The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Conduct internal audits and inspections interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Conduct internal audits and inspections Interview

Q 1. Describe your experience conducting internal audits.

Throughout my career, I’ve conducted numerous internal audits across diverse industries, focusing on financial controls, operational efficiency, and compliance. For instance, at my previous role at Acme Corp, I led a team auditing their supply chain management, identifying inefficiencies that saved the company over $500,000 annually. Another significant project involved assessing their cybersecurity posture, leading to the implementation of enhanced security protocols. My approach always involves a thorough understanding of the organization’s processes, followed by a risk-based assessment to prioritize audit areas. I meticulously document all findings and collaborate with management to develop effective remediation plans. I’m proficient in using various audit methodologies and tools to ensure comprehensive and effective audits.

Q 2. Explain your understanding of COSO framework.

The COSO (Committee of Sponsoring Organizations of the Treadway Commission) framework is a widely accepted internal control framework that provides a comprehensive model for evaluating and improving an organization’s internal control system. It focuses on five key components: Control Environment, Risk Assessment, Control Activities, Information and Communication, and Monitoring Activities. Think of it as a five-legged stool – if one leg is weak, the entire system is unstable. The Control Environment sets the tone at the top, influencing the ethical culture and commitment to internal controls. Risk Assessment involves identifying and analyzing potential risks that could affect the achievement of objectives. Control Activities are the actions established to mitigate identified risks. Information and Communication ensures that relevant information is captured, processed, and communicated effectively. Finally, Monitoring Activities evaluate the effectiveness of the entire system over time, allowing for adjustments as needed. I’ve utilized the COSO framework extensively in my audits to assess the effectiveness of internal controls and provide recommendations for improvement.

Q 3. How do you identify and assess risks during an audit?

Identifying and assessing risks is a crucial first step in any audit. I typically use a combination of methods, starting with understanding the organization’s business processes and strategic objectives. Then, I utilize risk assessments, including questionnaires, interviews with key personnel, and document reviews, to identify potential risks. These risks are then categorized by likelihood and impact, using a risk matrix. For example, a high likelihood and high impact risk, such as a significant data breach, would receive immediate attention, while a low likelihood and low impact risk might be addressed later. This prioritization ensures that audit resources are focused on the most critical areas. Data analytics plays a significant role in identifying trends and anomalies that might indicate emerging risks.

Q 4. What are your preferred audit methodologies?

My preferred audit methodologies are flexible and depend on the specific audit objective and the organization’s context. I often employ a combination of approaches:

- Risk-based auditing: Focusing audit efforts on areas with the highest risk.

- Compliance auditing: Ensuring adherence to regulations and policies.

- Operational auditing: Evaluating efficiency and effectiveness of processes.

- Financial auditing: Examining financial records for accuracy and compliance.

Q 5. How do you document your audit findings?

Thorough documentation is paramount to the audit process. My approach involves creating a comprehensive audit file which includes:

- Audit plan: Outlining the scope, objectives, and methodology.

- Working papers: Detailed records of testing performed, evidence gathered, and conclusions reached.

- Audit findings: A clear and concise summary of identified issues and their significance.

- Recommendations: Practical and achievable suggestions for improvement.

- Management response: The auditee’s response to the findings and proposed corrective actions.

Q 6. Explain your experience with data analytics in auditing.

Data analytics has revolutionized the auditing profession, and I’m proficient in using various data analysis tools and techniques to enhance the efficiency and effectiveness of my audits. For instance, I’ve used data mining to identify unusual patterns in financial transactions, potentially indicating fraud. I’ve also employed statistical sampling to reduce audit workload while maintaining audit quality. In a recent audit, I used data analytics to analyze large datasets to identify process bottlenecks and inefficiencies, resulting in significant improvements in operational efficiency. My skills encompass using various tools such as SQL, Excel, and specialized audit analytics software.

Q 7. How do you handle disagreements with auditees?

Disagreements with auditees are sometimes unavoidable. My approach emphasizes professional communication and collaboration. I begin by ensuring a clear understanding of the issue at hand, revisiting the audit evidence and methodology to address any concerns. If the disagreement persists, I document the differences of opinion, including all supporting evidence from both sides. I escalate the matter through proper channels, following the organization’s established procedures for resolving disputes. Ultimately, the goal is a collaborative solution that enhances the organization’s control environment and promotes continuous improvement. Transparency and objectivity are key in resolving such conflicts.

Q 8. Describe your approach to communicating audit results.

Communicating audit results effectively is crucial for driving positive change. My approach focuses on clarity, objectivity, and actionable recommendations. I begin by tailoring the communication to the audience – whether it’s senior management, department heads, or individual employees. For senior management, I provide a concise executive summary highlighting key findings, risks, and recommendations. For operational teams, I offer more detailed reports with specific examples and evidence. I always use clear, non-technical language unless the audience possesses relevant expertise. Visual aids such as charts and graphs are invaluable for illustrating key data and trends. Finally, I actively encourage a two-way dialogue, answering questions and ensuring the recipients fully understand the findings and recommended actions. For instance, in a recent audit of a procurement department, I used a visual dashboard to show the percentage of purchases made through approved vendors, immediately highlighting areas needing improvement and streamlining the feedback process.

