Preparation is the key to success in any interview. In this post, we’ll explore crucial Proficiency in Trade-Related Software (e.g., COMTRADE, UNCTADSTAT) interview questions and equip you with strategies to craft impactful answers. Whether you’re a beginner or a pro, these tips will elevate your preparation.

Questions Asked in Proficiency in Trade-Related Software (e.g., COMTRADE, UNCTADSTAT) Interview

Q 1. Explain the difference between COMTRADE and UNCTADSTAT datasets.

Both COMTRADE and UNCTADSTAT are invaluable resources for international trade data, but they differ in scope and detail. COMTRADE, run by the United Nations Statistics Division, focuses on providing highly detailed bilateral trade statistics at the HS (Harmonized System) 6-digit product level. Think of it as a very precise snapshot of who’s trading what with whom. UNCTADSTAT, maintained by the United Nations Conference on Trade and Development, offers a broader perspective, including data on trade, investment, finance, and development indicators. It provides a wider lens on global economic trends and often aggregates data at higher levels of aggregation than COMTRADE. For example, while COMTRADE might show the exact value of widgets exported from China to the US in 2022, UNCTADSTAT might focus on overall trade patterns between developing and developed nations.

In essence, COMTRADE excels in granular detail for specific trade flows, while UNCTADSTAT provides a more comprehensive overview of global trade within a broader economic context.

Q 2. Describe your experience using COMTRADE to analyze bilateral trade flows.

I’ve extensively used COMTRADE to analyze bilateral trade flows, often focusing on identifying trends and changes in specific commodity markets. For instance, I once analyzed the evolution of bilateral trade in solar panels between China and the European Union. Using COMTRADE’s detailed HS classification, I could pinpoint specific types of solar panels (e.g., crystalline silicon photovoltaic cells) and track their trade volumes and values over several years. This allowed me to identify periods of rapid growth or decline, helping to inform investment strategies and understand market dynamics. My analysis involved downloading the data in CSV format, cleaning and transforming it using Python (with libraries like pandas), and then visualizing the results using tools such as Tableau or R.

# Example Python code snippet (Illustrative):

import pandas as pd

data = pd.read_csv('comtrade_data.csv')

china_eu_solar = data[(data['Reporter'] == 'China') & (data['Partner'] == 'EU') & (data['Commodity Code'].str.startswith('8541'))]

print(china_eu_solar.head())This process allows for a rigorous and evidence-based understanding of market dynamics.

Q 3. How would you use UNCTADSTAT to identify emerging export markets for a specific product?

To identify emerging export markets for a specific product using UNCTADSTAT, I would begin by selecting the relevant product category from its classification system. Then, I would utilize the database’s search and filtering capabilities to examine import data for that product across various countries. Instead of focusing on individual bilateral relationships like in COMTRADE, I’d look for countries exhibiting consistent and significant growth in imports of that specific product over time.

I would also consider other relevant factors from UNCTADSTAT, such as a country’s economic growth rate, import tariffs, and trade policies, to assess the overall market potential. A country might show high import growth, but political instability or high tariffs could pose challenges. Combining quantitative import data with qualitative indicators from UNCTADSTAT’s broader economic and development data allows for a more robust market analysis.

For example, if analyzing the potential export market for organic coffee beans, I would focus on countries with a growing demand (based on import data) and a consumer culture that appreciates premium, sustainably sourced products. This holistic approach provides a well-rounded picture of market opportunity.

Q 4. What are the limitations of using COMTRADE data for market analysis?

While COMTRADE is a powerful resource, it does have limitations for market analysis. Firstly, data reporting lags can exist; the most recent data may not be immediately available, delaying analysis. Secondly, data accuracy depends on the reporting practices of individual countries; discrepancies or inconsistencies may occur across countries due to differing reporting standards or methodologies. Thirdly, COMTRADE provides quantity and value data, but it doesn’t always provide insights into factors such as market prices, consumer preferences, or competitive landscapes. These are all crucial for a comprehensive market analysis. Finally, the data only reflects reported trade and may not capture informal or undocumented trade flows which can be substantial in some markets.

Understanding these limitations is crucial for interpreting COMTRADE data accurately and avoiding biased conclusions. Relying solely on COMTRADE might lead to an incomplete market assessment.

