Interviews are more than just a Q&A session—they’re a chance to prove your worth. This blog dives into essential Knowledge of International Economics and Trade Law interview questions and expert tips to help you align your answers with what hiring managers are looking for. Start preparing to shine!

Questions Asked in Knowledge of International Economics and Trade Law Interview

Q 1. Explain the theory of comparative advantage.

The theory of comparative advantage, a cornerstone of international trade, explains why countries benefit from specializing in producing and exporting goods and services they can produce relatively more efficiently, even if they’re not absolutely more efficient in producing everything. It’s not about being the *best* at producing something, but about being *relatively better* compared to other goods.

Imagine two countries, Country A and Country B, both capable of producing apples and oranges. Country A might be better at producing *both* apples and oranges, producing more of each with the same resources. However, if Country A is significantly better at producing apples compared to oranges (relative to Country B), it makes more economic sense for Country A to specialize in apple production and trade apples for oranges with Country B, even if Country B is better at oranges. This is because specializing allows both countries to produce more goods overall and consume outside their production possibility frontiers. This specialization leverages each country’s relative efficiency, leading to higher overall output and greater consumption for both.

Example: Let’s say Country A can produce 10 apples or 5 oranges with its resources, while Country B can produce 6 apples or 3 oranges. Country A has an absolute advantage in both. However, Country A’s opportunity cost of producing one orange is 2 apples (10 apples / 5 oranges), while Country B’s is 2 apples (6 apples / 3 oranges). Both opportunity costs are equal, meaning there’s no comparative advantage. But if we adjust the numbers: Country A can produce 10 apples or 2 oranges, and Country B can produce 6 apples or 3 oranges. Now Country A has a comparative advantage in apples (its opportunity cost of producing an orange is 5 apples, much higher than B’s 2 apples), and Country B has a comparative advantage in oranges (its opportunity cost of producing an apple is 0.5 oranges, lower than A’s 0.2 oranges). Specialization and trade would benefit both.

Q 2. Describe the different types of trade barriers.

Trade barriers are government-imposed restrictions on international trade. They aim to protect domestic industries but often lead to higher prices and reduced consumer choice. They can be broadly classified into:

- Tariffs: Taxes imposed on imported goods, making them more expensive for consumers and thus less competitive with domestic products. Examples include specific tariffs (a fixed amount per unit) and ad valorem tariffs (a percentage of the good’s value).

- Non-Tariff Barriers (NTBs): These are more subtle and diverse, including:

- Quotas: Numerical limits on the quantity of a specific good that can be imported.

- Embargoes: Complete bans on the import or export of specific goods, often for political reasons.

- Sanctions: Similar to embargoes, but usually targeting specific countries or entities.

- Technical Barriers to Trade (TBTs): Regulations on product standards, labeling, and testing procedures that can make it difficult for foreign goods to enter a market. This can include safety regulations, environmental standards, or health requirements.

- Sanitary and Phytosanitary (SPS) Measures: Regulations to protect human, animal, and plant health. While intended to be scientifically justified, they can also be used as trade barriers.

- Subsidies: Government financial assistance to domestic producers, making their goods artificially cheaper and more competitive against imports.

For example, a country might impose tariffs on imported steel to protect its domestic steel industry. Or, it might set quotas on imported textiles to limit competition for local producers. NTBs are often harder to identify and quantify than tariffs, as they’re often embedded in complex regulations.

Q 3. What are the key functions of the World Trade Organization (WTO)?

The World Trade Organization (WTO) is an intergovernmental organization regulating international trade and overseeing the implementation of various trade agreements. Its key functions include:

- Administering WTO trade agreements: The WTO provides a framework for member countries to negotiate, implement, and monitor trade agreements.

- Acting as a forum for trade negotiations: The WTO facilitates multilateral trade negotiations among its members, aiming to reduce trade barriers and liberalize trade.

- Providing a mechanism for settling trade disputes: The WTO’s Dispute Settlement Body (DSB) provides a system for resolving trade disagreements between member countries, ensuring a rules-based system.

- Providing technical assistance to developing countries: The WTO offers technical assistance and training to help developing countries build capacity in trade policy and negotiation.

- Monitoring national trade policies: The WTO regularly monitors the trade policies of its member countries to ensure compliance with WTO agreements.

In essence, the WTO aims to create a fair, predictable, and non-discriminatory trading system through rules and dispute settlement mechanisms. It strives to ensure that trade flows smoothly, reducing barriers and creating opportunities for all member countries.

Q 4. Explain the concept of dumping in international trade.

