Preparation is the key to success in any interview. In this post, we’ll explore crucial Resource Valuation interview questions and equip you with strategies to craft impactful answers. Whether you’re a beginner or a pro, these tips will elevate your preparation.

Questions Asked in Resource Valuation Interview

Q 1. Explain the different approaches to resource valuation (e.g., income, market, cost).

Resource valuation employs several approaches, each offering a unique perspective on a resource’s worth. The three primary methods are the income approach, the market approach, and the cost approach.

- Income Approach: This method focuses on the future cash flows a resource is expected to generate. We project future revenues from resource extraction, deduct operating expenses, and then discount these future cash flows back to their present value using a suitable discount rate. Think of it like calculating the present value of all the money you expect to earn from an oil well over its lifetime. This is commonly done using Discounted Cash Flow (DCF) analysis, which we’ll discuss later.

- Market Approach: This approach values a resource by comparing it to similar resources that have recently traded in the market. For example, if a gold mine is being valued, we’d look at the prices paid for comparable gold mines sold recently. This method relies heavily on finding truly comparable assets, which can be challenging. Market transactions data serves as a strong indicator of market perception of value.

- Cost Approach: This method estimates the value based on the cost of replacing or reproducing the resource. It’s particularly relevant for newly discovered resources where market data is scarce. For example, the cost approach could be used to estimate the value of a newly discovered copper deposit by calculating the cost of developing and extracting the copper based on current market prices for labor, materials, and technology.

The choice of approach often depends on the specific resource, the availability of data, and the purpose of the valuation. Often, a combination of approaches is used to provide a more robust and reliable estimate.

Q 2. Describe the concept of discounted cash flow (DCF) analysis and its application in resource valuation.

Discounted Cash Flow (DCF) analysis is a cornerstone of the income approach to resource valuation. It’s a method that determines the present value of future cash flows generated by a resource. The core idea is that money received in the future is worth less than money received today because of inflation, risk, and the potential to earn a return on your investment elsewhere.

Here’s how it works: We project the expected net cash flows (revenues minus expenses) for each year of the resource’s life. Then, we discount each year’s cash flow back to its present value using a discount rate that reflects the risk associated with the project. This discount rate usually incorporates a risk-free rate (like the return on government bonds) and a risk premium (that accounts for the uncertainty in the project’s cash flows).

The sum of all these discounted cash flows represents the present value of the resource. A higher discount rate results in a lower present value, reflecting a higher perceived risk. The DCF model can be relatively complex to build; accurate forecasting of future prices, costs, and production levels are critical to reliable results.

Example: Present Value = Σ (Net Cash Flow in Year t) / (1 + Discount Rate)^tWhere ‘t’ represents the year, and the summation is done over the entire life of the project. Software tools are widely used to conduct sophisticated DCF analysis, incorporating various scenarios and probabilities.

Q 3. How do you handle uncertainty and risk in resource valuation?

Uncertainty and risk are inherent in resource valuation, especially in the extractive industries. Several techniques help us account for this:

- Sensitivity Analysis: This involves changing key variables (e.g., commodity prices, operating costs, production rates) one at a time to see how they impact the valuation. It reveals the variables that exert the most influence on value. Think of it as a ‘what-if’ scenario analysis.

- Scenario Planning: We develop different scenarios (e.g., optimistic, pessimistic, most likely) based on various combinations of key variables. Each scenario is valued separately, giving a range of possible values.

- Monte Carlo Simulation: A more advanced technique that uses probability distributions for key variables to simulate a large number of potential outcomes. This gives a probability distribution of possible values, rather than just a single estimate, providing a much richer representation of the risk and uncertainty.

- Real Options Analysis: This considers the value of managerial flexibility, such as the option to defer development, expand production, or abandon the project if circumstances change. This adds another layer of complexity but can significantly impact the valuation.

The choice of method depends on the level of sophistication required and the availability of data. Generally, using multiple methods and comparing results provides better risk management.

Q 4. What are the key factors influencing the value of mineral reserves?

Several factors heavily influence the value of mineral reserves:

- Commodity Prices: The most significant factor. Higher commodity prices translate directly into higher revenue projections and therefore a higher valuation.

- Reserve Size and Grade: The amount of ore and its concentration of valuable minerals directly affect the volume and profitability of production.

- Geological Factors: Complexity of extraction, the presence of difficult-to-extract minerals, and geological risks (e.g., rock instability) can affect production costs and project feasibility.