Q 9. How do you prioritize audit tasks and manage your time effectively?

Prioritizing audit tasks and managing time effectively is paramount. I use a risk-based approach, focusing first on areas with the highest potential impact. This often involves considering the likelihood and potential severity of identified risks. I then develop a detailed audit plan with clearly defined timelines and milestones. Project management tools, such as Gantt charts, are used to visualize the project schedule, track progress, and allocate resources efficiently. Regular progress meetings with stakeholders are vital to address any roadblocks and ensure the audit remains on track. I also prioritize tasks based on deadlines and urgency, utilizing time-management techniques such as the Eisenhower Matrix (urgent/important) to allocate my time effectively. For example, during a recent compliance audit, we prioritized the assessment of critical regulations facing the highest penalties, ensuring timely remediation of identified gaps.

Q 10. How do you ensure the independence and objectivity of your audits?

Maintaining independence and objectivity is fundamental to the integrity of any audit. This begins with a clear understanding of the audit scope and objectives, ensuring there are no conflicts of interest. I avoid any involvement in the areas being audited, and I ensure my reporting lines are independent from those being assessed. My audit methodology rigorously follows professional standards, adhering to established frameworks and guidelines. Furthermore, I use a robust audit program, carefully documenting all procedures, evidence gathered, and conclusions reached. The use of a second reviewer for critical findings also helps ensure a second pair of eyes on critical findings. A recent internal audit I conducted of the finance department involved a thorough review of transactions, and I reported directly to the audit committee, eliminating any potential bias.

Q 11. What is your experience with regulatory compliance audits?

I have extensive experience with regulatory compliance audits, covering various sectors including finance, healthcare, and technology. My work has involved assessing compliance with laws and regulations like SOX (Sarbanes-Oxley Act), HIPAA (Health Insurance Portability and Accountability Act), and GDPR (General Data Protection Regulation). This includes reviewing policies, procedures, and controls, testing their effectiveness, and identifying any gaps. I’m adept at interpreting complex regulations and translating them into practical audit procedures. For instance, during a recent HIPAA audit of a healthcare provider, I focused on the security of patient data, identifying vulnerabilities in their systems and recommending improvements to meet compliance standards. Understanding the specific requirements for each regulation, as well as the potential penalties for non-compliance is crucial in these types of audits.

Q 12. Describe your experience with IT audits.

My IT audit experience encompasses a wide range of areas, including security assessments, system controls reviews, and data integrity checks. I have a strong understanding of IT infrastructure, databases, networks, and applications. I’m proficient in using various audit tools and techniques to assess the effectiveness of IT controls and identify potential vulnerabilities. For example, I’ve conducted penetration testing to identify security weaknesses in a company’s network, and I’ve reviewed access controls to ensure only authorized personnel have access to sensitive data. I also possess experience in auditing cloud-based systems and assessing the security posture of cloud providers. In a recent IT audit of an e-commerce company, I assessed the security of their payment gateway and identified vulnerabilities that could have led to data breaches, resulting in preventative measures being implemented.

Q 13. Explain your understanding of audit sampling techniques.

Audit sampling is a crucial technique used to examine a subset of data or transactions to draw conclusions about the entire population. It’s essential when auditing large volumes of information. There are various sampling methods, including random sampling, stratified sampling, and monetary unit sampling. The choice of method depends on the audit objective and the characteristics of the population. It’s vital to understand the sampling risk – the risk of drawing an incorrect conclusion based on the sample. To mitigate this risk, a statistically valid sample size needs to be calculated. Proper documentation of the sampling methodology and the results is essential. For example, in an accounts receivable audit, I might use monetary unit sampling to focus on the larger accounts, which have a higher inherent risk of misstatement. This ensures efficiency and prioritizes areas requiring more thorough scrutiny.

Q 14. How do you develop an effective audit plan?

Developing an effective audit plan is the cornerstone of a successful audit. It begins with clearly defining the audit’s scope, objectives, and timeline. This involves understanding the key risks and controls within the area under review. Next, a detailed audit program is developed, outlining the specific procedures to be performed, the evidence to be gathered, and the resources required. Risk assessment plays a critical role in determining the areas requiring more attention and allocating resources accordingly. The plan should also incorporate effective communication strategies, including regular updates to stakeholders and a clear process for reporting findings. A well-defined plan provides a roadmap for the entire audit process, ensuring efficiency and effectiveness. For example, when auditing a company’s supply chain, we mapped out all key processes and identified areas with the highest risk of fraud or disruption before tailoring the audit program to address these specifically.

Q 15. How do you maintain audit documentation?

