The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Economic Valuation interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Economic Valuation Interview

Q 1. Explain the difference between market value, fair value, and intrinsic value.

The terms market value, fair value, and intrinsic value, while often used interchangeably, represent distinct concepts in economic valuation. Think of it like judging the price of a rare stamp:

- Market Value: This is the price at which an asset is currently trading in the open market. For our stamp, it’s the price someone actually paid for a similar stamp recently. It reflects the current supply and demand dynamics and can be volatile. It’s readily observable for publicly traded assets but less so for private companies or unique assets.

- Fair Value: This represents the price that a hypothetical willing buyer and a willing seller would agree upon, given full information and no pressure to transact. For our stamp, this might involve expert appraisal considering its rarity, condition, and historical significance. It’s often an estimate based on various valuation techniques.

- Intrinsic Value: This is the fundamental value of an asset based on its underlying characteristics and future cash flows. It’s what an asset is truly worth, independent of market sentiment or short-term fluctuations. For our stamp, this reflects its true historical worth and collector appeal. It’s often considered the ‘true’ value but the most difficult to ascertain, requiring deep analysis.

In summary: Market value is what the market says it’s worth, fair value is a negotiated price between informed parties, and intrinsic value is its fundamental worth based on long-term prospects.

Q 2. Describe the different approaches to valuing a company (e.g., DCF, market multiples, asset-based).

Valuing a company involves several approaches, each with its strengths and weaknesses. The most common include:

- Discounted Cash Flow (DCF) Analysis: This method projects a company’s future cash flows and discounts them back to their present value using an appropriate discount rate (WACC). It’s considered an intrinsic valuation method, focusing on the company’s inherent worth.

- Market Multiples: This approach compares the company’s valuation metrics (e.g., Price-to-Earnings ratio, Enterprise Value/EBITDA) to those of comparable publicly traded companies. It leverages market data and is quicker than DCF, but relies on the comparability of the companies chosen. Finding truly comparable companies can be challenging.

- Asset-Based Valuation: This method focuses on the net asset value of the company – the difference between its assets and liabilities. It’s particularly useful for companies with substantial tangible assets, like real estate or manufacturing firms. However, it often undervalues companies with significant intangible assets, like strong brands or intellectual property.

The choice of method depends on factors such as the company’s industry, stage of development, availability of data, and the specific purpose of the valuation. Often, a combination of these approaches is used to provide a more robust and comprehensive valuation.

Q 3. What are the limitations of the Discounted Cash Flow (DCF) method?

While DCF is a powerful tool, it has several limitations:

- Sensitivity to Assumptions: DCF is heavily reliant on projections of future cash flows, discount rates, and terminal growth rates. Small changes in these assumptions can significantly impact the valuation. Imagine slightly altering projected revenue growth – a small percentage change can dramatically impact your final valuation.

- Terminal Value Estimation: Estimating the terminal value (the value of the company beyond the explicit forecast period) can be challenging and subjective. This often comprises a significant portion of the total valuation, making its estimation crucial.

- Discount Rate Determination: Accurately determining the Weighted Average Cost of Capital (WACC) is crucial, but can be difficult, particularly for privately held companies where beta estimation is challenging.

- Qualitative Factors: DCF primarily focuses on quantitative data and might not adequately capture qualitative factors like management quality, competitive landscape, or regulatory changes. These factors can have a substantial influence on a company’s long-term success.

It is important to acknowledge these limitations and perform sensitivity analysis to understand the impact of different assumptions on the final valuation.

Q 4. How do you handle intangible assets in a valuation?

Handling intangible assets in valuation requires careful consideration as they are not easily quantifiable. Methods include:

- Income Approach: Estimating the future cash flows attributable to the intangible assets and discounting them to present value. This could involve isolating the contribution of a specific brand to overall profitability.

- Market Approach: Comparing the company’s intangible assets to similar assets that have been recently sold or valued in the market. This requires finding comparable transactions, a process that can be particularly difficult for unique intangible assets.

- Cost Approach: Estimating the cost of recreating the intangible asset. This is useful for assets like software or patents, where the development cost is readily available. However, this approach doesn’t capture the value added from goodwill and brand recognition.

Often a combination of these approaches is used, and adjustments are made to account for the unique characteristics of each intangible asset. The challenge lies in properly identifying and quantifying the economic benefits of intangible assets, which can significantly influence a company’s overall value.

Q 5. Explain the concept of Weighted Average Cost of Capital (WACC) and how it’s used in valuation.

The Weighted Average Cost of Capital (WACC) represents the average rate of return a company expects to pay to its investors (debt and equity holders). It’s a crucial component in DCF valuation, serving as the discount rate to bring future cash flows back to their present value. Think of it as the cost of using someone else’s money.

