The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Agricultural Market Research interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Agricultural Market Research Interview

Q 1. Explain the difference between qualitative and quantitative agricultural market research.

Qualitative and quantitative agricultural market research are two distinct approaches that offer complementary insights. Qualitative research focuses on understanding the why behind market behaviors. It delves into the motivations, perceptions, and attitudes of farmers, consumers, and other stakeholders. Think of it as exploring the ‘soft’ data – opinions, beliefs, and experiences. Quantitative research, on the other hand, emphasizes numerical data and statistical analysis to understand the what and how much. This approach relies on hard data such as sales figures, production yields, and market prices to identify trends and correlations. It aims to quantify market characteristics and test hypotheses.

Example: Imagine researching consumer preferences for organic produce. Qualitative methods might involve conducting focus groups to explore consumer motivations for buying organic food (e.g., health concerns, environmental awareness, ethical considerations). Quantitative methods would involve surveys to determine the percentage of consumers purchasing organic produce, their spending habits, and demographic characteristics related to organic food consumption. Combining both approaches provides a comprehensive understanding.

Q 2. Describe your experience with various agricultural market research methodologies.

My experience spans a wide range of agricultural market research methodologies. I’ve extensively used primary research techniques such as surveys (both online and in-person), focus groups, in-depth interviews, and ethnographic studies to gather firsthand data. For instance, I conducted a series of in-depth interviews with smallholder farmers in rural communities to assess the impact of a new irrigation technology on their crop yields and income.

I’m also proficient in secondary research methods, leveraging data from government agencies (e.g., USDA in the US), international organizations (e.g., FAO), market intelligence firms, and academic publications. This often involves analyzing agricultural statistics, commodity price data, and trade reports to identify market trends and patterns. I’ve developed expertise in econometric modeling to forecast future market conditions and assess the impact of various factors on prices and production.

Furthermore, I’ve employed advanced analytical techniques, including spatial analysis and GIS mapping to understand geographical variations in agricultural production and market access. For example, I used GIS to map the distribution of different crop types and identify potential market opportunities for specific regions.

Q 3. How do you identify and analyze key market trends in the agricultural sector?

Identifying and analyzing key market trends requires a multi-faceted approach. It starts with monitoring a broad range of data sources – commodity prices, production statistics, consumer spending patterns, technological advancements, and climate change impacts. I use a combination of time series analysis, regression modeling, and other statistical techniques to identify significant patterns and trends.

For instance, I recently analyzed data showing a rising global demand for sustainable and ethically sourced agricultural products, leading to a shift in consumer preferences and market opportunities for organic and fair-trade produce. Technological advancements, such as precision agriculture and biotechnology, are also closely monitored for their impact on production efficiency and market dynamics. I pay close attention to global political and economic events and their ripple effects on agricultural trade and commodity prices. For example, geopolitical instability in major agricultural-producing regions can drastically impact global supply chains and prices.

The process also involves qualitative research to understand the underlying drivers of these trends. For example, consumer focus groups can provide insights into shifting preferences, and interviews with industry experts help gauge the adoption of new technologies.

Q 4. What are the major factors influencing agricultural commodity prices?

Agricultural commodity prices are influenced by a complex interplay of factors. Supply-side factors include production costs (fertilizers, labor, land), weather conditions (droughts, floods), disease outbreaks, technological advancements, and government policies (subsidies, trade restrictions). Demand-side factors are equally important and include consumer preferences, population growth, income levels, and global economic conditions. Additionally, speculation in futures markets can significantly impact price volatility.

Example: A severe drought in a major wheat-producing region will reduce supply, leading to higher prices. Conversely, an increase in consumer disposable income may boost demand for higher-quality foods, increasing prices for premium products. Government policies like export subsidies can temporarily depress prices in the global market while impacting domestic prices positively.

Q 5. How do you assess the impact of government policies on agricultural markets?

Assessing the impact of government policies on agricultural markets involves analyzing how specific interventions alter supply, demand, and prices. This can be done through econometric modeling, simulating the effects of policy changes on market equilibrium. For example, I might use a model to assess the impact of a new agricultural subsidy program on farmers’ income, production levels, and consumer prices.