Maintaining audit documentation is crucial for ensuring the audit’s integrity, defensibility, and traceability. It’s like keeping a meticulous recipe for a complex dish – if you miss a step, you might not get the desired result. My approach involves a multi-layered system.

- Centralized Repository: I utilize a secure, centralized document management system, often cloud-based for easy access and version control. This ensures all documents are stored consistently and securely.

- Organized File Structure: The system uses a clear, logical file structure based on the audit subject, date, and document type. For example, a folder might be named ‘2024-Q3-Finance-Payroll-Audit’ with subfolders for working papers, findings, and reports.

- Metadata Tagging: Every document is meticulously tagged with relevant metadata – audit date, auditor, related processes, and keywords – facilitating efficient searching and retrieval. Think of it like indexing a library.

- Version Control: The system tracks all revisions, allowing us to trace changes and understand the audit’s evolution. This is crucial for demonstrating the audit process’s rigor and transparency.

- Access Control: Strict access control measures are in place to ensure only authorized personnel can view and modify sensitive documents. This aligns with data protection regulations and company policy.

- Regular Backups: Regular backups are performed to prevent data loss and ensure business continuity. This protects our work and minimizes any potential disruption.

This comprehensive system ensures all documentation is readily available, well-organized, secure, and auditable itself, providing a complete and verifiable record of the audit process.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you use audit software or tools?

Audit software and tools significantly enhance efficiency and effectiveness. I’ve worked extensively with tools like ACL (Audit Command Language) and IDEA (Interactive Data Extraction and Analysis) for data analysis and audit testing. These aren’t just glorified spreadsheets; they’re powerful analytical tools.

- Data Analysis: These tools allow me to import large datasets, perform complex calculations, identify anomalies, and extract relevant information much faster than manual methods. For example, I can use ACL to quickly identify duplicate payments or unusual transactions within a large financial dataset.

- Testing & Sampling: They facilitate various audit tests, such as substantive testing and compliance testing. I can use IDEA to randomly sample invoices for verification, ensuring a representative sample and reducing manual effort. This saves time and enhances the reliability of the audit conclusion.

- Reporting: They automate report generation, including charts, graphs, and summary tables, providing clear and concise visualizations of audit findings. This enhances the report’s accessibility and impact.

- Workflow Management: Some software offers workflow management capabilities, aiding collaboration and task tracking among the audit team. This ensures seamless execution and reduces the chances of oversight.

In addition to these specialized tools, I’m proficient in using project management software like Jira or Asana for task assignment, progress tracking, and communication among team members.

Q 17. Describe your experience with performing follow-up audits.

Follow-up audits are critical for verifying the effectiveness of corrective actions implemented after an initial audit. They’re like a doctor’s check-up after treatment— ensuring the problem is truly resolved. My experience involves a structured approach:

- Review of Corrective Actions: I first review the management responses and the corrective actions taken to address the initial audit findings. I assess whether these actions are appropriate and sufficient to mitigate the identified risks.

- Re-testing and Verification: I perform re-testing of the previously identified control weaknesses to validate the effectiveness of the corrective actions. This might involve re-examining documents, re-performing procedures, or interviewing personnel.

- Assessment of Residual Risks: I evaluate the remaining risks after the corrective actions have been implemented. Sometimes, completely eliminating a risk isn’t possible, and determining the acceptable level of residual risk is important.

- Reporting: I prepare a follow-up audit report documenting the assessment of corrective actions, the results of re-testing, and the residual risks. This provides management with confirmation of the effectiveness of the remediation and allows for further action if necessary.

For example, if an initial audit revealed weaknesses in inventory controls, the follow-up audit would verify that the implemented improvements, like improved stocktaking procedures or tighter access controls, effectively address those weaknesses and reduce inventory discrepancies.

Q 18. How do you handle sensitive information during an audit?

Handling sensitive information during an audit requires strict adherence to confidentiality and data protection principles. This is paramount; it’s like guarding a vault containing valuable assets.

- Confidentiality Agreements: All audit team members sign confidentiality agreements before accessing sensitive data, outlining their responsibility to protect the information.

- Access Control: Access to sensitive information is strictly controlled and limited to authorized personnel only, using secure systems and password protection.

- Data Encryption: Sensitive data is encrypted both in transit and at rest to protect it from unauthorized access, even if a security breach occurs. Think of it as using a secret code.

- Secure Storage: Physical and electronic storage of sensitive information adheres to strict security protocols, including locked cabinets, password-protected computers, and secure data storage solutions.

- Data Disposal: After the audit is complete, all sensitive information is securely disposed of, following company policy and data protection regulations. This could involve shredding physical documents or securely deleting electronic files.

- Compliance with Regulations: All audit activities comply with relevant data protection regulations such as GDPR or CCPA, ensuring we meet legal and ethical obligations.

Every step is documented, creating an audit trail that ensures transparency and accountability in handling sensitive data.

Q 19. What are the key challenges you face in conducting internal audits?

Conducting internal audits presents unique challenges. It’s not just about finding issues; it’s about navigating relationships and influencing positive change within the organization.