The formula is:

WACC = (E/V) * Re + (D/V) * Rd * (1 - Tc)Where:

- E = Market value of equity

- D = Market value of debt

- V = E + D (Total market value)

- Re = Cost of equity

- Rd = Cost of debt

- Tc = Corporate tax rate

The WACC reflects the risk associated with the company’s capital structure. A higher WACC indicates higher risk and thus a higher discount rate applied to future cash flows, leading to a lower present value.

Q 6. How do you select appropriate discount rates for different projects or companies?

Selecting appropriate discount rates requires a thorough understanding of the risk associated with the project or company being valued. For different projects or companies, the approach differs slightly:

- Public Companies: The cost of equity can be estimated using the Capital Asset Pricing Model (CAPM), which considers the risk-free rate, the market risk premium, and the company’s beta (a measure of systematic risk). The cost of debt is typically the yield to maturity on the company’s outstanding debt.

- Private Companies: Estimating the cost of equity is more challenging for private companies due to the lack of readily available market data. One approach is to use the CAPM with a proxy beta derived from comparable public companies, adjusting for size and other relevant factors. The cost of debt can be estimated based on the prevailing interest rates for comparable debt financing.

- Specific Projects: For projects, the discount rate is often the company’s hurdle rate, reflecting the minimum acceptable rate of return for undertaking the investment. This hurdle rate may be adjusted to reflect the specific risks of the project.

In all cases, sensitivity analysis is crucial to assess the impact of variations in the discount rate on the final valuation. A higher discount rate leads to a lower valuation.

Q 7. Describe your experience with different valuation models (e.g., Black-Scholes, binomial trees).

My experience encompasses various valuation models, including:

- Discounted Cash Flow (DCF): As discussed previously, I have extensive experience in building and refining DCF models for a wide range of companies and projects, including sensitivity analysis and scenario planning.

- Market Multiples: I’m proficient in selecting appropriate comparables, applying various multiples (P/E, EV/EBITDA, etc.), and understanding the limitations of this approach. I’ve utilized this method extensively for quick valuations and cross-checking DCF results.

- Black-Scholes Model: I have applied this model to value options and other derivative instruments. I understand the underlying assumptions and limitations of the model and am familiar with adapting it for various option types.

- Binomial Trees: I’ve used binomial trees for option valuation and to model other situations involving uncertainty, appreciating their ability to handle more complex option characteristics than Black-Scholes in specific circumstances, like American options.

My experience covers both theoretical understanding and practical application of these models across various industries and situations. I always emphasize choosing the appropriate model based on the specific context and data availability.

Q 8. How do you account for risk in your valuation?

Risk is a crucial element in any valuation, as it directly impacts the expected return of an investment. We account for risk primarily through the discount rate. A higher discount rate reflects higher risk, leading to a lower present value of future cash flows. Think of it like this: would you rather receive $100 today or $100 a year from now? Most people would choose today, because there’s a risk associated with waiting. That risk premium is built into the discount rate.

Specifically, we often use the Capital Asset Pricing Model (CAPM) to determine the appropriate discount rate. CAPM considers the risk-free rate of return (e.g., government bonds), the market risk premium (the expected return of the market above the risk-free rate), and the beta of the asset (a measure of its volatility relative to the market). A higher beta indicates higher risk and therefore a higher discount rate. We also consider qualitative factors like industry-specific risks, regulatory changes, or management quality, which can influence the discount rate subjectively.

For example, a startup company would have a significantly higher discount rate than a well-established, profitable company in a stable industry, reflecting the higher uncertainty associated with the startup’s future performance.

Q 9. What are some common valuation multiples and how do you choose the most appropriate ones?

Common valuation multiples include Price-to-Earnings (P/E), Price-to-Sales (P/S), Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Book (P/B). The choice of the most appropriate multiple depends heavily on the specific industry, stage of development of the company, and the availability of reliable data.

For example, P/E ratios are widely used for mature companies with stable earnings, while P/S ratios are more common for companies with negative earnings or those in early-stage growth. EV/EBITDA is often favored in capital-intensive industries, as it is less sensitive to accounting differences than P/E. P/B ratios are commonly used in asset-heavy industries like banking or real estate.

The selection process involves a thorough analysis of comparable companies. We look for companies with similar business models, industry positioning, growth prospects, and financial characteristics. After identifying suitable comparables, we calculate the relevant multiples for each, eliminating outliers and adjusting for any significant differences (like leverage or growth rates) before using a weighted average multiple to estimate the value of the target company. It’s important to select a range of multiples as well to reflect uncertainty.

Q 10. How do you adjust for differences in capital structure when using comparable company analysis?

Differences in capital structure – the mix of debt and equity financing – significantly impact valuation multiples. To ensure accurate comparison across companies, we often use adjusted multiples to account for these discrepancies. A common method is to calculate the unlevered beta or use the enterprise value rather than market capitalization in calculating multiples like EV/EBITDA.