Q 5. How do you ensure data accuracy and consistency when working with trade datasets?

Ensuring data accuracy and consistency when working with trade datasets is paramount. My approach involves a multi-step process: Firstly, I always cross-reference data from multiple sources whenever possible. For example, comparing data from COMTRADE with national statistics offices’ publications helps detect anomalies and discrepancies. Secondly, I meticulously check for data inconsistencies such as missing values, outliers, or illogical entries. Data cleaning techniques, such as imputation (for missing values) and outlier removal, are employed. Finally, I consistently maintain detailed documentation of all data cleaning and processing steps, ensuring reproducibility and transparency.

Data validation is also critical. This involves establishing a set of rules and checks to verify that the data meets predefined quality standards. Using checksums or hash values also helps to detect unintentional data alterations during the processing and storage phases.

Q 6. Explain your process for cleaning and preparing trade data for analysis.

My process for cleaning and preparing trade data for analysis typically starts with data importing and initial inspection. I assess data completeness, check for consistent formatting, and identify any obvious errors or inconsistencies. Then, I use scripting languages such as Python or R to automate the data cleaning process. This often involves dealing with missing values (through imputation or removal), handling inconsistent units or formats, and standardizing variable names. Outlier detection and treatment is another essential step. Outliers may represent genuine anomalies or data entry errors and require careful analysis.

Finally, after cleaning, I transform the data into a suitable format for analysis, usually a structured format suitable for statistical software packages or data visualization tools. This might include aggregating data to different levels of granularity, creating new variables, or merging datasets from different sources. The entire process is meticulously documented for reproducibility and to facilitate future analysis.

Q 7. What statistical methods are you familiar with for analyzing trade data?

I’m proficient in various statistical methods for analyzing trade data, including:

- Descriptive Statistics: Calculating means, medians, standard deviations, and other descriptive measures to summarize key trends and patterns in trade data.

- Regression Analysis: Exploring the relationships between trade flows and various economic factors, such as GDP, exchange rates, or trade policies (e.g., gravity models).

- Time Series Analysis: Examining changes in trade flows over time to identify trends, seasonality, and cyclical patterns (e.g., ARIMA models for forecasting).

- Panel Data Analysis: Investigating trade flows across multiple countries and time periods, controlling for country-specific and time-specific effects.

- Econometric Modeling: Applying advanced statistical techniques to model and forecast trade flows, accounting for complex relationships and potential biases.

The choice of method depends heavily on the research question and the nature of the data. I often employ a combination of techniques to obtain a robust and insightful understanding of the trade data.

Q 8. How would you identify and interpret trends in trade data using COMTRADE or UNCTADSTAT?

Identifying and interpreting trends in trade data using COMTRADE or UNCTADSTAT involves a multi-step process. First, you need to define the scope of your analysis – which countries, products, and time periods are you interested in? Once defined, you can download the relevant data. Both databases allow for sophisticated queries to extract specific data sets. Next, I would use various analytical techniques. For example, I might calculate year-on-year growth rates to identify trends in export or import values for specific goods or between specific trading partners. I would look for patterns using moving averages to smooth out short-term fluctuations and reveal longer-term trends. I’d also create charts and graphs to visualize these trends. For instance, a line chart showing export volume over time for a specific product will clearly illustrate any upward or downward trends. If analyzing multiple products or countries, I might group them based on similar patterns to draw broader conclusions. Ultimately, interpretation relies on understanding global economic factors, domestic policies, and events. For example, a sharp decline in exports of a certain commodity might be linked to changes in global demand or an economic recession in a key trading partner.

For instance, if I were analyzing global coffee exports using COMTRADE, I could compare the export values from Brazil and Vietnam over a decade. A declining trend in Brazilian coffee exports combined with a rising trend in Vietnamese exports might suggest a shift in global market share driven by factors such as production costs, climate change impacts or trade agreements.

Q 9. Describe your experience using pivot tables or other data manipulation techniques in Excel with trade data.