- Resistance to Change: Sometimes, departments or individuals may resist audit recommendations, viewing them as criticisms rather than opportunities for improvement. Effective communication and building trust are crucial to overcome this resistance.

- Resource Constraints: Audits often face time and budget limitations, requiring efficient planning and prioritization to maximize the impact within the available resources.

- Scope Creep: The initial audit scope may expand unexpectedly due to unforeseen issues or new requirements. Managing scope creep effectively is essential to stay on track and within budget.

- Data Accessibility: Gaining timely access to necessary data and information can be challenging, requiring skillful negotiation and proactive communication with relevant stakeholders.

- Maintaining Objectivity: Maintaining objectivity is crucial, especially when auditing departments or individuals with whom the auditor has established working relationships. A robust audit methodology and a commitment to ethical conduct are vital.

Overcoming these challenges involves proactive planning, clear communication, strong interpersonal skills, and a flexible approach.

Q 20. How do you stay current with auditing standards and best practices?

Staying current with auditing standards and best practices is essential for maintaining professional competency and ensuring the quality of my work. It’s like a chef constantly upgrading their culinary skills.

- Professional Development: I actively participate in professional development activities, such as attending conferences, workshops, and webinars related to internal auditing. This keeps me abreast of the latest standards, techniques, and technologies.

- Continuing Professional Education (CPE): I obtain required CPE credits annually to maintain my professional certifications, ensuring I meet the standards of professional bodies like the IIA (Institute of Internal Auditors).

- Industry Publications: I regularly read industry publications, journals, and online resources to stay updated on emerging trends, best practices, and regulatory changes in auditing.

- Networking: I network with other internal auditors through professional organizations and online forums, engaging in discussions and sharing knowledge to broaden my perspective.

- Staying Informed about Regulatory Changes: I stay informed about any changes in relevant regulations and standards, including updates to accounting standards (GAAP/IFRS) and data protection regulations (GDPR, CCPA), as these directly influence the audit process.

This continuous learning ensures my audits are conducted in accordance with the latest standards and best practices, maintaining their credibility and reliability.

Q 21. Explain your experience with different types of audit reports.

My experience encompasses various audit report types, each serving a specific purpose. Think of them as different tools in a toolbox, each suited for a specific job.

- Management Letter: This is a common type of report that communicates audit findings and recommendations to management. It focuses on areas for improvement and suggests corrective actions. It’s like a doctor’s prescription for improving health.

- Compliance Report: This report focuses on evaluating the organization’s adherence to relevant laws, regulations, and internal policies. It often summarizes the results of compliance testing and identifies any non-compliance issues.

- Financial Statement Audit Report: This is typically used for external audits of financial statements, providing an opinion on the fairness of the financial statements. It’s a formal report with a high level of scrutiny.

- Operational Audit Report: This report focuses on the efficiency and effectiveness of operations, including processes, controls, and resource utilization. It identifies areas for improvement and cost savings.

- Special Purpose Audit Report: This covers specific areas or projects as needed. For example, a special purpose audit might focus on the effectiveness of a new IT system or a particular department’s performance.

The specific format and content of each report are tailored to the audit’s objectives and the audience. Regardless of the type, clarity, conciseness, and objectivity are essential to ensure the report is effectively communicated and understood.

Q 22. How do you identify and mitigate audit risks?

Identifying and mitigating audit risks is a crucial part of ensuring the reliability and validity of an audit. It’s like a detective investigating a crime scene – you need to carefully examine all potential areas of vulnerability. I begin by understanding the organization’s risk appetite and the inherent risks associated with its operations. This involves reviewing strategic plans, industry benchmarks, and regulatory requirements. I then use a risk assessment methodology, often a combination of top-down and bottom-up approaches, to identify specific risks. The top-down approach considers overall strategic risks, while the bottom-up approach focuses on individual processes and controls.

For instance, in auditing a financial institution, a top-down risk might be the risk of non-compliance with anti-money laundering regulations. A bottom-up risk might be a weakness in the reconciliation process for customer accounts. Once identified, these risks are analyzed using a framework that considers their likelihood and potential impact. This enables prioritization of the most critical risks. Mitigation strategies are then developed and implemented. These strategies can range from improving internal controls to increasing monitoring activities or enhancing staff training. For example, if we identify a weakness in the segregation of duties, a mitigation strategy might be implementing a mandatory review process by a supervisor. The effectiveness of mitigation strategies is continuously monitored and reassessed throughout the audit.

Q 23. How do you assess the effectiveness of internal controls?

Assessing the effectiveness of internal controls is about evaluating how well a company’s processes and procedures protect its assets, ensure the reliability of its financial reporting, and comply with regulations. I approach this using a risk-based approach, focusing on controls that mitigate the most significant risks. I typically use a combination of techniques including:

- Documentation review: Examining policies, procedures, and organizational charts to understand the design of the controls.

- Inquiry: Interviewing personnel involved in the processes to understand how the controls are actually operated.