Unlevering the beta removes the effect of financial leverage on the company’s risk profile, allowing for a more accurate comparison of operating risk. We use the following formula: βU = βL / [1 + (1-t)(D/E)], where βU is the unlevered beta, βL is the levered beta, t is the tax rate, D is the market value of debt, and E is the market value of equity.

Using enterprise value instead of market capitalization in the multiple calculation directly accounts for the company’s total capital structure, encompassing both debt and equity financing. This leads to a more accurate comparison of value creation, regardless of debt levels. For example, a company with high debt will have a lower market cap than a similar company with low debt, despite potentially having a similar overall value. Using EV/EBITDA accounts for this difference.

Q 11. Explain the concept of precedent transactions and how it’s applied in valuation.

Precedent transactions analysis involves evaluating past acquisitions of similar companies to determine a potential valuation range for the target company. It is a valuable approach because it reflects real market prices paid for comparable assets in recent transactions.

The process begins with identifying relevant comparable transactions, focusing on deals closed within a reasonable time frame (typically the past 3-5 years). We examine deal structures, purchase multiples, buyer motivation, and other factors that influenced the transaction price. Like comparable company analysis, we also account for differences between the target company and the acquired companies in the precedent transactions (size, industry-specific conditions, market cycle etc.). We make adjustments to normalize multiples to ensure comparability and derive the valuation range.

For example, if a similar company was recently acquired at a 10x EBITDA multiple, this could suggest a similar range for the target company, although adjustments would be necessary to account for differences in size, growth, or profitability.

Q 12. How do you deal with missing or unreliable data in a valuation?

Dealing with missing or unreliable data is a common challenge in valuation. We address this using several strategies. First, we explore all available data sources, including company filings, industry reports, and financial databases. If data is missing for a specific metric, we might use proxies, such as industry averages or comparable company data, to estimate the missing values. It’s crucial to clearly document any estimations or assumptions made and qualify the resulting valuations.

Secondly, we assess the reliability of available data. If we suspect data inconsistencies or errors, we might perform sensitivity analysis, testing how changes in the uncertain values affect the overall valuation. This illustrates the range of possible outcomes given the data uncertainties. We might also conduct multiple valuations using different methodologies, such as discounted cash flow (DCF) and comparable company analysis, to cross-check the results and identify potential inconsistencies. It’s critical to communicate the limitations of the valuation explicitly, acknowledging any reliance on estimations or assumptions due to data gaps.

Q 13. Describe your experience using valuation software (e.g., Argus, Bloomberg Terminal).

I have extensive experience using both Argus and Bloomberg Terminal for valuation purposes. Argus is a powerful software for detailed DCF modeling, allowing for flexible forecasting and scenario planning. I use it regularly to build sophisticated financial models, which incorporate different assumptions and sensitivity analyses. It facilitates the integration and reconciliation of data across different sources. Bloomberg Terminal provides comprehensive access to market data, including financial statements, comparable company information, and transaction details. This is essential for both comparable company analysis and precedent transactions analysis. I leverage Bloomberg to gather reliable, up-to-date information efficiently, enhancing the accuracy and reliability of my valuations.

For example, when performing a DCF analysis in Argus, I might use Bloomberg Terminal to quickly access and verify financial statement information for the target company and its comparable companies. Then, I can use Argus to conduct the necessary adjustments to the data. Both platforms complement each other effectively, optimizing my workflow and ensuring rigorous analysis.

Q 14. How do you present your valuation findings to senior management or clients?

Presenting valuation findings requires clear and concise communication, tailored to the audience. For senior management or clients, I focus on delivering a compelling narrative rather than simply presenting numerical results. I start with a high-level summary, outlining the methodology used, key assumptions, and the resulting valuation range. This summary should be free of unnecessary jargon.

I follow this with a deeper dive into the analysis, explaining the rationale behind my assumptions and addressing potential limitations of the valuation. I use visuals such as charts and graphs to illustrate key findings and trends. This helps to make the complex data more accessible and engaging. Finally, I leave time for questions and discussions, ensuring that the audience fully understands the valuation and its implications. The goal is to not just deliver numbers, but to provide insights that aid strategic decision-making. If there are significant uncertainties or limitations of the model, this will be clearly emphasized.

Q 15. What are some key considerations when valuing a privately held company?

Valuing a privately held company presents unique challenges compared to publicly traded ones because there isn’t a readily available market price. Key considerations include:

- Lack of Market Data: Unlike publicly traded firms, there’s no continuous stream of market-determined prices. We must rely on alternative methods like discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions.

- Liquidity Discount: Because shares aren’t easily traded, a discount is often applied to the valuation to reflect the reduced liquidity. This discount can range significantly depending on factors like the company’s size, industry, and ownership structure.

- Control Premium: Conversely, if a controlling interest in the company is being valued, a premium is typically added to reflect the increased control and influence afforded to the buyer.

- Financial Statement Quality: Scrutinizing the accuracy and reliability of the company’s financial statements is crucial. Private companies sometimes have less rigorous accounting standards than publicly traded ones.