- Operating Costs: These include labor, energy, transportation, and processing costs. Lower operating costs lead to higher profitability.

- Location and Infrastructure: Accessibility, proximity to infrastructure (roads, power, water), and regulatory environment influence development costs and risks.

- Technology: Advancements in extraction and processing technologies can improve efficiency and lower costs, thereby increasing value.

- Environmental Regulations: Stringent environmental regulations can increase compliance costs and add project risks.

- Political and Social Factors: Political stability, community relations, and permitting processes all impact the development and operation of mining projects.

A sophisticated valuation will carefully consider the interplay of all these factors and their potential interdependencies.

Q 5. Explain the significance of reserve classification (proven, probable, possible).

Reserve classification (proven, probable, possible) is crucial for transparency and risk management in resource valuation. It reflects the level of geological confidence in the existence and recoverability of the resource.

- Proven Reserves: These are reserves with a high degree of geological assurance. They are supported by detailed geological data, drilling results, and feasibility studies. There’s a high confidence that they can be economically extracted.

- Probable Reserves: These reserves have a reasonable chance of being economically extracted. The geological evidence is less comprehensive than for proven reserves, and there’s a higher degree of uncertainty.

- Possible Reserves: These reserves are speculative and have a low probability of being economically extracted. Geological information is limited, and significant exploration is needed to confirm their existence and recoverability.

Different reserve categories are used for different purposes. For instance, proven reserves might be used to secure financing or make production commitments, while probable reserves might inform longer-term planning decisions. Valuation techniques adjust for the different levels of certainty associated with each category, reflecting the inherent uncertainty in each classification.

Q 6. How do you account for depletion and depreciation in resource valuation?

Depletion and depreciation are essential accounting considerations in resource valuation, reflecting the consumption of a natural resource and the wearing down of capital assets, respectively.

- Depletion: This represents the reduction in the value of a natural resource as it is extracted. The depletion expense reflects the portion of the resource’s value that is used up during a period. It’s calculated based on the units of the resource extracted and the resource’s total value.

- Depreciation: This applies to the physical assets used in resource extraction (e.g., mining equipment, processing plants). Depreciation reflects the allocation of the asset’s cost over its useful life. Several methods exist for calculating depreciation (straight-line, declining balance, etc.).

Both depletion and depreciation are non-cash expenses; they reduce the reported net income but do not involve an actual cash outflow. However, they are crucial for determining the true economic profit of the resource extraction activity and for tax purposes. A proper calculation is essential for representing the true economic return on the investment.

Q 7. What are the challenges in valuing intangible assets related to resource extraction?

Valuing intangible assets related to resource extraction presents significant challenges. These assets are non-physical and difficult to quantify, yet can significantly influence the overall value of a resource project.

- Exploration Data and Expertise: The knowledge gained from years of exploration, geological surveys, and technical expertise is invaluable but hard to quantify. It can reduce future exploration risks and guide efficient resource extraction, but its monetary value is difficult to assign.

- Permitting and Licenses: Obtaining necessary permits and licenses can be a lengthy and costly process. The value of a secured permit is related to the reduced risk of project delays or rejection but it’s not easily expressed in monetary terms.

- Reputation and Brand: A company with a strong reputation for safe and responsible resource extraction might command higher prices or attract better financing terms. However, this intangible value is difficult to directly measure.

- Employee Skills and Knowledge: A skilled workforce is vital for successful resource extraction. Valuing this collective knowledge and expertise is a challenge; it can lead to higher productivity and efficiency but its valuation needs to account for factors like attrition and staff turnover.

Often, a combination of qualitative and quantitative techniques is used. These might include market-based approaches (comparing premiums paid for companies with stronger reputations), cost-based approaches (estimating the costs of rebuilding the intangible asset), or income-based approaches (assessing the future contributions of the intangible assets to the project’s cash flows). The lack of readily available comparable transactions complicates this exercise.

Q 8. Discuss the impact of commodity price volatility on resource valuations.

Commodity price volatility significantly impacts resource valuations because the value of a resource is directly tied to its market price. High volatility introduces considerable uncertainty, making it challenging to accurately predict future cash flows, a critical component of any valuation model. Imagine you’re valuing an iron ore mine: if the price of iron ore fluctuates wildly, your projections of future revenue will be unreliable, leading to a wider range of possible valuations and increasing the risk associated with the investment.