I extensively use pivot tables in Excel to analyze trade data. They are invaluable for summarizing large datasets and revealing hidden relationships. For example, I might use a pivot table to calculate the total value of exports from a country to different regions for each year, or to aggregate trade values by product category. Beyond simple summarization, I utilize calculated fields within pivot tables to create new metrics – such as the trade balance for each region or the year-on-year growth rate of specific exports. I also use Excel’s filtering and sorting capabilities in conjunction with pivot tables to isolate specific aspects of the data for closer examination. For instance, I can filter a pivot table to focus only on exports of manufactured goods during a specific economic recession to analyze the sector’s performance during that time. In addition to pivot tables, I employ other data manipulation techniques like VLOOKUP and INDEX/MATCH to consolidate data from multiple sheets, cleanse datasets (dealing with inconsistencies or errors) and create custom reports. This is especially helpful when combining trade data from various sources.

Example: Using a pivot table with 'Country' as Row Labels, 'Year' as Column Labels, and 'Export Value' as Values, I can quickly see a yearly export value summary for each country. Adding a calculated field to compute the percentage change from the previous year provides insightful growth data.Q 10. How would you visualize trade data effectively using tools like Tableau or Power BI?

To visualize trade data effectively, I utilize Tableau and Power BI. These tools allow me to create interactive and compelling visualizations which effectively communicate complex information to both technical and non-technical audiences. For example, to visualize trade flows, I use maps to display trade between countries, the size of the flow represented by the line thickness or marker size. For time-series data, I employ line charts to show trends in export/import values, and bar charts for comparing trade values across different countries or product categories. To show the composition of trade, I utilize pie charts or treemaps. The interactive nature of these tools allows viewers to drill down into the data to examine specific subsets, further enhancing understanding. For example, a dashboard showing total trade volume by product might then allow users to select a specific product category to view more detailed analysis on that sector. Choosing appropriate visualizations is crucial: a poorly chosen chart can obscure patterns; a well-chosen one can highlight them.

Q 11. How do you handle missing data in trade datasets?

Missing data in trade datasets is a common challenge. My approach depends on the extent and nature of the missing data. For small amounts of missing values, I might use simple imputation techniques, such as replacing missing values with the mean or median of the available data for that variable. However, this method can distort the results if the missing data is not random. For more significant missing data, I would explore more sophisticated methods, such as regression imputation, which uses statistical models to predict the missing values based on other variables. For example, I might use historical data and related economic indicators to predict missing export values. Alternatively, I might employ multiple imputation, which generates several plausible values for each missing data point, reflecting the uncertainty introduced by the missing data. It’s crucial to document all data imputation methods to ensure transparency and maintain the integrity of the analysis. Before using any method, I would assess if there is a pattern in the missing data, for instance whether it’s more prevalent in certain countries or time periods. Understanding the reason for the missing data provides clues on the best imputation strategy.

Q 12. What are the key indicators you would use to assess the competitiveness of a country’s export sector?

Assessing a country’s export sector competitiveness requires considering multiple key indicators. Firstly, market share – the percentage of global exports accounted for by a specific country in a particular product – reveals competitiveness relative to other nations. Export growth rates over time show the dynamism of the sector. Export diversification, meaning a spread across various products, is vital for resilience against changes in global demand or protectionist measures. Examining the unit value of exports helps determine the price competitiveness of a nation’s goods; higher values usually suggest greater value addition and higher-quality products. Trade balances for specific sectors indicate how well exports are performing against imports in the same sector. A positive balance signals strong competitiveness. Also crucial are indicators of the efficiency of the production process, such as labor productivity in export-oriented industries. Lastly, the quality of supporting infrastructure (ports, transportation, logistics) significantly influences export performance. Analysis of all these metrics provides a comprehensive assessment of export sector competitiveness.

Q 13. Explain your understanding of trade balances and their implications.

A trade balance represents the difference between a country’s total exports and total imports over a specific period (usually a year). A trade surplus means exports exceed imports, while a trade deficit signifies that imports are higher than exports. The implications of a trade balance are multifaceted. A persistent trade surplus might indicate a highly competitive export sector, but it can also signal underconsumption at home or a lack of investment in domestic production. Conversely, a consistent trade deficit might signal high domestic demand and foreign investment, but it can also suggest over-reliance on imports and potential vulnerabilities to external economic shocks. It’s essential to analyze the trade balance in context – considering economic growth rates, investment levels, and government policies. Focusing on the balance in specific sectors (e.g., manufacturing, agriculture) rather than just the overall balance provides a more nuanced understanding.

For example, a country might have an overall trade deficit but maintain a trade surplus in technology exports, suggesting strong international competitiveness in that particular sector. Analyzing this nuance is vital for effective economic policymaking.