Qualitative research is also crucial in understanding the unintended consequences of policies. This could involve interviewing farmers and consumers to understand how they adapt to policy changes or whether the policy has resulted in unexpected outcomes. For example, a tariff on imported agricultural goods might protect domestic producers but could also lead to higher consumer prices and potential retaliation from other countries.

Furthermore, the effectiveness of a policy is gauged by comparing outcomes with and without policy intervention (e.g., before and after comparisons). Various quantitative measures are used to evaluate the effectiveness, including changes in production, farm income, consumer welfare, and government expenditure.

Q 6. Explain your understanding of supply and demand dynamics in agriculture.

Supply and demand dynamics in agriculture are similar to those in other markets but exhibit unique characteristics. Supply is influenced by factors like land availability, weather patterns, technology, and input costs. Demand is influenced by consumer preferences, population growth, income levels, and prices of substitutes and complements. However, agriculture has a relatively inelastic supply in the short term due to the time lag between planting and harvesting, meaning that quantity supplied doesn’t respond readily to price changes.

Example: A sudden increase in wheat prices due to a bad harvest won’t immediately lead to a large increase in wheat production; it takes time to plant and grow a new crop. This inelasticity can cause significant price fluctuations. Furthermore, perishable nature of many agricultural products and unpredictable weather conditions further complicate supply and demand interactions.

Q 7. How do you forecast future agricultural market conditions?

Forecasting future agricultural market conditions requires a combination of quantitative and qualitative methods. Quantitative forecasting involves using time series analysis, econometric models, and other statistical techniques to predict future prices and production levels based on historical data. For example, I might use ARIMA models (Autoregressive Integrated Moving Average) or more sophisticated models to forecast commodity prices. However, it’s crucial to acknowledge limitations inherent in any model and understand its underlying assumptions.

Qualitative insights are invaluable in refining quantitative forecasts. By incorporating information gleaned from interviews with industry experts, farmer surveys, and analyses of emerging technologies and geopolitical factors, we can adjust the quantitative predictions for a more realistic outlook. This includes accounting for unforeseen events like climate-related shocks or major policy changes. Scenario planning can also help us to assess the potential impact of different future possibilities.

Q 8. Describe your experience with agricultural data analysis tools and techniques.

My experience with agricultural data analysis encompasses a wide range of tools and techniques. I’m proficient in using statistical software packages like R and Python, leveraging libraries such as pandas, numpy, and statsmodels for data manipulation, cleaning, and statistical modeling. For visualizing data, I frequently utilize tools like Tableau and Power BI to create insightful dashboards and reports that effectively communicate complex findings. Beyond statistical analysis, I’m also experienced in geospatial analysis using GIS software (e.g., ArcGIS) to analyze yield patterns, soil characteristics, and irrigation efficiency across different geographical regions. For instance, I recently used geospatial analysis to identify areas with high potential for drought-resistant crop cultivation, informing a successful investment strategy for a major agricultural company.

My approach also includes using time series analysis to identify trends and seasonality in agricultural data, forecasting future production based on historical patterns and weather predictions. Machine learning techniques, such as regression and classification models, are employed to predict crop yields, optimize resource allocation, and assess market risks. For example, I’ve built a predictive model using Random Forests to forecast corn prices with remarkable accuracy, leading to improved risk management strategies for our clients.

Q 9. How do you interpret and present agricultural market research findings?

Interpreting and presenting agricultural market research findings requires a clear and concise approach that balances technical accuracy with accessibility for diverse audiences. My process typically involves several key steps: first, I thoroughly analyze the data to identify key trends, patterns, and relationships. This may involve statistical tests, regression analysis, or other relevant methods depending on the research question. Then, I synthesize the findings into a narrative that clearly explains the implications of the research. I avoid using overly technical jargon, preferring instead to use clear, straightforward language that anyone can understand.

The presentation of findings is equally crucial. I use a variety of methods, including reports, presentations, and dashboards, tailoring the format to the audience and the specific information being communicated. For instance, a report for a senior management team might focus on high-level summaries and strategic implications, while a presentation to farmers might focus on more practical, on-the-ground recommendations. Visualizations such as charts, graphs, and maps are crucial for enhancing understanding and engagement.