- Increased Uncertainty: Volatile prices make it harder to forecast future profits, affecting the Net Present Value (NPV) calculation and making it difficult to assess the project’s profitability.

- Higher Discount Rates: Investors will demand higher returns to compensate for the increased risk associated with volatile commodity prices, leading to a lower NPV.

- Impact on Investment Decisions: Extreme price swings can cause projects that looked viable at one point to become uneconomical very quickly, potentially leading to project delays, cancellations, or even bankruptcies.

For example, a sudden drop in oil prices can drastically reduce the value of an oil exploration project, even if all other factors remain constant. Conversely, a sustained price increase can significantly enhance its value. Effective resource valuation requires sophisticated techniques to model and manage this price risk, often incorporating scenario analysis and Monte Carlo simulations.

Q 9. Explain the concept of net present value (NPV) and its use in resource investment decisions.

Net Present Value (NPV) is a core concept in finance used to evaluate the profitability of a project. It represents the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Essentially, it tells us if an investment is worthwhile by comparing the value of money received in the future to the cost of investing today, accounting for the time value of money.

In resource investment decisions, NPV is crucial because it allows investors to compare different projects objectively. A positive NPV indicates that the project is expected to generate more value than it costs, making it a worthwhile investment. Conversely, a negative NPV suggests the project is likely to lose money. The higher the NPV, the more attractive the investment.

The formula for NPV is:

NPV = Σ [CFt / (1 + r)^t] - C0Where:

- CFt = Net cash flow at time t

- r = Discount rate

- t = Time period

- C0 = Initial investment

For example, if a mining project requires an initial investment of $10 million and is expected to generate $2 million in net cash flow annually for 10 years, with a discount rate of 10%, we can calculate its NPV. A positive NPV would suggest that the investment is worth pursuing.

Q 10. How do you determine the appropriate discount rate for resource valuation projects?

Determining the appropriate discount rate is critical in resource valuation as it directly impacts the NPV and hence the investment decision. The discount rate reflects the risk and opportunity cost associated with the project. A higher discount rate implies a higher risk or a greater opportunity to earn returns elsewhere, leading to a lower NPV. Conversely, a lower discount rate implies a lower risk or fewer attractive alternatives.

Several methods exist to determine the appropriate discount rate:

- Weighted Average Cost of Capital (WACC): This is a common approach, especially for publicly traded companies. It considers the proportions of debt and equity financing and the respective costs of each. It represents the minimum return a company needs to earn to satisfy its investors.

- Capital Asset Pricing Model (CAPM): This model uses the risk-free rate, the market risk premium, and the project’s beta (a measure of its volatility relative to the market) to calculate the required return. It’s more suitable for projects with comparable market-traded assets.

- Adjusted Present Value (APV): This method separates the project’s financing effects from its operating cash flows, allowing for a more accurate valuation in situations with complex financing structures.

The chosen method depends on several factors, including the nature of the project, the availability of market data, and the company’s financing structure. Often, a sensitivity analysis is performed to understand how the NPV changes with variations in the discount rate, illustrating the impact of uncertainty in the discount rate selection.

Q 11. Describe your experience with different valuation models (e.g., Black-Scholes, real options).

My experience encompasses a range of valuation models, each appropriate for different situations. I’ve extensively used:

- Discounted Cash Flow (DCF) Analysis: This is a fundamental approach, especially for valuing developed resource assets, where future cash flows can be relatively well-predicted. This includes the NPV calculation discussed earlier and other variations like the Internal Rate of Return (IRR).

- Black-Scholes Model: This option pricing model is particularly useful for valuing undeveloped resource assets or projects with embedded options, like the option to defer development or abandon a project. While primarily used for financial options, it can be adapted to resource valuation problems when appropriate assumptions can be made about price volatility and other parameters.

- Real Options Analysis: This is a powerful technique that explicitly incorporates flexibility and managerial decisions into the valuation. It acknowledges that resource development projects often involve several strategic decisions (e.g., whether to invest in exploration, develop a mine, expand capacity, etc.) that influence the project’s overall value. This method often involves using decision trees or binomial lattices to model the sequence of decisions.

- Comparative Company Analysis: This involves comparing the subject company or asset to similar publicly traded companies or assets, using valuation multiples (e.g., Price-to-Earnings ratio, Enterprise Value-to-EBITDA) to derive a value. This is particularly useful in the early stages of valuation or when detailed financial projections are unavailable.