Q 14. How do tariffs and non-tariff barriers affect international trade flows?

Tariffs and non-tariff barriers significantly impact international trade flows. Tariffs are taxes imposed on imported goods, increasing their price and thus reducing their competitiveness compared to domestically produced goods. High tariffs often lead to decreased imports and potential retaliation from other countries, impacting export markets. Non-tariff barriers are regulatory measures that restrict trade without directly imposing taxes. Examples include sanitary and phytosanitary regulations (SPS), technical barriers to trade (TBT), and administrative procedures such as customs inspections. These barriers can be more subtle than tariffs but equally effective in limiting imports. For instance, strict SPS regulations on food safety might exclude goods from certain countries, even if they are priced competitively. In essence, both tariffs and non-tariff barriers raise the costs of importing goods, thereby affecting the overall volume and pattern of international trade, potentially hindering economic growth and efficiency.

Q 15. How familiar are you with HS codes and their application in trade data analysis?

Harmonized System (HS) codes are a standardized, internationally recognized system for classifying traded products. They are crucial for trade data analysis because they provide a consistent way to categorize goods, regardless of the country of origin or destination. This allows for accurate aggregation and comparison of trade flows across different countries and time periods.

For example, instead of vaguely describing a product as “clothing,” the HS code provides a very specific classification, like 620462 for “Women’s or girls’ suits, ensembles, jackets, blazers, dresses, skirts, trousers, bibs and breeches, other garments and knitted or crocheted articles; other garments, made from textile materials, of man-made fibers.” This level of detail is critical for precise analysis. I’ve extensively used HS codes in COMTRADE and UNCTADSTAT to filter and analyze specific product categories, allowing me to pinpoint trends in particular industries or identify specific product import/export patterns for given countries.

My familiarity extends beyond simple data filtering. I understand the hierarchical structure of HS codes, allowing me to aggregate data at different levels of granularity (e.g., analyzing all clothing versus only women’s clothing). I also understand the nuances of code changes over time (amendments to the HS nomenclature) and how to adjust analyses accordingly.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How would you use trade data to identify potential risks or opportunities for a specific company?

To identify potential risks or opportunities for a company using trade data, I would employ a multi-faceted approach. First, I’d analyze the company’s import and export patterns, looking for trends in volumes, values, and trading partners. This helps identify key markets and potential vulnerabilities.

For example, if a company relies heavily on imports from a single supplier in a politically unstable region, this presents a significant risk. Conversely, identifying a rapidly growing market segment for a company’s products presents an opportunity for expansion.

Second, I’d use the data to conduct competitive analysis. By looking at import and export data for competitors, I can assess their market share, identify their primary sources and destinations, and spot emerging competitors. This information is valuable for strategic planning and risk mitigation.

Third, I would perform a market analysis. By examining overall import and export trends for the products relevant to the company, I can identify changes in demand, supply-chain disruptions, or the emergence of new substitutes. I can also assess tariff and non-tariff barriers that might affect a company’s operations.

Finally, I would consider macro-economic factors like exchange rate fluctuations and global trade policies. Changes in these factors can significantly impact a company’s profitability and competitiveness. All of this would be done using COMTRADE or UNCTADSTAT data, supplemented with other relevant sources to gain a holistic view.

Q 17. Describe your experience with data extraction, transformation, and loading (ETL) processes for trade data.

My ETL experience with trade data involves several key steps. It begins with extraction, typically from databases like COMTRADE or UNCTADSTAT. This often involves using SQL queries to extract the relevant data based on specific criteria (e.g., country, product, time period). I’m proficient in writing complex SQL queries to handle large datasets and efficiently retrieve the required information. I’ve worked with both direct database connections and data download methods depending on the API limitations and the size of the data.

The transformation stage is crucial. This involves cleaning, standardizing, and enriching the data. This may include handling missing values, correcting inconsistencies in data entries, converting data types, and joining data from multiple sources. For instance, I might need to merge HS code descriptions with trade volume data or geo-code country names for easier mapping.

Finally, the loading step involves transferring the transformed data into a target database or data warehouse for further analysis and visualization. I have experience with loading data into various DBMS, including relational databases like PostgreSQL and MySQL, as well as cloud-based solutions like Snowflake and BigQuery.