Q 10. How do you handle conflicting data or inconsistent findings in agricultural market research?

Conflicting data or inconsistent findings are common challenges in agricultural market research. My approach involves a systematic investigation to understand the source of the discrepancy. This involves carefully reviewing the data collection methods, sample selection, and data cleaning processes. Are there errors in the data entry? Were the samples representative of the population? Were there any biases introduced during the data collection process?

Once identified, I address the inconsistencies by either correcting the errors, refining the analysis methods, or potentially excluding the problematic data points if necessary. For example, if data from a specific region shows significant outliers, I’ll investigate the underlying reasons — was there an unusual weather event, a disease outbreak, or a change in farming practices? Documenting the process of handling inconsistencies is critical for transparency and reproducibility. In the case of irreconcilable differences, I present the conflicting findings transparently, highlighting the limitations of the data and the potential explanations for the discrepancies.

Q 11. What are some common challenges in conducting agricultural market research?

Conducting agricultural market research presents unique challenges. Data accessibility can be a significant hurdle, as agricultural data may be scattered across various sources, including government agencies, private companies, and individual farmers. Data quality can also be inconsistent, due to variations in data collection methods and record-keeping practices. Another challenge is the inherent variability in agricultural production due to weather patterns, pests, and diseases, making it difficult to establish clear cause-and-effect relationships.

Seasonal factors also complicate analysis, as demand and supply fluctuate significantly throughout the year. Finally, reaching and surveying the target population (farmers, processors, consumers) can be difficult, particularly in remote areas or among diverse and dispersed farming communities. For instance, gaining the trust of smallholder farmers who may be skeptical of surveys requires building rapport and demonstrating the value of their participation. Successfully navigating these challenges necessitates careful planning, robust methodologies, and adaptability.

Q 12. How do you ensure the accuracy and reliability of your agricultural market research data?

Ensuring accuracy and reliability is paramount in agricultural market research. I employ a multi-pronged approach: First, I meticulously design the research methodology, selecting appropriate sampling techniques, survey instruments, and data collection methods. For example, I may choose a stratified random sampling method to ensure adequate representation of various sub-populations within the agricultural sector. Rigorous quality control procedures are implemented at every stage of the research process, from data collection to data cleaning and analysis.

Data validation techniques, such as data consistency checks and outlier detection, help identify and correct errors. I also leverage triangulation, using multiple data sources to verify the accuracy of findings. This might involve comparing survey data with government statistics or secondary market reports. Finally, careful documentation of the entire research process, including data collection methods, data cleaning procedures, and statistical analyses, ensures transparency and facilitates reproducibility. By rigorously applying these principles, we can significantly enhance the credibility and reliability of our research findings.

Q 13. Describe your experience with different types of agricultural surveys.

My experience encompasses a variety of agricultural surveys, including:

- Farm-level surveys: These surveys collect data directly from farmers, covering aspects like crop production, livestock holdings, input usage, and farm management practices.

- Consumer surveys: These gather information about consumer preferences, purchasing behavior, and attitudes towards agricultural products.

- Value chain analysis surveys: These examine the entire supply chain, from farm to consumer, including producers, processors, distributors, and retailers.

- Qualitative surveys: These often involve in-depth interviews or focus groups to gather rich qualitative data, capturing farmers’ perspectives and experiences.

- Online surveys: These leverage online platforms to reach a wider audience and facilitate data collection and analysis, especially useful in reaching younger or more tech-savvy farmers.

The choice of survey type depends on the research question and the target population. For example, a farm-level survey might be appropriate for evaluating the impact of a new agricultural technology, while a consumer survey would be used to assess market demand for a new product. I tailor the design and implementation of the survey to maximize accuracy and response rates.

Q 14. How do you account for seasonality and weather patterns in agricultural market analysis?

Seasonality and weather patterns significantly influence agricultural markets. I account for these factors by incorporating time series analysis into my market analysis. This involves analyzing historical data to identify seasonal trends and cyclical patterns in production, prices, and demand. For instance, we might observe that corn prices peak during the harvest season and decline in the off-season. This seasonal variation needs to be accounted for when forecasting future market conditions.