The selection of the appropriate model is crucial and depends on the project’s specific characteristics, data availability, and the desired level of sophistication.

Q 12. How do environmental regulations impact resource valuations?

Environmental regulations significantly impact resource valuations. Stringent environmental laws and permitting processes can increase the costs and timelines of resource development projects. These impacts can translate directly to lower project profitability and, therefore, a lower valuation.

- Increased Costs: Compliance with environmental regulations often requires investments in pollution control equipment, waste management systems, and environmental monitoring programs, all adding to the project’s capital expenditures.

- Delayed Project Timelines: Obtaining environmental permits and approvals can be a lengthy process, leading to delays in project development and affecting the timing of cash flows.

- Potential for Project Rejection: Non-compliance or failure to secure necessary permits can result in project rejection, rendering the investment worthless.

- Liability Costs: Environmental damage or non-compliance can lead to significant fines and legal liabilities, impacting the project’s profitability and valuation.

- Carbon Pricing: Increasing carbon taxes and cap-and-trade schemes affect the value of carbon-intensive resources, potentially reducing their economic viability.

For example, stricter regulations on mine tailings disposal can significantly increase the cost of operating a mine, potentially reducing its NPV. Conversely, projects with strong environmental management practices might attract higher valuations, reflecting a lower risk profile and potential for favorable public perception. These factors should be meticulously considered in any resource valuation exercise.

Q 13. Explain the concept of optionality in resource development projects.

Optionality in resource development projects refers to the flexibility to make strategic decisions about the project’s development over time. These options arise from the ability to defer, expand, contract, or abandon a project depending on future market conditions, technological advancements, and other unforeseen events. These options have value, representing the potential to adjust the project’s development pathway to maximize profitability.

Examples of optionality:

- Option to Defer: The right to delay the project’s development if market conditions are unfavorable.

- Option to Expand: The right to increase production capacity if demand increases.

- Option to Contract: The right to reduce production capacity if demand falls.

- Option to Abandon: The right to cease operations if the project becomes uneconomical.

Real options analysis (ROA) is a sophisticated technique to explicitly quantify the value of these options. Unlike traditional DCF analysis, ROA doesn’t treat future decisions as predetermined; it models the strategic choices available, and their impact on value. For example, the option to defer development can significantly increase a project’s value when there’s substantial uncertainty in future commodity prices. This ability to wait and learn, before committing large capital expenditures, holds considerable value. Properly accounting for optionality provides a more realistic and comprehensive assessment of a project’s potential.

Q 14. What are the key differences between valuing developed and undeveloped resource assets?

Valuing developed and undeveloped resource assets involves fundamentally different approaches, primarily due to the level of certainty regarding cash flows and the presence of optionality.

- Developed Assets: These are assets that are already in production or are nearing production. Valuation is generally based on discounted cash flow (DCF) analysis, projecting future production levels, operating costs, and commodity prices to estimate future cash flows. The level of certainty in these estimates is relatively higher compared to undeveloped assets. For example, an operating oil refinery has a clearer path to projecting future cash flows than an undeveloped oil field.

- Undeveloped Assets: These assets are not yet in production and require significant exploration, development, and construction before generating revenue. Valuation is more complex and often involves real options analysis to account for uncertainty and the flexibility to make decisions along the project’s lifecycle. The potential for failure is high, and the time horizon is extended. Optionality plays a crucial role since the investor may choose to develop the project or not depending on future conditions.

In summary, valuing developed assets focuses on predicting future cash flows, whereas valuing undeveloped assets emphasizes assessing the strategic choices available and incorporating the potential value of future flexibility. The techniques used, the level of uncertainty, and the resulting valuation outcomes differ significantly between these two asset classes.

Q 15. How do you handle geological uncertainty in resource valuation?

Geological uncertainty is a significant challenge in resource valuation, as it affects the quantity and quality of resources that can be extracted. We handle this by employing probabilistic methods. Instead of relying on single point estimates, we utilize a range of possible outcomes based on geological models and data. This involves:

- Geostatistical Modeling: Creating 3D models of the resource deposit that incorporate the spatial variability of resource grades and thicknesses. These models are typically based on drilling data, which inherently has limitations and uncertainty. Software like Leapfrog Geo are commonly used.

- Monte Carlo Simulation: Running numerous simulations that sample from probability distributions assigned to key geological parameters (e.g., grade, tonnage, recovery rate). This generates a distribution of potential resource values, allowing us to assess the range of possible outcomes and their likelihoods.