- Observation: Directly observing processes and procedures in action.

- Re-performance: Independently performing selected control procedures to verify their effectiveness.

- Testing of data: Analyzing data samples to assess the accuracy and completeness of information used in decision-making.

For example, if we are evaluating the effectiveness of inventory controls, we’d review procedures for receiving goods, storing inventory, and managing stock levels. We’d then observe the process of receiving goods, interview warehouse personnel, and potentially re-perform a sample of inventory counts to verify accuracy. Any deficiencies identified are documented, along with recommendations for improvement. The overall effectiveness of internal controls is rated based on the identified strengths and weaknesses, considering the inherent risks and the effectiveness of implemented mitigations.

Q 24. Describe your experience with fraud investigations.

I have been involved in several fraud investigations during my career. These investigations typically involve a structured approach that follows a clear methodology. It begins with a thorough understanding of the suspected fraud, gathering preliminary evidence, and assessing potential risks. My experience includes:

- Developing interview protocols to obtain information from relevant personnel, using techniques like open-ended questions and confirming statements.

- Analyzing financial data to identify anomalies, inconsistencies, or unusual patterns that may indicate fraudulent activities. This often involves utilizing data analysis software to identify outliers and trends.

- Working collaboratively with external forensic accountants or law enforcement when necessary, coordinating information and ensuring a consistent investigation approach.

- Documenting all findings, evidence, and conclusions thoroughly, adhering to strict confidentiality and ethical standards.

In one case, I helped investigate a potential embezzlement scheme. By analyzing bank statements, expense reports, and employee records, I was able to pinpoint suspicious transactions and ultimately recovered a significant amount of misappropriated funds. The key is to approach such investigations with a combination of analytical skills, attention to detail, and professional skepticism.

Q 25. How do you measure the success of an internal audit?

Measuring the success of an internal audit is multi-faceted. It’s not just about identifying problems; it’s about demonstrating the value added to the organization. Key performance indicators (KPIs) I use to measure success include:

- Number and severity of identified risks: This highlights the effectiveness of the risk assessment process and the potential impact of the identified issues.

- Quality of audit reports: Clear, concise, and actionable reports contribute significantly to the impact of the audit.

- Management response to recommendations: The timely implementation of recommendations signifies the organization’s commitment to addressing identified weaknesses.

- Impact on improved operational efficiency: Demonstrating how the audit contributed to cost savings, improved processes, or reduced risk demonstrates tangible value.

- Enhancement of internal controls: Tracking the implementation of control improvements and measuring their effectiveness showcases a direct impact on risk mitigation.

Ultimately, success is measured by whether the audit helped the organization improve its governance, risk management, and control processes, ultimately contributing to the achievement of its strategic objectives. I regularly report on these metrics to stakeholders and proactively seek feedback to continuously improve our audit process.

Q 26. How do you contribute to continuous improvement based on audit findings?

Contributing to continuous improvement is a core principle of effective internal audit. I utilize several methods to ensure that audit findings lead to tangible improvements. Firstly, I provide clear and concise recommendations in my audit reports. These recommendations are specific, actionable, and prioritized based on the severity of the identified risks. Secondly, I conduct follow-up reviews to assess management’s response to these recommendations and ensure that the necessary corrective actions are implemented. This involves verifying whether the recommended improvements have been made and whether they are effective. If not, further corrective actions are identified and implemented.

Furthermore, I actively participate in management discussions, presenting my findings and sharing my insights to facilitate improvements. I work collaboratively with management to develop and implement improvement plans. I also utilize data analytics to identify trends and patterns from multiple audits to reveal areas for broader improvement initiatives. For example, if recurring deficiencies are identified in a specific area across multiple audits, we might implement a comprehensive process improvement project to address the root cause. Finally, I regularly review and update our audit methodology and procedures to incorporate best practices and lessons learned from past audits, fostering a culture of continuous learning and development.

Q 27. Describe a time you had to deal with a challenging audit situation.

One particularly challenging audit involved a significant system implementation project. The project was already significantly behind schedule and over budget when I started the audit. The complexity of the system, coupled with limited documentation and a lack of clear project management oversight, created a difficult environment. I had to navigate competing priorities, tight deadlines, and significant resistance from some project team members.

My approach involved a phased audit, focusing first on understanding the system’s critical functionalities and then systematically testing them. I also had to build trust with the project team by demonstrating my competence and focusing on providing constructive feedback. Throughout the process, I maintained meticulous documentation and clear communication with management, keeping them informed of progress and any significant issues. While the situation was stressful, the resulting audit report provided valuable insights into the project’s shortcomings, leading to significant improvements in project management processes and preventing further issues.

Q 28. What are your career aspirations in internal auditing?