Weather data is also crucial. I use weather forecasting data and climate information to assess the potential impact of weather events on crop yields and livestock production. For example, an unexpected drought could drastically reduce crop yields, leading to price increases. I often integrate weather data into predictive models, creating more accurate forecasts of agricultural market dynamics. Incorporating these factors ensures a more realistic and nuanced understanding of the market and helps in developing robust and effective market strategies.

Q 15. Explain your understanding of agricultural value chains.

Agricultural value chains represent the entire process from farm to fork, encompassing all stages involved in bringing agricultural products to consumers. Think of it as a relay race: each stage passes the baton, adding value along the way.

- Production: Farming, livestock rearing, aquaculture.

- Processing: Transforming raw materials into consumable products (e.g., milling wheat into flour, slaughtering animals for meat).

- Distribution: Transportation, storage, and wholesale activities getting products to markets.

- Retail: Selling to consumers, either through supermarkets, farmers’ markets, or direct-to-consumer channels.

- Consumption: The final stage where the consumer purchases and uses the product.

Understanding the value chain is critical for identifying bottlenecks, inefficiencies, and opportunities for improvement. For example, if transportation is poor in a region, it significantly impacts the quality and price of the final product. Analyzing each stage helps pinpoint areas for intervention, such as improving farming practices, investing in better storage facilities, or developing efficient retail networks.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you measure the effectiveness of agricultural marketing strategies?

Measuring the effectiveness of agricultural marketing strategies requires a multifaceted approach, combining quantitative and qualitative data. We look at both market share and impact on producer profitability.

- Sales and Market Share: Tracking sales volume, revenue, and market share over time provides a direct measure of success. We compare this to previous periods or competitors.

- Producer Price and Profitability: Analyzing the impact of marketing strategies on the prices received by farmers and their overall profitability is crucial, as ultimately, their success underpins the whole chain.

- Consumer Perception and Brand Awareness: Surveys and focus groups help gauge consumer awareness of products and brands, determining the success of marketing messages.

- Cost-Effectiveness: Analyzing the Return on Investment (ROI) of different marketing channels, such as digital marketing vs. traditional methods, is essential for optimizing resource allocation.

- Distribution Efficiency: Monitoring time-to-market and minimizing losses during transportation and storage are indicators of efficient marketing strategies. Tracking spoilage rates, for example, is critical.

For instance, if a marketing campaign successfully increases demand for a specific crop leading to higher prices for farmers, it’s considered effective. Conversely, if the campaign leads to increased sales but decreased farmer income, it might be deemed unsuccessful despite seeming market success.

Q 17. How do you assess the competitive landscape of a specific agricultural market?

Assessing the competitive landscape involves a detailed analysis of the forces shaping the market and the players operating within it. We use Porter’s Five Forces framework as a starting point.

- Threat of New Entrants: How easy is it for new players to enter the market? This depends on barriers like capital requirements, technology access, and regulations.

- Bargaining Power of Suppliers: How much influence do suppliers (e.g., seed providers, fertilizer companies) have on prices? Are there many suppliers or just a few?

- Bargaining Power of Buyers: Do consumers have many choices, or are they limited? Large retailers, for example, have more bargaining power than individual consumers.

- Threat of Substitute Products: Are there alternative products that consumers might switch to? For example, plant-based alternatives to meat are impacting the traditional meat market.

- Competitive Rivalry: How intense is the competition between existing players in the market? This looks at factors like pricing strategies and product differentiation.

By analyzing these forces for a specific agricultural market (e.g., the coffee market in a particular region), we can identify key competitive advantages, weaknesses, and opportunities for market players. For example, understanding the bargaining power of large coffee buyers can help farmers develop strategies for better price negotiations or exploring alternative markets.

Q 18. Describe your experience working with agricultural stakeholders (farmers, processors, retailers).

My experience working with agricultural stakeholders is extensive, involving collaborative projects with farmers, processors, and retailers across several commodities. I use a participatory approach focusing on building trust and understanding their unique perspectives.

- Farmers: I work directly with farmers to understand their production practices, challenges (e.g., access to finance, climate change impacts), and marketing needs. This involves conducting farm surveys, focus group discussions, and participatory rural appraisals to gather qualitative data. For example, a project focused on understanding the challenges faced by smallholder farmers in accessing fertilizer.