- Sensitivity Analysis (discussed further in the next question): Identifying which geological parameters are most influential on the final valuation and focusing on reducing uncertainty around those parameters. For example, if the resource grade is highly uncertain and has a large impact on the final value, we might conduct additional drilling or geophysics to refine our understanding.

For instance, in a gold mine valuation, we might use geostatistics to model the gold grade distribution within the orebody. A Monte Carlo simulation would then generate thousands of possible grade distributions, leading to a distribution of possible gold reserves and a corresponding distribution of Net Present Value (NPV).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with sensitivity analysis in resource valuation.

Sensitivity analysis is crucial in resource valuation because it allows us to assess the impact of changes in input variables on the final valuation. It’s like testing the robustness of our estimate. I’ve extensively used sensitivity analysis across various projects, employing both deterministic and probabilistic approaches.

- Deterministic Sensitivity Analysis: This involves changing one input variable at a time (e.g., metal price, discount rate, recovery rate) by a certain percentage and observing the impact on the NPV. This provides insights into which variables are most influential on the valuation. Imagine a spreadsheet where we systematically change each input cell and observe the effect on the final NPV.

- Probabilistic Sensitivity Analysis: This takes a more sophisticated approach. Instead of using fixed changes, we assign probability distributions to each input variable (using Monte Carlo simulation as mentioned earlier). This method accounts for the uncertainty inherent in each input and generates a distribution of NPVs, which is far more informative than a single point estimate.

In a recent nickel mine project, sensitivity analysis revealed that the nickel price was the most influential factor in the valuation. This highlighted the need for further research and analysis on price forecasting and risk management strategies related to commodity price volatility.

Q 17. How do you incorporate social and environmental factors into resource valuation?

Incorporating social and environmental factors is increasingly important and is often required by regulatory frameworks or investors’ ESG (Environmental, Social, and Governance) goals. This often involves:

- Environmental Impact Assessments (EIAs): These assess the potential environmental consequences of resource extraction and processing, including greenhouse gas emissions, water usage, and habitat destruction. The potential costs and liabilities associated with environmental impacts are then incorporated into the valuation model.

- Social Impact Assessments (SIAs): These evaluate the impact on local communities, considering factors like employment opportunities, displacement, and changes to cultural heritage. The results might adjust valuation via costs related to mitigation or community benefit agreements.

- Carbon Pricing: Considering the carbon emissions associated with extraction and processing. Carbon pricing mechanisms (e.g., carbon taxes, emissions trading schemes) will impose costs, impacting profitability and the NPV.

- Stakeholder Engagement: Consulting with local communities, indigenous groups, and other stakeholders to understand their concerns and incorporate them into the valuation process.

For example, a mining project might incorporate costs associated with mine rehabilitation and biodiversity offsetting to address environmental concerns, and include payments to local communities for access to land and resources to address social considerations. These add to the capital expenditure and thus affect the final valuation.

Q 18. Explain the concept of replacement cost in resource valuation.

Replacement cost in resource valuation refers to the cost of finding and developing a similar resource deposit in the future. It’s a useful measure of the value of a resource, especially when dealing with exhaustible resources. The concept assumes that if the current resource is depleted, a similar resource would need to be found and developed at a future cost. This replacement cost serves as a benchmark to understand the long-term value of the resource and informs decisions around resource allocation and sustainable extraction.

The replacement cost is not simply the current market price. It includes all the exploration costs, development capital, operational costs, and any environmental or social costs required to find and bring a new resource into production. It’s a forward-looking measure that considers the anticipated costs and challenges in future resource development.

For example, a large oil company might consider the replacement cost of oil reserves when making decisions about exploration investment and production planning. If the replacement cost of oil is significantly higher than the current market price, it might justify investing in new exploration and production projects even if current profits are modest.

Q 19. How do you assess the reliability of data used in resource valuation?

Data reliability is paramount. We approach this systematically using a multi-pronged strategy:

- Data Source Validation: We rigorously check the source and quality of all data used in the valuation. This includes verifying the credentials of the data providers, assessing the methodology used to collect the data, and checking for any inconsistencies or errors.

- Data Triangulation: Whenever possible, we use multiple data sources to corroborate information. This reduces reliance on a single source and enhances the reliability of the final valuation.

