt established trade patterns, leading to uncertainty and reduced trade volumes. Businesses face increased costs, reduced market access, and supply chain disruptions. Consumers face higher prices for imported goods and a reduction in the variety of goods available.

Trade wars often trigger retaliatory measures, creating a cycle of escalating protectionism. This can escalate into wider geopolitical tensions. The US-China trade war, for instance, involved significant tariff increases on billions of dollars worth of goods, impacting businesses and consumers in both countries and disrupting global supply chains.

The impact on global economic growth can be substantial, as reduced trade diminishes overall economic output. Investment can fall due to increased uncertainty, hindering long-term economic growth. Moreover, trade wars can disproportionately affect certain sectors and countries, leading to job losses and increased economic inequality.

Trade wars can also lead to distortions in global markets. Countries may engage in artificial support for domestic industries, leading to overcapacity and inefficiencies. This can lead to the misallocation of resources and undermine the comparative advantages that countries would normally have. The long-term damage of trade wars can significantly outweigh short-term gains from protecting specific domestic industries.

Q 22. Explain the difference between quotas and tariffs.

Both quotas and tariffs are trade restrictions used to limit imports, but they operate differently. A tariff is a tax imposed on imported goods, increasing their price and making them less competitive with domestically produced goods. Think of it like a toll on imported items. The higher the tariff, the more expensive the import becomes. A quota, on the other hand, is a direct limit on the quantity of a specific good that can be imported during a given period. Once the quota is reached, no more of that good can be imported, regardless of demand. Imagine it like a gate that only allows a certain number of cars to pass through.

Example: The US might impose a tariff on imported steel, making it more expensive for American consumers to buy foreign steel but protecting domestic steel producers. Conversely, the US might impose a quota on sugar imports, limiting the amount of foreign sugar that can enter the country, regardless of price. This protects domestic sugar producers from intense foreign competition.

The key difference is that tariffs affect the price, while quotas affect the quantity of imported goods. Tariffs generate revenue for the government, while quotas don’t. The choice between the two often depends on the specific policy goals.

Q 23. Describe the role of international institutions in governing international trade.

International institutions play a crucial role in governing international trade by establishing rules, providing a forum for dispute resolution, and promoting cooperation among nations. The most prominent example is the World Trade Organization (WTO). It sets the rules for international trade, administers trade agreements, and acts as a dispute settlement body. The WTO’s agreements cover a wide range of areas, including tariffs, quotas, technical barriers to trade, and intellectual property rights.

Other important institutions include the International Monetary Fund (IMF), which focuses on macroeconomic stability and financial assistance to member countries, and the World Bank, which provides financial and technical assistance for development projects. While not directly focused on trade rules, their work significantly impacts the global trading environment by influencing macroeconomic conditions and investment flows.

These institutions help to create a more predictable and stable trading system by reducing uncertainty and promoting transparency. They also provide a mechanism for resolving trade disputes peacefully, preventing potential trade wars and promoting cooperation.

Q 24. How can trade policy be used to promote sustainable development?

Trade policy can be a powerful tool for promoting sustainable development by encouraging environmentally friendly practices and ensuring fair labor standards. This can be achieved through several mechanisms:

- Environmental regulations linked to trade: Countries can impose tariffs or other restrictions on imports from countries with lax environmental standards, incentivizing them to improve their practices. For example, a carbon tax on high-carbon emission products.

- Promoting green technologies: Trade policies can facilitate the transfer and diffusion of green technologies by reducing tariffs or providing subsidies for their import or export. This can help developing countries adopt cleaner and more sustainable technologies.

- Fair trade initiatives: These initiatives promote fair prices for products from developing countries, ensuring that producers receive a living wage and work under decent conditions. They often include labelling and certification programs to identify products that meet specific criteria.

- Sustainable procurement policies: Governments can use their purchasing power to promote sustainable development by favoring products that meet certain environmental or social standards.

Effectively implementing such policies requires careful consideration of potential trade-offs and the need for international cooperation. A poorly designed policy might harm developing countries rather than promoting sustainable development.

Q 25. Analyze the impact of globalization on international trade patterns.

Globalization has profoundly reshaped international trade patterns, leading to increased trade volumes, greater integration of global value chains, and a shift in the geographic distribution of trade. Several key impacts include:

- Increased trade volumes: Reduced trade barriers and improvements in transportation and communication technologies have significantly increased the volume of goods and services traded internationally.