- Processors: Collaboration with processors involves assessing their processing capacity, quality control measures, and market access strategies. Data analysis focuses on production efficiency, waste management, and value-added product development. For example, a study on optimizing the efficiency of a dairy processing plant.

- Retailers: Working with retailers focuses on understanding consumer preferences, supply chain management, and pricing strategies. Data collection may involve conducting consumer surveys, analyzing sales data, and mapping retail networks. For example, research into the effectiveness of different promotional strategies employed by supermarkets.

Building strong relationships with stakeholders is critical to gather accurate and reliable information, ensuring research findings are relevant and actionable.

Q 19. How do you utilize GIS or other mapping tools in your agricultural market research?

Geographic Information Systems (GIS) are invaluable tools in agricultural market research, offering powerful visualization and analytical capabilities.

- Mapping Production Areas: GIS helps map the geographic distribution of different crops or livestock, identifying key production zones and potential areas for expansion.

- Analyzing Market Access: GIS allows the visualization of transportation networks, market locations, and distances, enabling the assessment of market access challenges and opportunities. For example, it can pinpoint areas with limited access to markets and identify potential solutions like building new roads or improving storage facilities.

- Identifying Climate Risks: Integrating climate data with GIS allows us to analyze the vulnerability of agricultural production to climate change, identifying areas at high risk of drought or flooding. This information can inform risk management strategies and climate-smart agricultural practices.

- Spatial Analysis of Market Data: GIS can be used to analyze spatial patterns in market prices, consumer demand, and competition. This provides insights into regional market dynamics and consumer preferences. For example, determining the correlation between proximity to large urban areas and product prices.

Example: Using QGIS to overlay maps of rainfall patterns, soil types, and market locations to identify optimal areas for a specific crop.

Q 20. What are the ethical considerations in agricultural market research?

Ethical considerations are paramount in agricultural market research. Our work must uphold the integrity of the research process and protect the rights of stakeholders.

- Informed Consent: Obtaining informed consent from all participants before data collection is essential. This means ensuring they understand the purpose of the research, how their data will be used, and their right to withdraw at any time.

- Data Confidentiality and Anonymity: Protecting the confidentiality and anonymity of participants’ data is crucial. Data should be stored securely and used only for the intended research purposes.

- Conflict of Interest: Researchers must be transparent about any potential conflicts of interest that could bias their findings. This includes disclosing any financial ties to stakeholders or companies involved in the market.

- Data Integrity and Transparency: Ensuring data accuracy, completeness, and transparency is essential. Research methods should be clearly documented, and data analysis should be rigorous and unbiased.

- Community Benefit: Research should aim to benefit the communities involved. Findings should be shared with stakeholders in a clear and accessible manner, enabling them to use the results to improve their livelihoods.

Ignoring these ethical principles could lead to skewed results, harming the reputation of the research and potentially causing detrimental effects on the communities involved. It’s crucial to prioritize fairness, honesty, and transparency in all aspects of the research process.

Q 21. Describe your experience with using econometric modeling in agricultural market analysis.

Econometric modeling plays a crucial role in analyzing agricultural market data, enabling us to quantify relationships between variables and make predictions.

- Demand and Supply Analysis: Econometric models can estimate demand and supply functions for agricultural products, helping understand price determination, market equilibrium, and the impact of policy interventions.

Example: Using a linear regression model to estimate the price elasticity of demand for maize. - Price Forecasting: Models can be used to forecast future prices based on historical data and other relevant factors, such as weather patterns, input costs, and policy changes.

- Impact Assessment: Econometric modeling can assess the impact of various policies (e.g., subsidies, trade restrictions) on agricultural markets, helping inform policy decisions.

- Risk Analysis: Models can help quantify the risks associated with agricultural production and marketing, assisting in risk management strategies.

For example, we might use a time series model to forecast future coffee prices, incorporating variables like global demand, weather conditions, and production costs. The results can help coffee farmers and traders make informed decisions about planting, harvesting, and trading strategies.

However, it’s important to note that econometric models are only as good as the data they are based on and the assumptions underlying them. Careful consideration of data quality and model specification is crucial to ensure reliable and valid results.