- Statistical Analysis: We apply statistical methods to assess the quality and reliability of the data, such as analyzing the distribution of data, identifying outliers, and evaluating the uncertainty associated with the data.

- Expert Review: We involve experts in relevant fields (e.g., geology, engineering, economics) to review the data and assess its quality and validity. This independent perspective helps mitigate biases and identify potential problems.

For instance, in valuing mineral reserves, I might compare data from different drilling programs, verify assay results from reputable laboratories, and consult with independent geological experts to ensure accuracy and reliability of the grade and tonnage estimations before incorporating them into the valuation model.

Q 20. Discuss the importance of due diligence in resource valuation.

Due diligence is an essential part of resource valuation, ensuring a comprehensive understanding of all aspects of the resource before any valuation is undertaken. It’s akin to a thorough medical check-up before making a major investment decision. It comprises:

- Legal Review: Examination of title ownership, permits, licenses, and other legal documents associated with the resource.

- Technical Review: Assessment of the geological, engineering, and operational aspects of the resource, involving site visits and discussions with operational staff when applicable.

- Financial Review: Analysis of historical financial performance, operating costs, and capital expenditure associated with the resource.

- Environmental Review: Evaluation of potential environmental impacts and liabilities associated with the resource extraction and processing.

- Social Review: Assessment of the social and community impacts of the resource development.

Without comprehensive due diligence, the valuation may be flawed, potentially leading to significant financial losses. Thorough due diligence safeguards against unseen risks and ensures the valuation reflects a realistic picture of the resource’s potential and associated uncertainties.

Q 21. How do you communicate complex valuation results to non-technical audiences?

Communicating complex valuation results to non-technical audiences requires clear and concise language, avoiding jargon. I use several strategies:

- Visualizations: Charts, graphs, and maps effectively communicate complex data. For instance, a simple bar chart showing the range of possible NPVs conveys uncertainty better than a single numerical value.

- Analogies and Metaphors: Relating complex concepts to familiar everyday examples makes the information more accessible. For example, I might explain risk using the analogy of a lottery ticket to illustrate the chance of success.

- Storytelling: Framing the valuation within a narrative context makes it more engaging and memorable. For example, highlighting the key factors that drive value and connecting them to the wider business strategy.

- Summary Reports: Producing concise summary reports that highlight the key findings and conclusions, avoiding detailed technical discussions that may confuse non-technical audiences.

For example, when presenting to a board of directors, I might focus on the key drivers of value, the range of possible outcomes, and the major risks and opportunities, supported by clear visuals and a concise narrative, rather than delving into the intricate details of the valuation model.

Q 22. What are the ethical considerations in resource valuation?

Ethical considerations in resource valuation are paramount, ensuring transparency, objectivity, and fairness throughout the process. This involves avoiding conflicts of interest, maintaining confidentiality, using appropriate valuation methodologies, and ensuring the accuracy and reliability of data. For instance, an independent valuer should disclose any potential biases or relationships with stakeholders that might influence their assessment. Similarly, using outdated or unreliable data would be unethical and lead to inaccurate valuations. Adherence to professional standards, such as those set by relevant valuation institutes, is crucial to maintain ethical conduct.

A specific example might be a mining project where the valuer has a financial stake in the company. This presents a clear conflict of interest, requiring full disclosure and possibly disqualification from the valuation to maintain impartiality. Another example is the accurate representation of environmental liabilities. Undervaluing these liabilities could mislead stakeholders and violate ethical principles.

Q 23. What software or tools are you proficient in for resource valuation?

My proficiency in resource valuation software includes widely-used packages such as Argus, PetroBank, and specialized mining valuation software like ValMine. I’m also comfortable utilizing spreadsheet software like Excel and programming languages like Python for data analysis, modelling, and visualization. Beyond software, I’m adept at using GIS (Geographic Information Systems) software for spatial data analysis, crucial in projects involving geographically dispersed resources such as forestry or oil and gas. My skills extend to database management and statistical software like R for robust data handling and advanced statistical analysis. This combined expertise allows me to efficiently process and analyze large datasets, perform complex calculations, and create comprehensive valuation reports.

Q 24. Describe your experience with different types of resource projects (e.g., mining, oil & gas, forestry).