My career aspirations in internal auditing involve progressing to a leadership role, where I can mentor and develop other auditors while contributing to the strategic direction of the internal audit function. I aim to broaden my expertise in areas like data analytics and emerging technologies, and become a recognized expert in my field. I am particularly interested in contributing to the development of innovative audit methodologies and tools that leverage technology to enhance efficiency and effectiveness. Ultimately, I want to make a significant contribution to organizations’ risk management and governance frameworks by helping them proactively identify and mitigate risks while achieving their strategic objectives.

Key Topics to Learn for Conduct Internal Audits and Inspections Interview

- Internal Control Frameworks: Understanding frameworks like COSO, COBIT, and ISO 19011 is crucial. Focus on their principles and how they apply to different organizational structures.

- Audit Planning & Methodology: Learn about risk assessment, scoping audits, developing audit programs, and selecting appropriate audit techniques (e.g., sampling, testing controls).

- Data Analysis Techniques: Mastering data analysis tools and techniques to identify trends, anomalies, and potential control weaknesses is essential. Consider exploring data visualization methods for presenting findings effectively.

- Compliance & Regulations: Familiarize yourself with relevant industry regulations and compliance standards impacting your target organization. Understanding how audits ensure compliance is vital.

- Communication & Reporting: Practice effectively communicating audit findings, both verbally and in writing, to diverse audiences, including senior management. Mastering the art of constructive feedback is key.

- Audit Documentation & Evidence Gathering: Learn best practices for documenting the audit process, gathering sufficient and appropriate audit evidence, and maintaining a clear audit trail.

- Problem-Solving & Critical Thinking: Develop your ability to identify root causes of issues uncovered during audits, and propose practical and effective solutions. Demonstrate strong analytical and problem-solving skills.

- Ethical Considerations: Understand the importance of maintaining objectivity, confidentiality, and professional skepticism throughout the audit process. Know your professional responsibilities and limitations.