Throughout this process, I ensure data quality and integrity. Regular validation steps are performed to guarantee accuracy and consistency.

Q 18. Have you used any APIs to access trade data?

Yes, I have extensive experience using APIs to access trade data. I’ve worked with the APIs provided by various organizations such as COMTRADE and UNCTADSTAT. These APIs allow for programmatic access to large datasets, avoiding the need for manual downloads and facilitating automation.

For example, I’ve used Python libraries like requests to make API calls, retrieve trade data in JSON format, and then process the data using pandas for cleaning and analysis. I understand how to handle API rate limits, authentication protocols, and error handling to ensure smooth and efficient data retrieval. My experience includes working with both RESTful and other API structures.

Q 19. Explain your experience with database management systems (DBMS) relevant to trade data.

My experience with DBMS in the context of trade data encompasses both relational and NoSQL databases. I’m proficient in relational databases like PostgreSQL and MySQL, which are well-suited for structured trade data with clearly defined relationships between tables (e.g., country, product, time period). I’ve designed and optimized database schemas to efficiently store and query large volumes of trade data. I’m comfortable with SQL for data manipulation, query optimization, and database administration tasks.

While less common for purely structured trade data, I also have familiarity with NoSQL databases like MongoDB, which can be beneficial when dealing with semi-structured or unstructured data, such as textual descriptions of goods or qualitative assessments of trade barriers.

My approach to database management includes data modeling, schema design, performance optimization, security, and data backup and recovery procedures. I understand the importance of ensuring data integrity, security, and accessibility for analysis and reporting.

Q 20. How do you stay current with changes and updates in trade data sources and methodologies?

Staying current with changes in trade data sources and methodologies is essential. I achieve this through several strategies:

- Regularly checking official websites of organizations like the WTO, UNCTAD, and national statistical offices for updates and announcements on data revisions, methodology changes, and new data releases.

- Subscribing to newsletters and mailing lists from relevant organizations to receive notifications of significant updates.

- Attending conferences and workshops related to international trade and data analysis to learn about the latest developments and best practices.

- Actively engaging with online communities and forums dedicated to trade data analysis to discuss challenges, share knowledge, and learn from peers’ experiences.

- Reviewing academic publications and industry reports to stay abreast of the latest research and advancements in data analysis techniques.

This multi-faceted approach ensures that my work remains accurate, relevant, and compliant with the latest standards.

Q 21. How would you explain complex trade data findings to a non-technical audience?

Explaining complex trade data findings to a non-technical audience requires a clear and concise communication style. I avoid jargon and technical terms as much as possible. Instead, I use simple language, relatable analogies, and visual aids (charts, graphs, maps) to illustrate key findings.

For example, instead of saying “The coefficient of determination (R-squared) indicates a strong correlation between exports and GDP growth,” I might say “Our analysis shows a strong relationship between a country’s exports and its economic growth; as exports increase, so does the economy.” I’d also use a graph to clearly show this relationship.

I focus on telling a story with the data, highlighting the most important insights and their implications for the audience. I tailor my explanations to the audience’s background and level of understanding. Before presenting, I carefully consider what information is essential and how to present it in a way that is easily understood and remembered.

Q 22. What are some common challenges you face when working with large trade datasets?

Working with large trade datasets, like those from COMTRADE or UNCTADSTAT, presents several challenges. The sheer volume of data can overwhelm even powerful computers, leading to slow processing times and difficulties in data manipulation. Inconsistencies in data reporting across countries are another major hurdle. Different nations might use varying classifications, units of measurement, or reporting frequencies, requiring significant cleaning and harmonization efforts. Data quality is another key concern; errors, omissions, and inconsistencies can significantly affect analysis outcomes. Finally, the complex structure of these datasets requires specialized knowledge to navigate and extract meaningful insights efficiently. For example, finding a specific commodity’s trade flows between two countries over a period of several years can involve multiple steps and cross-referencing.

Imagine trying to assemble a massive jigsaw puzzle with missing pieces and some pieces in the wrong box! That’s the kind of challenge data cleaning represents. To address these issues, I utilize techniques like data profiling, employing robust software for efficient data management (like R or Python with specialized packages), and meticulously documenting the cleaning and transformation steps to ensure reproducibility and transparency.