My experience spans various resource sectors, including mining, oil & gas, and forestry. In mining, I’ve worked on projects evaluating both metallic and non-metallic mineral deposits, employing Discounted Cash Flow (DCF) analysis, comparable company analysis, and reserve estimation techniques. In oil and gas, my experience encompasses reserve audits, production analysis, and the valuation of upstream assets, using various methods including the income approach and market approach. Finally, in forestry, I’ve conducted valuations based on timber volume estimates, growth rates, and market prices, considering factors like timber quality and access challenges. Each sector has unique challenges and requires a specialized understanding of geological, engineering, or biological considerations, which I have carefully cultivated.

Q 25. How do you manage competing priorities and deadlines in a resource valuation project?

Managing competing priorities and deadlines in resource valuation projects necessitates a structured approach. I utilize project management methodologies, including prioritizing tasks based on critical path analysis and utilizing Gantt charts to visualize project timelines. Effective communication with clients and the project team is key to managing expectations and proactively addressing potential delays. Breaking down large projects into smaller, manageable tasks allows for better control and monitoring of progress. If unforeseen challenges arise, I employ flexible strategies, re-prioritizing tasks and communicating potential impacts to stakeholders transparently. Proactive risk management and contingency planning also prove critical in navigating tight deadlines and managing competing demands.

Q 26. Describe a time you had to overcome a challenge in a resource valuation assignment.

In one project involving a large-scale forestry valuation, we faced unexpected challenges due to a significant forest fire that damaged a substantial portion of the timber. Initially, the valuation model was based on pre-fire data, rendering it obsolete. To overcome this, I led the team in acquiring accurate post-fire data through aerial surveys, ground truthing, and collaboration with forestry experts. We then adapted the valuation model to incorporate the damage assessment, using statistical methods to estimate the loss and adjust the overall valuation. This involved meticulously documenting the methodology changes and clearly communicating the revised valuation to the client, ensuring transparency and maintaining confidence despite the unforeseen circumstances. The project ultimately succeeded due to effective teamwork, quick adaptation, and robust data analysis.

Q 27. Explain your understanding of different types of resource reserves and resources.

Resource reserves and resources are categorized based on the level of geological certainty and economic feasibility. Resources are broader, representing the total quantity of a material in the ground, which can be further classified into inferred, indicated, and measured resources, depending on the level of geological confidence. Reserves, on the other hand, are a subset of resources that are economically viable to extract under current conditions. They are further classified based on the degree of certainty in their extraction, including proven, probable, and possible reserves. The distinction is crucial because reserves are the basis for economic evaluations and project planning, whereas resources provide a broader geological perspective.

- Inferred resources are based on limited data and have a high degree of uncertainty.

- Indicated resources have a higher degree of geological confidence compared to inferred resources.

- Measured resources are those with the highest level of geological confidence.

- Proven reserves have the highest level of economic and geological certainty.

- Probable reserves have a moderate level of certainty.

- Possible reserves have the lowest level of certainty.

For example, a mining company might report large amounts of inferred resources, but only a smaller amount of proven and probable reserves that can be economically mined at present.

Q 28. How do you stay current with the latest developments and best practices in resource valuation?

Staying current in resource valuation involves continuous professional development and engagement with industry best practices. I actively participate in professional organizations such as the Society of Petroleum Engineers (SPE) and the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), attending conferences, workshops, and webinars. I regularly review industry publications, academic journals, and regulatory updates to stay abreast of technological advancements and changes in valuation methodologies. Moreover, I engage in peer networking and knowledge sharing to learn from colleagues’ experiences and insights. This commitment to continuous learning ensures that my valuations are based on the most up-to-date knowledge and best practices, leading to accurate and reliable results.

Key Topics to Learn for Resource Valuation Interview

- Discounted Cash Flow (DCF) Analysis: Understanding the core principles of DCF, including forecasting future cash flows, selecting appropriate discount rates (WACC), and sensitivity analysis. Practical application: Valuing oil reserves based on projected production and commodity prices.

- Reserve Estimation Techniques: Familiarize yourself with various methods used to estimate the quantity and quality of resources, including volumetric methods, decline curve analysis, and probabilistic methods. Practical application: Assessing the uncertainty inherent in reserve estimates and its impact on valuation.

- Cost Estimation and Capital Budgeting: Mastering the process of estimating project costs, including capital expenditures (CAPEX) and operating expenditures (OPEX). Practical application: Analyzing the economic viability of a new mining project using Net Present Value (NPV) and Internal Rate of Return (IRR).