Dumping in international trade refers to the practice of exporting goods at a price lower than their normal value in the exporting country. This ‘normal value’ is typically the price charged in the domestic market or a comparable export market. Dumping is often seen as an unfair trade practice because it can harm domestic industries in the importing country by undercutting their prices and potentially driving them out of business. It’s important to note that not all low-priced imports are considered dumping; the key is whether the price is significantly below the normal value, indicating predatory pricing.

Example: A steel producer in Country X might sell steel at a significantly lower price in Country Y than in its domestic market. If this price difference is substantial and demonstrates an intention to harm Country Y’s steel industry, it could be considered dumping. The motivation behind dumping can vary; it might be an attempt to gain market share quickly, to get rid of excess production, or to eliminate competition.

Q 5. How do anti-dumping duties work?

Anti-dumping duties are tariffs imposed by an importing country to counteract the effects of dumping. They aim to level the playing field by raising the price of the dumped goods to their fair market value. The process generally involves the following steps:

- Investigation: The importing country’s government (usually a trade commission or similar body) initiates an investigation to determine whether dumping has occurred and whether it has caused material injury to the domestic industry.

- Determination of dumping: If dumping is found, the investigation establishes the margin of dumping—the difference between the export price and the normal value.

- Determination of injury: The investigation determines whether the dumped imports have caused material injury (substantial damage) to the domestic industry. This often involves examining factors such as lost sales, reduced market share, and depressed prices.

- Imposition of anti-dumping duties: If dumping and material injury are found, the importing country can impose anti-dumping duties on the dumped goods. These duties are typically equal to the margin of dumping. These duties are temporary and are usually subject to review.

The WTO provides rules governing the use of anti-dumping duties, aiming to prevent their use as protectionist measures. The process should be transparent and based on objective evidence, ensuring that the duties only address actual dumping and injury.

Q 6. Describe the impact of trade agreements on national economies.

Trade agreements significantly impact national economies, both positively and negatively. The effects are complex and depend on various factors, including the type of agreement, the participating countries, and the specific industries involved.

- Positive Impacts:

- Increased trade and economic growth: Reducing trade barriers can lead to increased exports, foreign investment, and overall economic growth. Consumers benefit from lower prices and greater choice.

- Specialization and efficiency gains: Trade allows countries to specialize in producing goods and services where they have a comparative advantage, leading to increased efficiency and productivity.

- Technological transfer and innovation: Trade facilitates the transfer of technology and knowledge across borders, spurring innovation and economic development.

- Increased competition: Increased competition from imports can force domestic firms to become more efficient and innovative.

- Negative Impacts:

- Job displacement in certain sectors: Increased imports can lead to job losses in industries that cannot compete with foreign producers.

- Increased vulnerability to external shocks: Greater dependence on international trade can make economies more vulnerable to global economic fluctuations.

- Environmental concerns: Increased production and transportation associated with trade can raise environmental concerns.

- Potential exploitation of workers in developing countries: Some trade agreements may lead to concerns about labor standards and worker exploitation in countries with less stringent regulations.

For example, the North American Free Trade Agreement (NAFTA), later replaced by USMCA, initially led to increased trade among the US, Canada, and Mexico. While this stimulated some sectors, it also led to job displacement in certain industries in the US and potential exploitation of workers in Mexico. Therefore, careful policy design and supportive measures are crucial to mitigating negative impacts while maximizing benefits.

Q 7. What are the key principles of the General Agreement on Tariffs and Trade (GATT)?

The General Agreement on Tariffs and Trade (GATT), the predecessor to the WTO, was based on several key principles:

- Most-favored-nation (MFN) treatment: This principle requires that each member country grant the same trade concessions (tariff reductions, etc.) to all other member countries. It prevents discrimination among trading partners.

- National treatment: Imported goods should be treated no less favorably than domestically produced goods once they enter the market. This prevents discriminatory treatment after goods have crossed the border.

- Transparency: Member countries are required to publish their trade policies and regulations, making them transparent to other countries.

- Reciprocity: Trade concessions are typically granted on a reciprocal basis, meaning that countries negotiate tariff reductions in exchange for similar concessions from other countries.

- Dispute settlement: While less formal than the WTO’s DSB, GATT provided a mechanism for resolving trade disputes between member countries.

These principles aimed to create a more stable and predictable international trading system by reducing trade barriers and promoting fairness and non-discrimination. While GATT was successful in reducing tariffs, it had limitations in addressing non-tariff barriers, prompting the creation of the WTO to address this and other shortcomings.