Q 22. How do you assess the impact of climate change on agricultural markets?

Assessing the impact of climate change on agricultural markets requires a multifaceted approach. It’s not just about rising temperatures; it’s about the cascading effects on yield, production costs, and market stability.

- Changes in Crop Yields: Climate change alters growing seasons, increases the frequency of extreme weather events (droughts, floods, heatwaves), and spreads pests and diseases. This directly impacts crop yields, leading to price volatility and potential shortages. For example, prolonged droughts can significantly reduce wheat production in major exporting regions, driving up global prices.

- Increased Production Costs: Farmers may need to invest in drought-resistant seeds, irrigation systems, or pest control measures to adapt to changing conditions. These increased input costs are passed on to consumers, affecting market prices and potentially reducing profitability for farmers.

- Shifting Geographic Suitability: Certain crops may become unviable in regions that were previously ideal for their cultivation. This necessitates shifts in agricultural production patterns, leading to potential disruptions in supply chains and market share dynamics. For example, the optimal growing areas for coffee might shift, impacting producing countries’ economies.

- Market Volatility: The unpredictable nature of climate change creates significant uncertainty in agricultural markets. This volatility impacts investment decisions, supply chain management, and ultimately food security. Futures markets will reflect this instability.

To effectively assess this impact, we use a combination of climate models, agricultural yield models, market analysis techniques, and scenario planning to predict potential changes and their effects on different agricultural commodities and regions.

Q 23. How familiar are you with global agricultural trade agreements and regulations?

My familiarity with global agricultural trade agreements and regulations is extensive. I have worked extensively with organizations like the WTO (World Trade Organization), and I have a deep understanding of agreements like the Sanitary and Phytosanitary (SPS) measures and the Agreement on Agriculture (AoA).

These agreements significantly influence international agricultural trade by setting rules for tariffs, sanitary standards, and other trade barriers. Understanding these regulations is crucial for businesses involved in importing or exporting agricultural products. For instance, the SPS measures ensure food safety and prevent the spread of plant and animal diseases, necessitating stringent quality control and certification processes. Changes to these agreements can have profound effects on market access and competitiveness.

I also keep abreast of regional trade agreements like the USMCA (United States-Mexico-Canada Agreement) and the EU’s Common Agricultural Policy (CAP), which impact trade flows within specific geographical areas. Analyzing these agreements involves a detailed understanding of tariff schedules, non-tariff barriers, and their overall economic and social consequences.

Q 24. Explain your understanding of agricultural sustainability and its market implications.

Agricultural sustainability encompasses environmentally sound, economically viable, and socially equitable practices. It’s about producing food while minimizing environmental damage, ensuring fair treatment of farmers and workers, and maintaining long-term viability of the agricultural sector.

- Environmental Sustainability: This involves reducing the carbon footprint of agriculture, conserving water resources, minimizing pesticide use, and protecting biodiversity. Examples include adopting no-till farming, utilizing precision agriculture techniques, and promoting agroforestry.

- Economic Sustainability: This relates to creating profitable and resilient farming systems that provide livelihoods for farmers and contribute to the overall economic well-being of rural communities. This involves efficient resource use, access to markets, and fair pricing mechanisms.

- Social Sustainability: This emphasizes the ethical treatment of workers, ensuring fair labor practices, and promoting equitable access to resources and opportunities across all segments of the agricultural community. It involves considerations for food security and local community needs.

Market implications are significant. Consumers are increasingly demanding sustainably produced food, driving growth in organic and other eco-friendly agricultural products. Companies are incorporating sustainability into their supply chains, leading to new certifications and standards. Investors are also increasingly focusing on companies with strong sustainability credentials, creating new investment opportunities.

Q 25. How do you evaluate the potential risks and opportunities in investing in agricultural commodities?

Evaluating investment potential in agricultural commodities involves a thorough risk-reward analysis.

- Risks:

- Price Volatility: Agricultural commodity prices are highly susceptible to weather patterns, geopolitical events, and changes in supply and demand. A sudden drought or trade war can significantly impact prices.

- Storage and Transportation Costs: Storing and transporting agricultural commodities can be expensive, particularly perishable goods. Storage facilities and logistics need to be factored in.