Next Steps

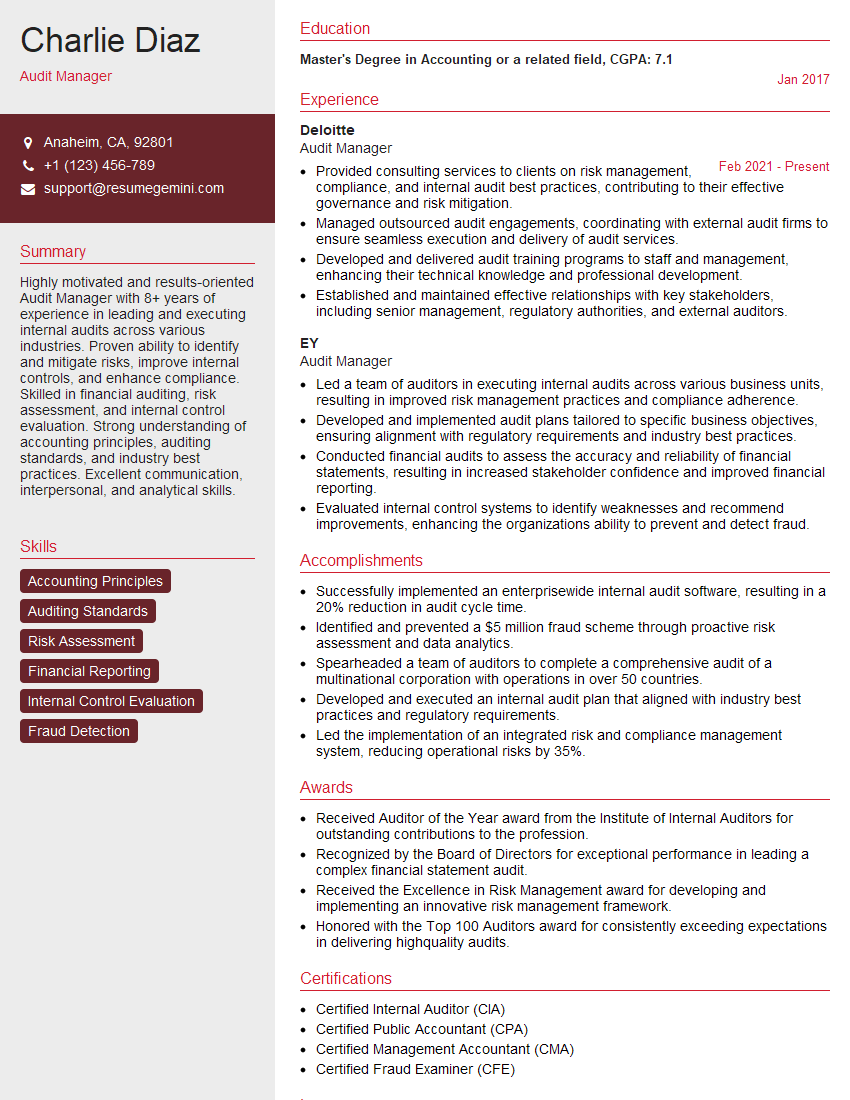

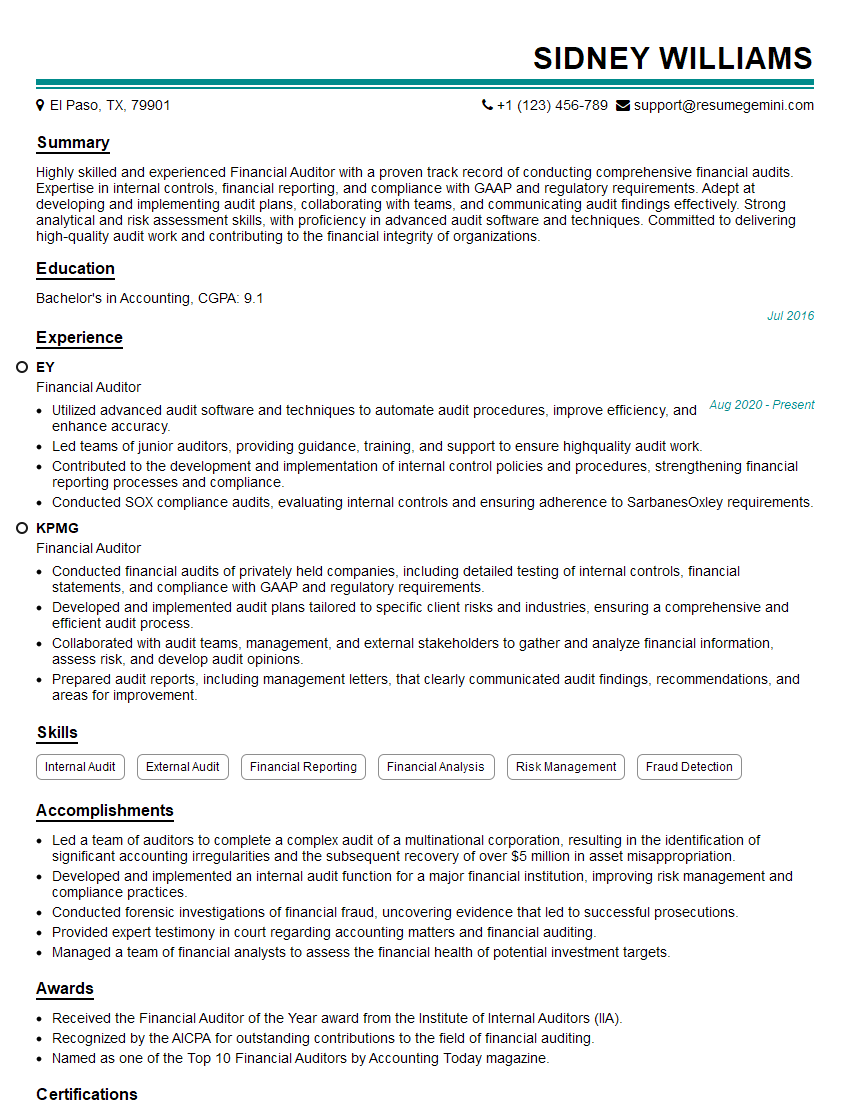

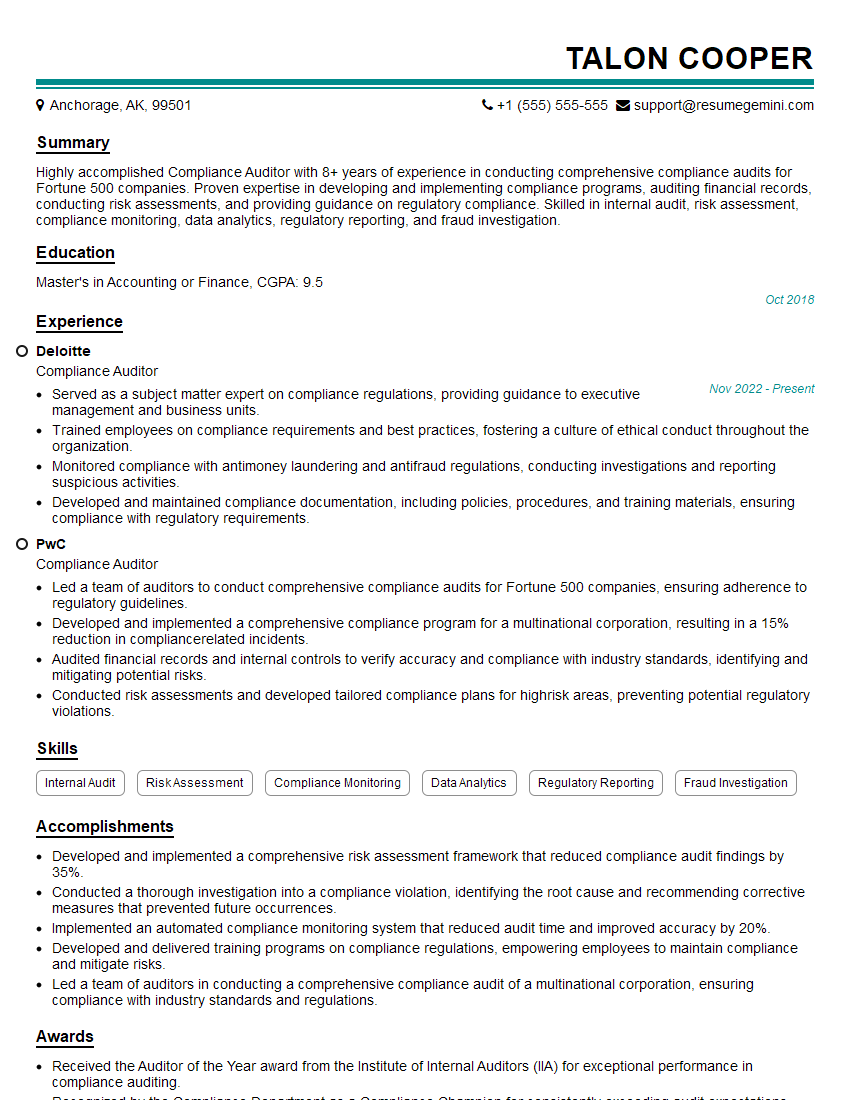

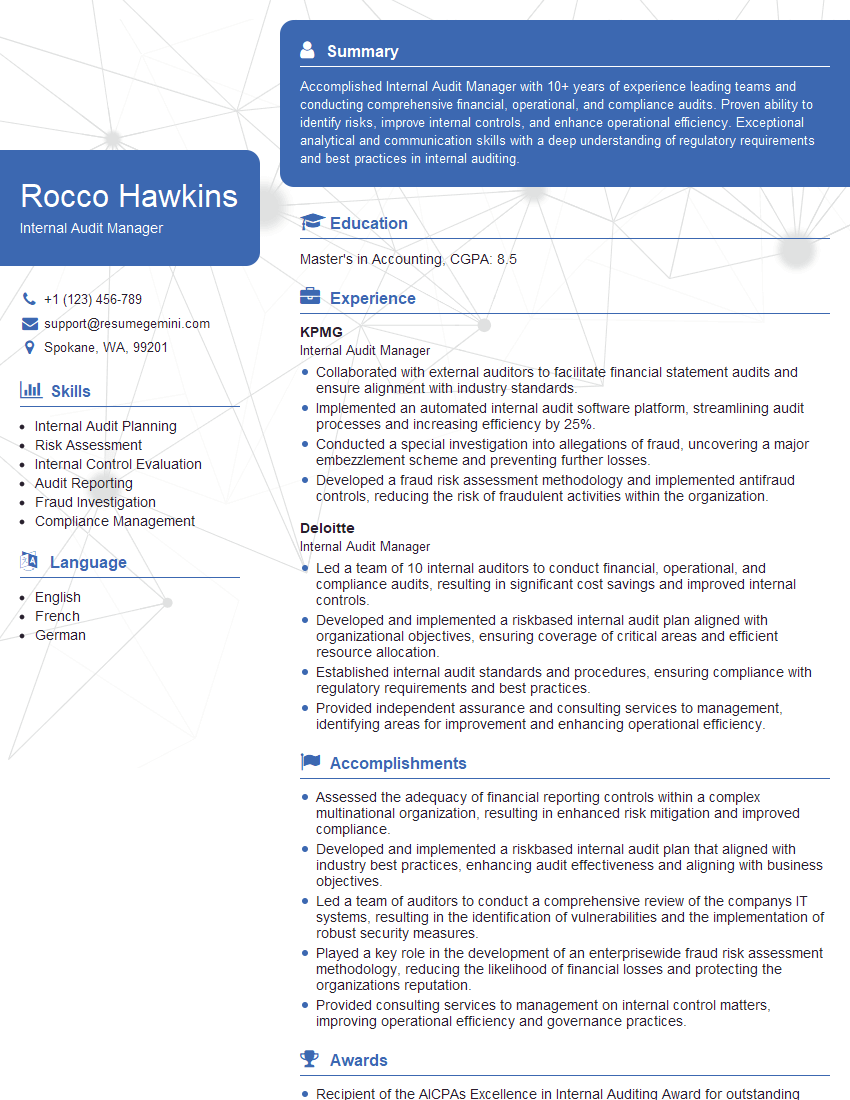

Mastering the art of conducting internal audits and inspections significantly enhances your career prospects, opening doors to leadership roles and demonstrating a commitment to organizational effectiveness and risk mitigation. To maximize your chances of securing your dream role, focus on building an ATS-friendly resume that highlights your skills and experience. ResumeGemini is a trusted resource for crafting professional and impactful resumes. They offer examples of resumes tailored to Conduct Internal Audits and Inspections roles, helping you present your qualifications effectively and increase your chances of landing an interview.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

To the interviewgemini.com Webmaster.

Very helpful and content specific questions to help prepare me for my interview!

Thank you

To the interviewgemini.com Webmaster.

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.