Q 8. Explain the role of regional trade agreements (RTAs) in global trade.

Regional Trade Agreements (RTAs) are agreements between two or more countries in a geographic region to reduce or eliminate trade barriers among themselves. They play a significant role in shaping global trade by creating preferential trading arrangements that go beyond the commitments made under the World Trade Organization (WTO).

How RTAs impact global trade:

- Increased Trade Volume: By lowering tariffs and non-tariff barriers, RTAs stimulate trade within the region. This is because goods and services can move more freely and at lower cost.

- Foreign Direct Investment (FDI): The enhanced market access and predictable regulatory environment offered by RTAs attract FDI, leading to economic growth and job creation within participating countries.

- Economic Integration: RTAs can pave the way for deeper economic integration, including harmonization of standards, regulations, and policies. This can lead to greater efficiency and competitiveness.

- Spillover Effects: While RTAs primarily benefit participating members, they can also have positive spillover effects on non-member countries through increased trade and investment.

- Negotiating Power: RTAs can enhance the negotiating power of participating countries when engaging in multilateral trade negotiations within the WTO.

Example: The European Union (EU) is a prime example of a successful RTA. It has significantly boosted intra-EU trade and fostered economic integration among its member states. The North American Free Trade Agreement (NAFTA), now replaced by USMCA, also demonstrates the impact of RTAs on trade volumes and investment flows.

Q 9. What are the challenges in enforcing international trade rules?

Enforcing international trade rules presents several challenges. The WTO’s dispute settlement system, while robust, faces limitations.

- Sovereign Immunity: Countries are largely immune from legal action in foreign courts, making it difficult to enforce rulings against unwilling nations.

- Retaliation and Countermeasures: The threat of retaliatory measures by a non-compliant country can deter enforcement efforts. It is a complex balancing act to ensure compliance without triggering trade wars.

- Lack of Enforcement Mechanisms: While the WTO can authorize sanctions, their effectiveness depends on the willingness of member states to implement them. Enforcement relies heavily on the cooperation and diplomatic pressure from other countries.

- Complexity of Rules: International trade rules are intricate and often subject to different interpretations, leading to disputes about compliance.

- Political Considerations: Political factors frequently influence trade decisions, sometimes overriding legal considerations. Domestic political priorities often impact willingness to comply with international obligations.

Example: The ongoing trade disputes between the US and China illustrate the difficulties in enforcing international trade rules. Despite WTO rulings, both countries have employed various measures to protect their domestic industries, highlighting the limits of the system’s enforcement power.

Q 10. Discuss the impact of globalization on international trade.

Globalization, the increasing interconnectedness of nations through trade, technology, and finance, has profoundly impacted international trade.

- Increased Trade Volumes: Globalization has led to a dramatic increase in the volume and value of global trade, facilitated by reduced transportation costs and technological advancements.

- Shift in Production Patterns: Global value chains (GVCs) have emerged, with production processes fragmented across multiple countries. This allows firms to specialize in specific tasks and take advantage of comparative advantages.

- Rise of Multinational Corporations (MNCs): MNCs play a crucial role in global trade, facilitating cross-border investment and the transfer of technology and know-how.

- Increased Competition: Globalization has intensified competition among firms, encouraging innovation and efficiency improvements.

- Job Creation and Relocation: While globalization creates jobs in some sectors and regions, it also leads to job losses in others due to shifting production patterns.

Example: The rise of China as a global manufacturing powerhouse is a clear manifestation of globalization’s impact on international trade. Its integration into the global economy has dramatically altered production patterns and trade flows.

Q 11. Explain the differences between free trade and protectionism.

Free trade and protectionism represent opposing approaches to international trade.

- Free Trade: Advocates for minimal government intervention in trade. It emphasizes the benefits of comparative advantage, arguing that countries should specialize in producing goods and services in which they are most efficient. This leads to lower prices, greater consumer choice, and enhanced overall economic welfare. Examples include the WTO’s principles of non-discrimination and market liberalization.

- Protectionism: Involves government intervention to protect domestic industries from foreign competition. This can take various forms, including tariffs, quotas, subsidies, and other trade barriers. Protectionist policies aim to shield domestic jobs, promote national security, or safeguard infant industries, but often come at the cost of reduced consumer welfare and efficiency losses.

Key Difference: The core difference lies in the role of government intervention. Free trade advocates for minimal interference, while protectionism embraces government intervention to shield domestic industries.

Example: The US steel industry has historically received protectionist measures, while many countries actively pursue free trade agreements to reduce trade barriers.

Q 12. What are the economic effects of tariffs?