- Growth Projections: Estimating future growth rates is inherently uncertain for any company, but especially for private firms with limited historical data. Sensitivity analysis and careful consideration of market trends are vital.

- Discount Rate Determination: The discount rate used in DCF analysis reflects the risk associated with the investment. Determining an appropriate discount rate for a private company requires careful consideration of various factors, including the company’s risk profile, industry benchmarks, and prevailing market interest rates.

For example, imagine valuing a privately held tech startup. We’d likely use a DCF model, projecting future cash flows based on the management’s business plan, then applying a discount rate reflecting the high risk associated with early-stage technology companies. A comparable company analysis could then provide a cross-check, but finding truly comparable private firms might be difficult.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle synergies in a merger and acquisition valuation?

Synergies in mergers and acquisitions represent the potential for increased value created by combining two companies. Handling them in valuation requires careful consideration and transparency.

- Identify and Quantify Synergies: The first step is to meticulously identify all potential synergies, both revenue and cost synergies. Revenue synergies might include increased market share, access to new customer segments, or cross-selling opportunities. Cost synergies could involve eliminating redundant operations, economies of scale in procurement, or streamlining administrative functions. It’s crucial to quantify these synergies with reasonable supporting evidence.

- Probability Weighting: It’s rare that all anticipated synergies materialize fully. We should assign probabilities to each synergy, reflecting the likelihood of its achievement. This introduces realism into the valuation.

- Time Horizon: Synergies typically don’t materialize immediately. A realistic timeframe for their realization needs to be incorporated into the valuation model. This might involve phasing in the synergy benefits over several years.

- Sensitivity Analysis: To test the robustness of the valuation, conduct a sensitivity analysis, examining the valuation’s response to changes in synergy assumptions. This highlights the uncertainty associated with synergy realization.

- Transparency: Clearly document all assumptions about synergies, including the methodology used to quantify and weight them. Transparency is essential for building confidence in the valuation.

For instance, in a merger of two pharmaceutical companies, revenue synergies might be derived from combining their sales forces to reach a broader market. Cost synergies could result from consolidating research and development functions. The valuation would incorporate the incremental cash flows from these synergies, discounted appropriately, adding to the overall valuation.

Q 17. What are the ethical considerations in economic valuation?

Ethical considerations are paramount in economic valuation. The goal isn’t just to produce a number, but to produce a credible and unbiased number that fairly represents the value. Key ethical considerations include:

- Independence and Objectivity: Maintaining independence from the parties involved is crucial. Avoid conflicts of interest, and ensure that all analyses are conducted objectively, based on factual information and sound methodologies.

- Transparency and Disclosure: Clearly document all assumptions, methodologies, and data sources used in the valuation. Disclose any limitations or uncertainties associated with the valuation. Transparency builds trust and allows for scrutiny.

- Competence and Due Diligence: The valuation professional must possess the necessary expertise and experience to perform the valuation appropriately. Thorough due diligence must be carried out to ensure that the data used is accurate and reliable.

- Confidentiality: Respect the confidentiality of sensitive information obtained during the valuation process. Protect client information and adhere to relevant regulations.

- Avoiding Bias: Consciously strive to avoid biases in all aspects of the valuation, from data selection to methodology selection to interpretation of results.

An example of unethical conduct would be selectively choosing data to support a predetermined conclusion or using an inappropriate valuation method to inflate or deflate the value to favor a particular party. Maintaining integrity is fundamental to the credibility of the valuation.

Q 18. Explain the concept of option pricing and its relevance to valuation.

Option pricing theory, primarily stemming from the Black-Scholes model, is crucial in valuing assets with contingent payoffs. It’s particularly relevant when evaluating:

- Real Options: These are managerial choices that may be exercised in the future, such as options to expand, contract, abandon, or delay a project. Real options increase a company’s flexibility and value, capturing the potential for future opportunities. For instance, a company might have the option to expand its manufacturing capacity if market demand rises unexpectedly. This option has intrinsic value, beyond the current operations.

- Growth Opportunities: A company’s value isn’t just determined by current cash flows but also by its potential for future growth. Option pricing models can help quantify the value of these growth opportunities.

- Acquisitions: When considering an acquisition, the acquirer might view the target company as a collection of assets and options. For instance, the target might have options to develop new products, enter new markets, or streamline its operations.

The Black-Scholes model is one way to value these options. Though it’s based on simplifying assumptions, it provides a framework to incorporate uncertainty and the timing of potential payoffs into valuations. Real options analysis can greatly improve the accuracy of valuing companies in dynamic industries.

Q 19. How do you account for inflation in your valuation?

Inflation significantly impacts future cash flows, requiring careful consideration in valuation. Here’s how we account for it:

- Nominal vs. Real Cash Flows: Distinguish between nominal cash flows (unadjusted for inflation) and real cash flows (adjusted for inflation). Most valuation models work with real cash flows because they provide a clearer picture of the underlying economic value, unaffected by inflationary pressures.