- Regulatory Changes: Government regulations and policies can impact the profitability of agricultural investments. Trade policies, environmental regulations, and food safety standards all play a role.

- Pest and Disease Outbreaks: Disease outbreaks can decimate crops, causing significant losses for investors.

- Opportunities:

- Growing Global Demand: The global population is growing, increasing the demand for food and agricultural products. This creates a long-term opportunity for investment.

- Technological Advancements: New technologies in precision agriculture, biotechnology, and food processing can boost efficiency and productivity, creating investment opportunities.

- Sustainable Agriculture: The increasing demand for sustainably produced food creates opportunities for investments in organic farming and other eco-friendly practices.

- Biofuels: The growing interest in biofuels presents opportunities for investment in crops used for biofuel production.

A successful investment strategy involves diversification, thorough market research, risk management strategies, and a long-term perspective.

Q 26. Describe your experience with market segmentation in the agricultural sector.

My experience with market segmentation in the agricultural sector involves identifying distinct groups of consumers or businesses with unique needs and preferences within the agricultural landscape. This is critical for effective marketing and product development.

For example, I’ve worked on projects segmenting farmers based on farm size, type of crop produced, technological adoption level, and their access to resources. A large-scale commercial farmer has vastly different needs compared to a small-scale subsistence farmer. This affects the types of products, services, and marketing messages that are most effective for each segment. Similarly, we can segment consumers based on their dietary preferences (organic, vegetarian, etc.), their price sensitivity, and their values (e.g., sustainability concerns).

This segmentation allows for targeted marketing campaigns, the development of customized products and services, and improved resource allocation, ultimately maximizing the impact and efficiency of market strategies. Understanding these segments enables companies to create tailored solutions to address each segment’s specific needs.

Q 27. How would you approach researching a new agricultural technology’s market potential?

Researching a new agricultural technology’s market potential requires a systematic approach.

- Define the Technology and its Benefits: Clearly articulate the technology’s function, its advantages over existing solutions, and the potential problems it solves.

- Identify Target Markets: Determine which types of farmers or agricultural businesses would most benefit from this technology. Consider factors such as farm size, crop type, and geographic location.

- Market Size and Potential: Estimate the potential market size and the technology’s adoption rate within different market segments. This might involve surveys, interviews, and analyses of existing market data.

- Competitive Analysis: Assess the competitive landscape, including existing technologies and potential substitutes. Analyze the strengths and weaknesses of competitors.

- Pricing Strategy: Develop a pricing strategy that is both profitable and competitive. This might involve cost analysis and market research into the willingness to pay.

- Regulatory Landscape: Investigate any regulatory hurdles or approvals required for the technology’s commercialization.

- Financial Projections: Create financial projections to estimate the technology’s profitability and return on investment.

- Marketing Strategy: Develop a marketing plan to reach the target audience and promote the technology effectively.

By following these steps, a comprehensive understanding of the technology’s market potential can be obtained, informing decision-making regarding investment and commercialization.

Q 28. What are your salary expectations for this role?

My salary expectations for this role are commensurate with my experience and expertise in agricultural market research, and are in line with industry standards for similar roles. I am open to discussing a competitive salary package that reflects the responsibilities and challenges of this position.

Key Topics to Learn for Agricultural Market Research Interview

- Market Analysis Techniques: Understanding and applying various methods like SWOT analysis, PESTLE analysis, and Porter’s Five Forces to the agricultural sector. Practical application: Analyzing the impact of climate change on the demand for drought-resistant crops.

- Consumer Behavior in Agriculture: Exploring factors influencing farmer purchasing decisions, consumer preferences for agricultural products (organic, GMO, etc.), and the impact of marketing strategies on sales. Practical application: Designing a survey to understand consumer perception of sustainably sourced produce.

- Data Collection and Analysis: Mastering quantitative and qualitative research methods, including surveys, focus groups, experimental designs, and statistical analysis of agricultural data. Practical application: Interpreting results from a yield trial to inform future planting decisions.

- Agricultural Commodity Markets: Understanding supply and demand dynamics, price forecasting, and the role of government policies and regulations in shaping agricultural markets. Practical application: Analyzing the impact of trade tariffs on the price of imported grains.