Tariffs, taxes imposed on imported goods, have several economic effects.

- Increased Prices for Consumers: Tariffs directly increase the price of imported goods, reducing consumer surplus (the difference between what consumers are willing to pay and what they actually pay).

- Reduced Consumption: Higher prices due to tariffs lead to a decrease in the quantity demanded of imported goods.

- Increased Domestic Production: By making imported goods more expensive, tariffs protect domestic producers, allowing them to increase production and potentially capture a larger market share.

- Potential for Trade Wars: Tariffs can provoke retaliatory measures from other countries, leading to trade wars that harm all participants.

- Government Revenue: The government collects revenue from tariffs, which can be used to fund public services or reduce other taxes.

Example: The imposition of tariffs on imported steel can lead to higher steel prices for US consumers and businesses, increased production by US steel mills, and potential retaliation from steel-exporting countries.

Q 13. How does trade affect income distribution within a country?

Trade significantly impacts income distribution within a country.

- Winners and Losers: Trade liberalization, while beneficial overall, creates winners and losers. Workers in industries facing increased foreign competition may experience job losses or wage reductions, while workers in export-oriented sectors may see increased wages and employment.

- Skill-Biased Technological Change: Globalization and trade often lead to skill-biased technological change, favoring workers with higher skills and education while potentially disadvantaging those with lower skills.

- Regional Disparities: The impact of trade can vary across regions within a country, with some areas benefiting more than others. Regions specializing in industries facing stiff import competition may experience economic decline.

- Income Inequality: The distributional effects of trade can contribute to increased income inequality. Policies aimed at mitigating these effects often involve social safety nets, retraining programs, and investments in education.

Example: The decline of the US manufacturing sector due to competition from countries with lower labor costs has disproportionately affected workers in manufacturing-intensive regions, contributing to regional economic disparities and income inequality.

Q 14. Discuss the role of intellectual property rights in international trade.

Intellectual Property Rights (IPRs) play a crucial role in international trade by protecting the rights of creators and innovators.

- Promoting Innovation: IPRs, including patents, trademarks, and copyrights, provide incentives for innovation by granting exclusive rights to creators and inventors. This encourages investment in research and development (R&D) and the creation of new technologies and products.

- Facilitating Technology Transfer: IPRs can facilitate the transfer of technology across borders through licensing agreements and other contractual arrangements.

- Enhancing Competitiveness: Protection of IPRs enhances the competitiveness of firms that invest heavily in R&D and innovation. They can use their intellectual property to create new markets and generate economic value.

- Trade Disputes: Differences in IPR protection standards can lead to trade disputes between countries. The WTO’s Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) aims to harmonize IPR standards globally.

Example: Pharmaceutical companies rely heavily on patent protection to recoup the high costs associated with developing new drugs. Strong IPR protection encourages pharmaceutical innovation but can also lead to higher drug prices in countries with weak enforcement mechanisms.

Q 15. What are the challenges of managing global supply chains?

Managing global supply chains presents a multitude of challenges in today’s interconnected world. Think of it like orchestrating a complex symphony – each instrument (supplier, manufacturer, distributor, retailer) must play its part perfectly, and in perfect harmony, for the final product to arrive on time and in perfect condition. These challenges can be broadly categorized into:

- Geopolitical Risks: Political instability, trade wars (like the US-China trade war), and protectionist policies can disrupt supply routes and increase costs. For example, a sudden political upheaval in a key manufacturing hub can halt production and delivery.

- Supply Chain Disruptions: Natural disasters, pandemics (like COVID-19), and unforeseen events can severely impact the flow of goods. The pandemic highlighted the fragility of ‘just-in-time’ inventory models, leading to shortages and delays globally.

- Logistics and Transportation: Managing the complex logistics of moving goods across borders involves navigating customs regulations, port congestion, and fluctuating transportation costs (fuel prices, shipping container availability). A single port strike can have ripple effects across entire industries.

- Visibility and Transparency: Lack of transparency across the supply chain makes it difficult to track goods, monitor quality, and respond effectively to disruptions. Knowing where your products are at every stage of the journey is crucial for efficient management.

- Sustainability Concerns: Increasingly, businesses face pressure to ensure their supply chains are environmentally and socially responsible. This involves tracking carbon emissions, promoting fair labor practices, and sourcing materials sustainably.

- Technology Integration: Effective supply chain management requires sophisticated technology, including inventory management systems, blockchain for traceability, and AI for predictive analytics. Investing in and integrating these tools is crucial but can be expensive and complex.