- Inflation Adjustment: If forecasting future cash flows using nominal values, deflate them using an appropriate inflation rate to convert them to real cash flows. The inflation rate used should be consistent with the industry and economic outlook.

- Inflation-Adjusted Discount Rate: Use a real discount rate (adjusted for inflation) instead of a nominal discount rate. This ensures consistency in the analysis. The relationship is:

(1 + Nominal Discount Rate) = (1 + Real Discount Rate) * (1 + Inflation Rate) - Inflation Expectations: Incorporating consistent and well-justified inflation expectations is crucial. Using incorrect or inconsistent inflation assumptions will significantly skew the valuation.

For example, if we’re valuing a company with projected cash flows of $10 million in year 5 and anticipate a 3% annual inflation rate, we’d deflate this future cash flow to its real value using the formula: Real Cash Flow = Nominal Cash Flow / (1 + Inflation Rate)^5. This results in a significantly lower real cash flow. This adjustment must be performed consistently across all projected cash flows to arrive at an accurate valuation.

Q 20. What are some common errors to avoid in economic valuation?

Several common errors should be avoided in economic valuation:

- Using Inappropriate Valuation Methods: Selecting a valuation method that is not suitable for the specific asset being valued is a common mistake. The choice of method depends on factors such as the nature of the asset, the availability of data, and the purpose of the valuation.

- Incorrect Data and Assumptions: Using inaccurate or unreliable data, or making unrealistic assumptions, will lead to erroneous valuation results. Thorough due diligence and sensitivity analysis are crucial to mitigate this risk.

- Ignoring Risk: Failing to adequately account for the risks associated with the asset being valued is another frequent error. This is often reflected in the discount rate used in discounted cash flow analyses. The discount rate should reflect the specific risk profile of the company or asset.

- Overreliance on Single Valuation Method: Relying solely on one valuation method can lead to a biased and potentially inaccurate result. Ideally, several methods should be employed, and the results compared to provide a range of possible values.

- Ignoring Market Context: Failing to consider market conditions, such as prevailing interest rates, economic trends, and market sentiment, can lead to inaccurate valuations. The valuation should consider the overall economic environment.

- Insufficient Sensitivity Analysis: Not performing a thorough sensitivity analysis, testing the valuation’s robustness to changes in key assumptions, can limit understanding of the valuation’s uncertainties.

For example, valuing a highly volatile technology company using a simple perpetuity method without considering the risks associated with future growth prospects would be a significant error. Employing a DCF analysis with a risk-adjusted discount rate and incorporating sensitivity analysis to growth projections would be a more robust approach.

Q 21. How do you validate your valuation conclusions?

Validating valuation conclusions requires a multi-faceted approach to ensure credibility and reduce reliance on any single metric.

- Multiple Valuation Approaches: Employing several valuation methodologies (e.g., DCF, comparable company analysis, precedent transactions) helps to corroborate results and identify inconsistencies. Significant divergence between methods should trigger further investigation.

- Sensitivity Analysis: Conduct thorough sensitivity analysis to assess the impact of changes in key assumptions on the valuation. This reveals the uncertainty inherent in the valuation process.

- Data Triangulation: Verify the data used from multiple sources to ensure accuracy and consistency. Compare financial data with industry averages and publicly available information.

- Peer Group Comparison: Compare the valuation multiples (e.g., Price-to-Earnings, Enterprise Value-to-EBITDA) to those of comparable companies to assess reasonableness. Significant deviations require careful explanation and consideration.

- Independent Review: An independent review by a qualified professional, ideally someone unfamiliar with the initial valuation, adds another layer of validation and objectivity. This can help identify potential biases or errors.

- Market Testing (where applicable): If possible, testing the valuation by comparing it to actual market transactions for similar assets provides strong validation. This could involve gauging the market response to an offer price during negotiations.

Imagine a valuation leading to a significantly higher value than suggested by comparable transactions. Validation would involve re-examining the assumptions, especially those regarding growth, risk, and synergies. Perhaps the higher valuation was justified by unique, defensible advantages, but this needs thorough substantiation.

Q 22. Describe your experience with sensitivity analysis in valuation.

Sensitivity analysis is a crucial aspect of any valuation exercise. It helps us understand how changes in key assumptions impact the final valuation. Think of it like this: you’re building a house (the valuation), and sensitivity analysis helps you assess the impact of using different materials (assumptions) – if the wood is cheaper, how much cheaper will the house be? Or if the concrete is more expensive, how much more will it cost? Instead of just providing one valuation figure, we systematically vary inputs – discount rates, growth rates, terminal values, etc. – to see the range of possible outcomes.