- Rise of global value chains (GVCs): Production processes are often fragmented across multiple countries, with different stages of production occurring in different locations. This has led to increased interdependence among countries and a shift from simple exports and imports to more complex, value-added trade.

- Shift in trade patterns: The rise of emerging economies, particularly in Asia, has significantly altered global trade patterns. These economies have become major exporters of manufactured goods and importers of raw materials and intermediate goods.

- Increased foreign direct investment (FDI): Globalization has facilitated increased FDI, leading to the establishment of multinational corporations and increased cross-border investment flows.

Globalization has also led to increased competition, requiring firms to become more efficient and innovative to survive in the global marketplace.

Q 26. Discuss the challenges posed by protectionist trade policies.

Protectionist trade policies, such as tariffs and quotas, while aiming to protect domestic industries, can pose several significant challenges:

- Higher prices for consumers: Protectionist measures restrict competition, leading to higher prices for consumers and reduced consumer surplus.

- Reduced efficiency: Protected industries may become less efficient as they face less pressure to innovate and compete. This can lead to lower overall productivity and economic growth.

- Retaliation from other countries: Protectionist measures can provoke retaliatory actions from other countries, leading to trade wars that harm all participants.

- Distorted resource allocation: Protectionism can lead to resources being allocated to inefficient industries, hindering the development of more competitive and innovative sectors.

- Negative impact on developing countries: Protectionist policies in developed countries can harm developing countries by limiting their access to export markets.

The overall welfare loss from protectionist policies often outweighs any short-term benefits to specific industries. A well-functioning, open trading system benefits all participating countries.

Q 27. Explain the role of trade negotiations in resolving trade disputes.

Trade negotiations play a vital role in resolving trade disputes. They offer a mechanism for countries to discuss their concerns, negotiate compromises, and reach mutually acceptable solutions. The process typically involves several stages:

- Consultation: The initial step involves consultations between the disputing parties to identify the problem and attempt to find a solution.

- Mediation: If consultations fail, a neutral third party might be involved to mediate the dispute and help the parties reach an agreement.

- Arbitration: In some cases, the dispute may be submitted to arbitration, where a panel of experts makes a binding decision.

- WTO Dispute Settlement Mechanism: The WTO’s dispute settlement system provides a formal mechanism for resolving trade disputes between member countries. It involves a series of stages, including consultations, panel review, and appeals.

Successful trade negotiations require flexibility, compromise, and a willingness to find common ground. The outcome can range from a simple agreement to amend a trade practice to a comprehensive trade agreement. The WTO’s dispute settlement system has been particularly effective in ensuring compliance with trade rules and preventing escalation of trade tensions.

Q 28. How can countries benefit from strategic trade policy?

Strategic trade policy involves government intervention in trade to support specific industries or achieve national economic goals. Countries can benefit from it in several ways:

- Promoting infant industries: Temporary protection can allow new industries to develop and become competitive in the global market. This is based on the idea that initially, they may not be able to compete with established foreign firms.

- Developing national champions: Government support can help domestic firms gain a competitive edge in strategically important industries, such as technology or advanced manufacturing.

- Improving terms of trade: Strategic interventions, such as export subsidies or anti-dumping measures, can potentially improve a country’s terms of trade (the ratio of export prices to import prices).

- Addressing market failures: Strategic trade policies can address market failures, such as externalities (like pollution) or information asymmetries, that might prevent efficient resource allocation.

However, strategic trade policy requires careful design and implementation, as it can be prone to inefficiencies and potential for abuse. It also raises concerns about fairness and reciprocity in international trade. The success of strategic trade policy largely depends on factors such as the government’s ability to identify promising industries and effectively implement supportive measures.

Key Topics to Learn for International Trade Policy Analysis Interview

- Trade Theories: Understand the foundational theories like comparative advantage, Heckscher-Ohlin model, and new trade theory. Be prepared to discuss their implications for policy decisions.

- Trade Instruments: Master the practical applications of tariffs, quotas, subsidies, and anti-dumping measures. Analyze their impact on domestic industries and global trade flows.

- Trade Agreements and Institutions: Familiarize yourself with the WTO, regional trade agreements (like NAFTA/USMCA, EU), and their dispute settlement mechanisms. Discuss their impact on global trade governance.

- Trade Policy Evaluation: Develop strong skills in evaluating the economic impacts of trade policies using tools like cost-benefit analysis, general equilibrium modeling, and impact assessments.