Q 23. How do you prioritize competing deadlines when managing multiple trade data projects?

Prioritizing competing deadlines across multiple trade data projects demands a strategic approach. I typically begin by creating a comprehensive project overview, outlining all tasks, deadlines, and dependencies. Then, I employ a prioritization framework that considers factors such as project urgency, impact, resource allocation, and stakeholder expectations. This involves assigning each project a priority level (high, medium, low) and then scheduling tasks accordingly using project management tools. For instance, a time-sensitive project with high stakeholder visibility would receive immediate attention, while others might be sequenced based on their individual deadlines and resource requirements.

I also regularly communicate project status to stakeholders, providing updates and proactively addressing potential roadblocks. Transparency and open communication are crucial to maintaining positive relationships and managing expectations. Think of it like an air traffic controller guiding multiple planes to land safely – each plane (project) needs careful monitoring and management to avoid collisions (missed deadlines).

Q 24. Describe a situation where you had to troubleshoot an issue with trade data.

In one project involving analysis of agricultural exports from Southeast Asia, I encountered a significant discrepancy in data from COMTRADE. The reported export values for rice from Vietnam were unusually low compared to other sources, including national statistics. After initial investigation, I discovered that the COMTRADE data used a different Harmonized System (HS) code for a subset of rice exports compared to other data sources. This resulted in a misclassification and underreporting of rice exports. I spent several days meticulously investigating various HS code classifications and cross-referencing different data sources before resolving the issue. Ultimately, I had to revise my analysis to account for this data discrepancy and ensured to clearly document the correction process.

This highlights the importance of careful data validation and cross-checking to ensure accuracy and reliability. It also demonstrated the need for strong understanding of HS codes and the complexities in international trade data reporting methodologies.

Q 25. What strategies do you use to effectively communicate your trade data analysis findings?

Effective communication of trade data analysis findings is critical for ensuring they are understood and acted upon. I utilize various strategies depending on the audience and the complexity of the analysis. For technical audiences, I leverage detailed reports with charts, graphs, and statistical analyses. I might include R or Python code snippets to illustrate my methodology, ensuring transparency and reproducibility. For non-technical audiences, I opt for more concise presentations focusing on key insights and actionable recommendations. I frequently incorporate visually appealing dashboards and infographics, avoiding overly technical jargon.

Regardless of the audience, clarity, conciseness and visual aids are paramount. Think of it as telling a story with your data; you need to engage your audience and make the findings relevant to their interests. I regularly provide clear summaries, emphasizing the key findings and their implications, and am always ready to answer questions and provide further clarification.

Q 26. Describe your experience working with various data formats related to international trade.

My experience encompasses a broad range of data formats commonly used in international trade. I’m proficient in working with comma-separated values (CSV), tab-separated values (TSV), and Excel spreadsheets (.xlsx). I also have experience handling more structured formats like XML and JSON, which are increasingly prevalent in modern trade databases. Furthermore, I have extensive familiarity with relational databases (SQL) and can extract and manipulate data efficiently. I’ve worked with various APIs provided by organizations like the WTO and UNCTAD to directly access and download datasets in different formats.

Understanding data structure is key; imagine trying to use a screwdriver to hammer a nail. Different formats have different structures and strengths. My proficiency ensures I can adapt to any format efficiently. This adaptability is crucial for effectively managing diverse datasets and extracting valuable insights.

Q 27. How do you ensure the confidentiality and security of sensitive trade data?

Ensuring the confidentiality and security of sensitive trade data is of paramount importance. I adhere to strict protocols, including anonymizing data where appropriate, employing strong password protection, and using secure data storage solutions such as encrypted cloud storage or on-premise servers with robust access controls. I always follow any data governance policies and procedures established by the organization. Furthermore, I meticulously document all data handling processes, ensuring a clear audit trail for accountability and transparency. Data security is not an afterthought; it’s an integral part of every stage of the data lifecycle.

Imagine trade secrets as high-value assets. Protecting them requires a multi-layered security approach, just like a bank vault with multiple locks and security personnel. This includes not only technical safeguards but also strict adherence to ethical guidelines.

Q 28. What are your salary expectations for this position?

My salary expectations for this position are commensurate with my experience, skills, and the market rate for similar roles. I am open to discussing a competitive salary range based on the specific responsibilities and compensation package offered. I’m confident that my expertise and contributions would significantly benefit your organization.