- Competitive Landscape: Identifying key players in the agricultural industry (farmers, processors, distributors, retailers), analyzing their strengths and weaknesses, and understanding market share dynamics. Practical application: Developing a competitive analysis report for a new agricultural technology startup.

- Forecasting and Predictive Modeling: Utilizing statistical tools and techniques to forecast future trends in agricultural production, consumption, and prices. Practical application: Creating a predictive model to estimate future demand for organic dairy products.

- Report Writing and Presentation: Clearly communicating research findings through compelling reports and presentations, tailoring your communication to different audiences (farmers, investors, policymakers). Practical application: Presenting your market research findings to a board of directors.

Next Steps

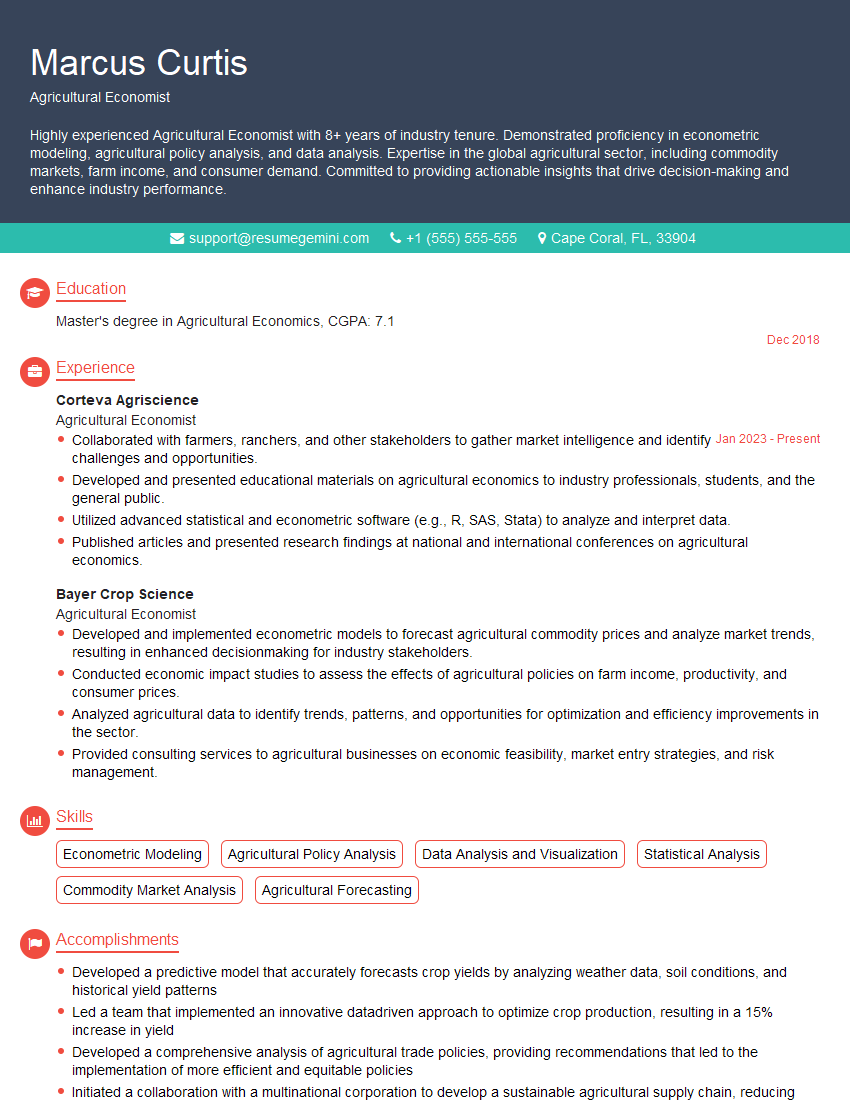

Mastering Agricultural Market Research is crucial for a successful and rewarding career. This field offers exciting opportunities for innovation and problem-solving, impacting food security and economic growth. To significantly boost your job prospects, create a compelling and ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional resume that showcases your qualifications in the best possible light. Examples of resumes tailored to Agricultural Market Research are available to guide you through this process, ensuring your application stands out.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.