- Protectionism vs. Free Trade: Articulate the arguments for and against protectionist measures, considering both economic and political factors. Be ready to discuss the potential consequences of each approach.

- Trade and Development: Explore the role of trade in economic development, focusing on issues like South-North trade relations, fair trade practices, and sustainable development goals.

- Quantitative Methods: Demonstrate proficiency in econometrics and statistical analysis relevant to trade data interpretation and policy modeling. This may include regression analysis and time series analysis.

- Case Studies: Prepare examples of specific trade policy cases (e.g., the impact of a specific tariff, the effects of a trade agreement) to illustrate your understanding of theoretical concepts and their practical application.

Next Steps

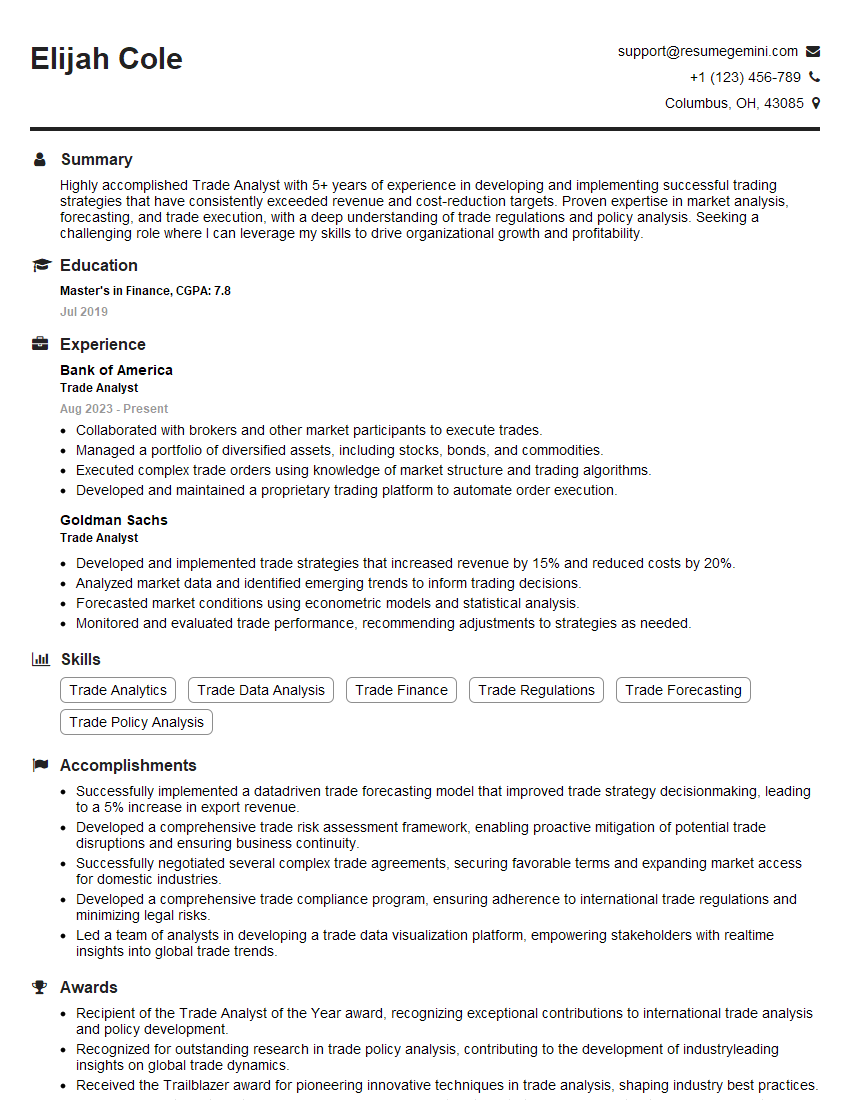

Mastering International Trade Policy Analysis opens doors to exciting careers in government, international organizations, research institutions, and the private sector. A strong understanding of these concepts will significantly enhance your interview performance and career prospects. To further strengthen your application, focus on creating an ATS-friendly resume that highlights your relevant skills and experience. Use ResumeGemini to build a professional and impactful resume tailored to your specific skills and experience. ResumeGemini offers examples of resumes specifically designed for candidates in International Trade Policy Analysis, providing you with valuable templates and guidance. This will ensure your resume gets noticed by recruiters and hiring managers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.