In practice, I often use spreadsheet software (like Excel) and scenario planning. I’ll create different scenarios, each reflecting a plausible variation in an input. For instance, in a Discounted Cash Flow (DCF) valuation, I might vary the discount rate by plus or minus one percentage point to see its impact on the present value. Similarly, I might test different terminal growth rates. The results are then presented visually, often as charts or tables, showcasing the sensitivity of the valuation to each key input. This allows stakeholders to understand the uncertainty inherent in the valuation and make more informed decisions.

For example, in valuing a tech startup, I might perform sensitivity analysis on factors such as customer acquisition cost, revenue growth, and market size. By systematically varying each of these, I can illustrate the range of possible valuations and identify the assumptions that have the greatest impact on the final result, allowing investors to gauge risk more accurately.

Q 23. What are the impacts of different accounting standards (e.g., IFRS, GAAP) on valuation?

Different accounting standards like IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles) significantly influence valuation. They affect how financial statements are prepared, and consequently, the inputs used in valuation models. For example, how revenue is recognized, how assets are depreciated, and how liabilities are measured differ under these standards. These differences can directly impact key valuation metrics like earnings, cash flows, and net assets.

IFRS tends to be more principles-based, allowing for greater flexibility in accounting choices, while GAAP is more rules-based. This can lead to variations in reported financial performance, which directly impacts the inputs to a discounted cash flow or asset-based valuation. For instance, differences in inventory valuation methods could lead to significant differences in reported earnings and ultimately the valuation.

When conducting a valuation, it’s critical to understand which accounting standards the target company uses and to adjust or reconcile the financial statements accordingly to ensure consistency. If I’m valuing a company using IFRS financials and my valuation requires GAAP figures, I’ll undertake the necessary adjustments based on publicly available information or by consulting with accounting professionals. A failure to appropriately consider accounting standards can result in a materially misstated valuation.

Q 24. How do you incorporate industry-specific factors into your valuation?

Industry-specific factors are paramount in accurate valuation. A ‘one-size-fits-all’ approach simply won’t work. Ignoring industry dynamics can lead to significantly flawed valuations. The key is to understand the specific drivers of value within that industry. This requires deep industry knowledge, often gained through extensive research, network contacts, and prior experience.

For example, when valuing a pharmaceutical company, I need to consider factors like patent expirations, R&D pipeline, regulatory hurdles, and market competition, all of which are unique to that industry and significantly influence future cash flows. These factors are not relevant in valuing, say, a retail business. Similarly, for a technology company, factors such as technological disruption, software licensing, and network effects are crucial.

Incorporating these factors might involve adjusting the discount rate to reflect industry-specific risk, modifying the growth rate assumptions to reflect realistic market trends, or using industry-specific multiples in a comparable company analysis. I might also build specific adjustments into the financial projections to reflect expected industry changes, such as anticipated market consolidation or increased regulatory scrutiny. The ultimate goal is to make the valuation reflect the industry’s unique challenges and opportunities, leading to a more accurate valuation.

Q 25. Describe your experience using regression analysis in valuation.

Regression analysis is a powerful statistical tool I use extensively in valuation. It helps me quantify the relationship between variables, particularly in comparable company analysis. Imagine you’re trying to determine the price of a specific house. Regression analysis allows you to examine the relationship between the house’s features (size, location, number of bedrooms, etc.) and its sale price using data from similar houses. Based on that relationship, you can estimate the value of your house.

In valuation, I frequently use regression to determine appropriate multiples for a comparable company analysis. For instance, I might regress enterprise value (EV) to EBITDA (earnings before interest, taxes, depreciation, and amortization) for a group of comparable companies. The resulting regression equation allows me to estimate the appropriate EV/EBITDA multiple for the target company, based on its own EBITDA.

Example: EV = β0 + β1*EBITDA + ε Where β0 is the intercept, β1 is the coefficient reflecting the relationship between EV and EBITDA, and ε is the error term. I’ll use statistical software such as Stata or R to perform this regression, carefully considering assumptions like the linear relationship, independence of errors, etc. The output provides not only the multiple but also statistical measures of significance and uncertainty, which are vital for robust valuation.

Q 26. How do you handle uncertainty and variability in your valuation models?

Uncertainty and variability are inherent in any valuation. Ignoring them results in a flawed and potentially misleading valuation. My approach is to explicitly incorporate uncertainty and variability throughout the valuation process, rather than treating them as an afterthought.

One common approach is Monte Carlo simulation. This involves randomly sampling from probability distributions for key inputs (like growth rates or discount rates), running the valuation model many times, and analyzing the distribution of resulting valuations. This provides a range of possible outcomes, highlighting the uncertainty. Imagine rolling a die multiple times to figure out potential outcomes. It’s the same principle.

Another approach is sensitivity analysis (as discussed earlier), where we systematically change key inputs to observe their impact on the valuation. Finally, I often use scenario planning, where I create different scenarios (e.g., optimistic, base case, pessimistic) reflecting different plausible outcomes and use this to estimate the range of plausible values. The outputs from these different methods are then combined to provide a comprehensive picture of the uncertainty surrounding the valuation. Transparent reporting of this uncertainty is crucial for informed decision-making.