Key Topics to Learn for Proficiency in Trade-Related Software (e.g., COMTRADE, UNCTADSTAT) Interview

- Data Navigation and Retrieval: Mastering the interface and efficiently extracting relevant trade data from COMTRADE and UNCTADSTAT databases. This includes understanding data structures and utilizing search filters effectively.

- Data Interpretation and Analysis: Moving beyond simply retrieving data to analyzing trends, identifying patterns, and drawing meaningful conclusions from trade statistics. Practice interpreting key indicators and visualizing data effectively.

- Specific Data Fields and Definitions: Gain a thorough understanding of the meaning and implications of various data fields within the software, such as HS Codes, trade values, quantities, and partners. Understanding data limitations is crucial.

- Data Cleaning and Validation: Learn techniques for identifying and handling inconsistencies or errors in the data. Understanding data quality is essential for accurate analysis.

- Report Generation and Presentation: Develop the skill to create clear, concise, and insightful reports based on your data analysis. Practice presenting your findings in a professional and understandable manner.

- Advanced Features and Functionality: Explore advanced features within the software, such as data downloads, customization options, and any specialized analytical tools.

- Comparative Analysis: Practice comparing trade data across different countries, time periods, or product categories. This demonstrates a deeper understanding of the data’s implications.

- Problem-Solving with Trade Data: Be prepared to discuss how you would approach a hypothetical scenario requiring analysis of trade data using COMTRADE or UNCTADSTAT to solve a specific business problem.