- Risk and Uncertainty Assessment: Learn to identify and quantify the key risks affecting resource valuation, such as commodity price volatility, regulatory changes, and geological uncertainty. Practical application: Incorporating risk into valuation models using Monte Carlo simulation or scenario planning.

- Valuation of different resource types: Gain a strong understanding of the unique challenges and methodologies for valuing various resources such as minerals, oil and gas, timber, and water. Practical application: Comparing valuation approaches for different resource types and justifying your chosen methodology.

- Economic and Financial Modeling: Develop proficiency in building and interpreting financial models to support valuation analyses. Practical application: Utilizing spreadsheet software (e.g., Excel) to create robust and transparent models.

- Depletion Accounting and Reporting: Understand the accounting principles and reporting requirements specific to resource extraction industries. Practical application: Preparing financial statements that accurately reflect the depletion of natural resources.

Next Steps

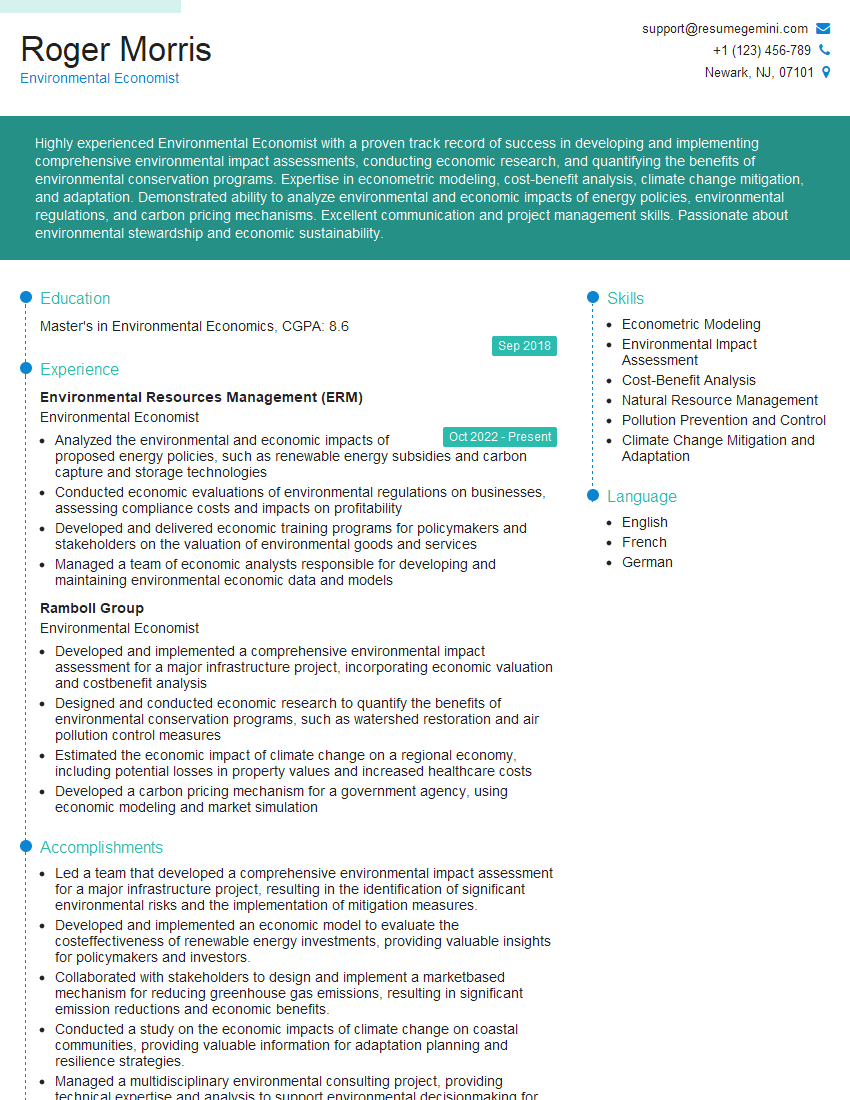

Mastering Resource Valuation is crucial for a successful and rewarding career in the resource sector, opening doors to exciting opportunities and significant professional growth. A well-crafted resume is your first step toward securing your dream role. An ATS-friendly resume ensures your application gets noticed by recruiters. To make a strong impression, consider using ResumeGemini to build a professional and impactful resume tailored to the Resource Valuation field. ResumeGemini offers examples of resumes specifically designed for this industry to help you create a compelling application that showcases your skills and experience effectively.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.