Q 27. Explain your understanding of real options and how they affect valuation.

Real options are valuable managerial flexibilities that a company may have. These options influence valuation because they provide the business with opportunities to modify its future actions based on market developments. Think of them as ‘options’ to act, similar to financial options but relating to real-world projects or investments. They can significantly enhance a business’s value.

Examples of real options include the option to expand operations, the option to abandon a project, the option to delay an investment, or the option to switch production methods. Valuing these options requires specialized techniques, often using option pricing models, which often rely on the Black-Scholes model or binomial tree. These models take into account the time value of money, risk and volatility, and the likelihood of exercising the option.

Incorporating real options requires careful consideration of the potential scenarios under which these options might be exercised. For example, in valuing an oil exploration company, we might factor in the option to abandon a project if initial test results are poor. Ignoring this option would underestimate the true value of the company because it would not include the flexibility to avoid future losses. Real options analysis adds a significant layer of complexity to the valuation but can significantly increase the accuracy of the assessment, especially in industries with significant uncertainty.

Q 28. What are your strengths and weaknesses related to economic valuation?

My strengths lie in my comprehensive understanding of various valuation methodologies (DCF, comparable company analysis, precedent transactions), my proficiency in quantitative techniques (regression analysis, Monte Carlo simulation), and my ability to communicate complex valuation concepts clearly and effectively to both technical and non-technical audiences. I’m adept at adapting my approach to different industries and situations, and I’m committed to producing rigorous and reliable valuations.

My area for continued development is expanding my knowledge of specific regulatory environments within specialized industries. While I can adapt to any regulatory framework presented, deepening my expertise in specific areas like the energy sector or healthcare valuations would enhance my ability to conduct even more nuanced valuations in those areas. I’m currently working on improving this through targeted training and increased interaction with experts in these fields.

Key Topics to Learn for Economic Valuation Interview

- Discounted Cash Flow (DCF) Analysis: Understand the core principles, including calculating terminal value, handling risk and uncertainty, and applying different valuation models (e.g., WACC, APV).

- Comparable Company Analysis (CCA): Learn how to select comparable firms, adjust financial metrics for differences, and understand the limitations of this approach.

- Precedent Transactions Analysis: Master the process of identifying relevant acquisitions, adjusting transaction multiples for deal-specific factors, and interpreting the results.

- Real Options Analysis: Grasp the concepts of embedded options (e.g., expansion, abandonment) and how to incorporate them into valuation models.

- Sensitivity Analysis & Scenario Planning: Develop strong skills in analyzing the impact of key assumptions and variables on valuation outcomes.

- Asset Valuation: Understand the methods for valuing different asset classes, including intangible assets and intellectual property.

- Regulatory and Legal Considerations: Become familiar with relevant accounting standards and legal frameworks impacting economic valuation.

- Practical Application: Prepare to discuss real-world examples where you applied economic valuation techniques (e.g., investment decisions, M&A processes, regulatory compliance). Be ready to explain your thought process and problem-solving approach.

- Advanced Topics (for senior roles): Explore areas like contingent claims analysis, option pricing models (Black-Scholes), and econometric techniques for valuation.