Next Steps

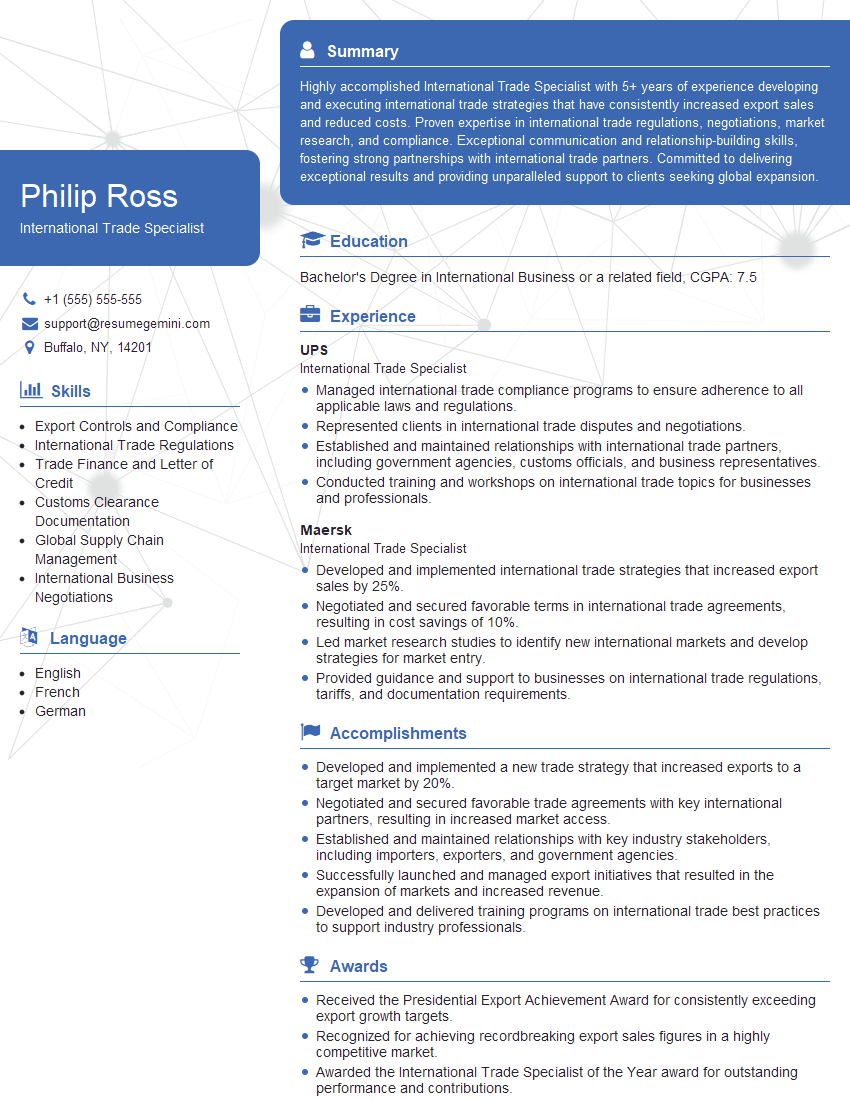

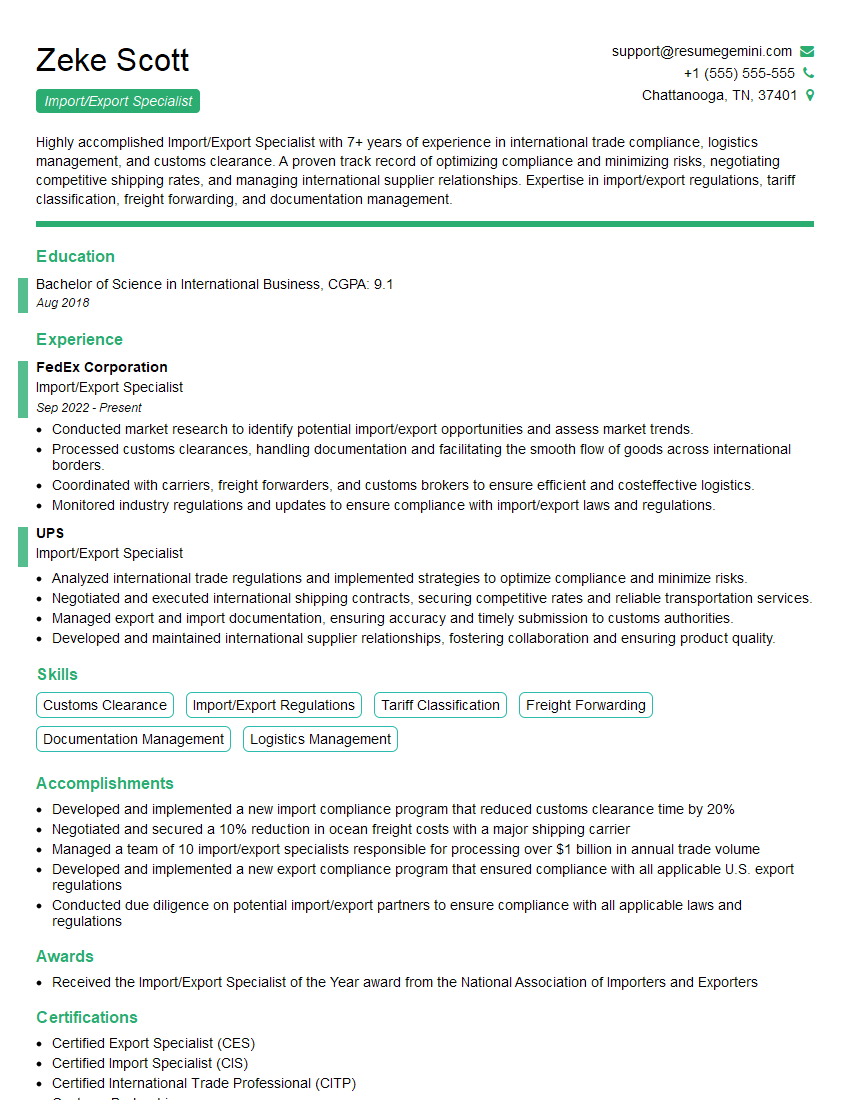

Mastering trade-related software like COMTRADE and UNCTADSTAT is crucial for career advancement in international trade, economics, and related fields. These skills demonstrate valuable analytical abilities and a practical understanding of global trade dynamics. To significantly boost your job prospects, it’s essential to create an ATS-friendly resume that highlights your expertise. ResumeGemini is a trusted resource to help you craft a professional and impactful resume that showcases your skills effectively. Examples of resumes tailored to proficiency in COMTRADE and UNCTADSTAT are available to further assist you in crafting your application materials. Take this opportunity to elevate your resume and confidently showcase your qualifications.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

To the interviewgemini.com Webmaster.

Very helpful and content specific questions to help prepare me for my interview!

Thank you

To the interviewgemini.com Webmaster.

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.