Next Steps

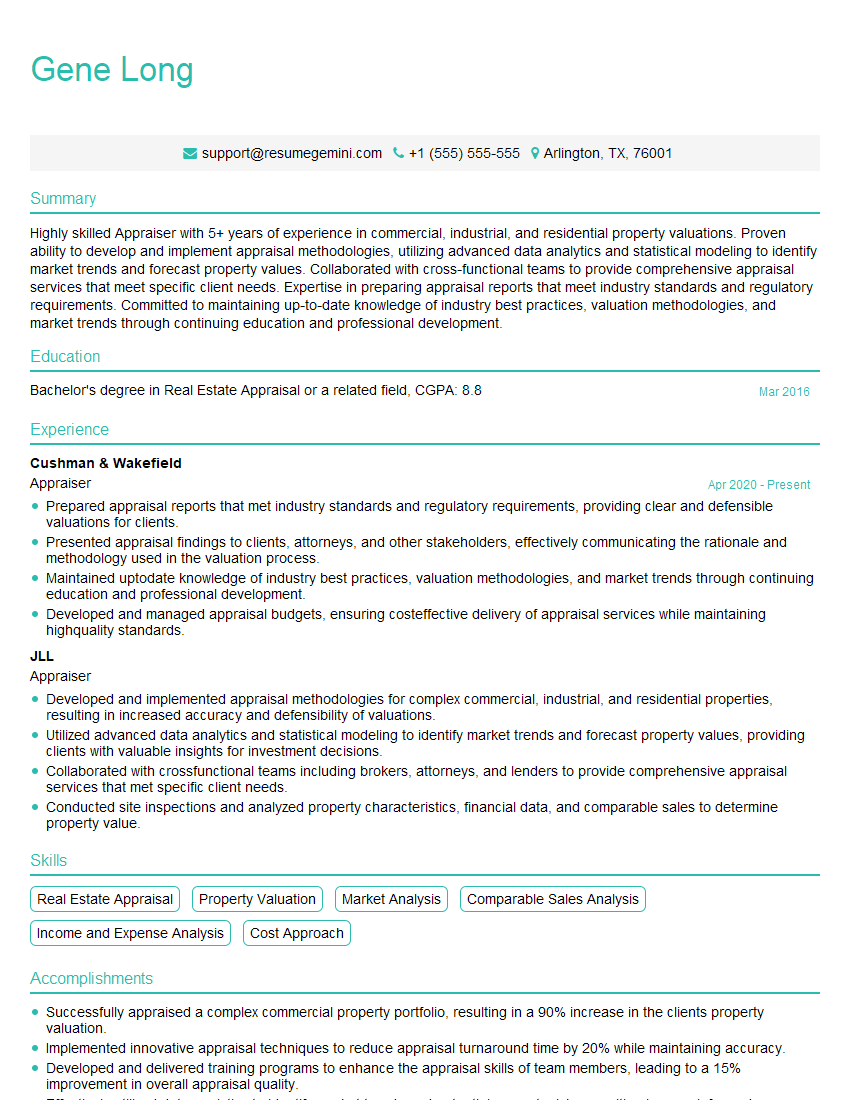

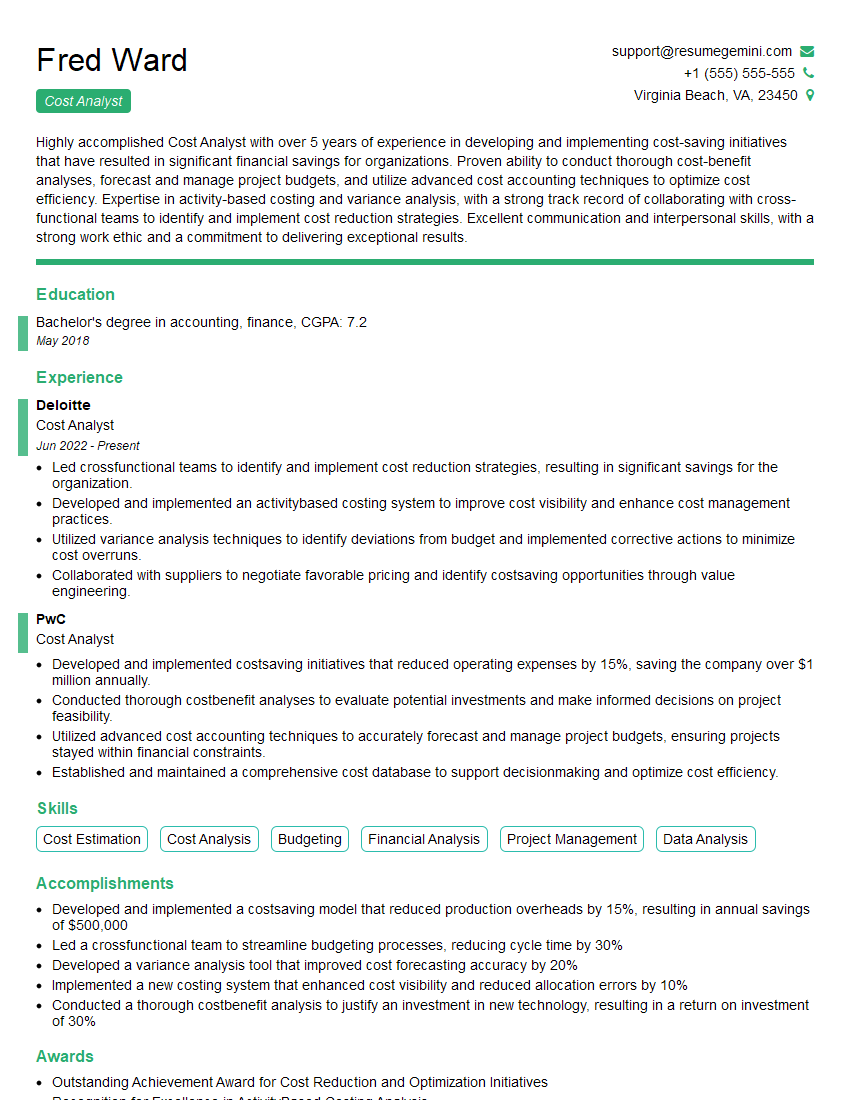

Mastering economic valuation is crucial for career advancement in finance, consulting, and related fields. A strong understanding of these techniques will significantly enhance your analytical skills and decision-making capabilities, opening doors to exciting opportunities. To maximize your job prospects, create an ATS-friendly resume that effectively highlights your skills and experience. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. Examples of resumes tailored to Economic Valuation are available to help you get started.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.