Successfully navigating these challenges requires proactive risk management, robust contingency planning, strong supplier relationships, and a commitment to technological innovation. It’s about building resilience and adaptability into the entire supply chain.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain the concept of trade liberalization.

Trade liberalization refers to the removal or reduction of barriers to international trade. Think of it as opening the doors and windows of a house to allow free airflow. These barriers, which can stifle economic growth, include:

- Tariffs: Taxes imposed on imported goods.

- Quotas: Restrictions on the quantity of goods that can be imported.

- Non-tariff barriers: Regulations, standards, and administrative procedures that make it more difficult or expensive to import goods (e.g., complex customs procedures, sanitary and phytosanitary regulations).

Liberalization aims to create a more efficient and competitive global market by allowing countries to specialize in producing goods and services where they have a comparative advantage. This leads to lower prices for consumers, greater variety of goods, and increased economic growth. The World Trade Organization (WTO) plays a crucial role in promoting trade liberalization through multilateral negotiations and dispute settlement mechanisms. However, it’s important to note that complete liberalization isn’t always feasible or desirable, as it can lead to job losses in certain sectors and potentially harm domestic industries.

Example: The reduction of tariffs on agricultural products under the WTO’s Doha Development Round aimed to benefit developing countries by increasing their access to global markets. However, concerns about the impact on domestic farmers in developed countries led to significant challenges in reaching a consensus.

Q 17. Describe the different types of currency exchange rate regimes.

Currency exchange rate regimes describe how a country manages its currency’s value relative to other currencies. There are several key types:

- Fixed Exchange Rate: The currency’s value is pegged to another currency or a basket of currencies at a predetermined rate. The central bank intervenes in the foreign exchange market to maintain this fixed rate. Examples include countries that peg their currency to the US dollar.

- Floating Exchange Rate: The currency’s value is determined by market forces (supply and demand) with minimal government intervention. The exchange rate fluctuates freely based on economic factors, trade balances, and investor sentiment. Most major economies, such as the US, EU, and Japan, have floating exchange rate regimes.

- Managed Float: A hybrid system where the currency’s value is primarily determined by market forces, but the central bank intervenes periodically to manage excessive volatility or achieve specific policy objectives (e.g., to prevent rapid appreciation or depreciation).

- Currency Board: A more rigid system where the domestic currency is backed by a foreign currency at a fixed exchange rate. The central bank’s ability to create money is limited by its foreign currency reserves.

The choice of exchange rate regime depends on a country’s economic circumstances, its policy objectives, and its level of integration into the global economy.

Q 18. How does exchange rate fluctuation affect international trade?

Exchange rate fluctuations significantly impact international trade. Think of it like this: if the value of your currency rises, your exports become more expensive for foreign buyers, and your imports become cheaper. Conversely, if your currency falls, your exports become cheaper, and your imports become more expensive.

- Impact on Exports: A weaker domestic currency makes exports more competitive in the global market, boosting demand and potentially leading to increased exports. However, a stronger currency can make exports less competitive, reducing demand.

- Impact on Imports: A stronger domestic currency makes imports cheaper, benefiting consumers but potentially hurting domestic producers competing with imports. A weaker currency makes imports more expensive, potentially leading to inflation.

- Impact on Businesses: Businesses involved in international trade need to manage exchange rate risk, using hedging techniques (e.g., forward contracts, options) to mitigate potential losses from unfavorable currency fluctuations. Unexpected changes can significantly affect profitability.

- Impact on Trade Balances: Exchange rate changes can influence a country’s trade balance (the difference between exports and imports). A weaker currency can improve the trade balance by increasing exports and reducing imports, although this effect is not always guaranteed.

Therefore, businesses and governments need to carefully consider exchange rate volatility when making decisions about international trade and investment.

Q 19. Explain the role of international financial institutions in trade.

International financial institutions (IFIs) play a crucial role in facilitating and regulating international trade. They act as key players in the global financial system, fostering economic growth and development.

- International Monetary Fund (IMF): The IMF promotes international monetary cooperation, exchange rate stability, and provides financial assistance to countries facing balance of payments problems. It also provides policy advice and technical assistance to member countries.

- World Bank Group: The World Bank provides loans and grants to developing countries for various development projects, including infrastructure development, poverty reduction, and economic growth. This indirectly supports trade by improving a country’s infrastructure and productive capacity.

- World Trade Organization (WTO): The WTO’s primary role is to administer existing trade agreements, act as a forum for trade negotiations, and settle trade disputes between member countries. It works to create a more stable and predictable trading environment.

- Regional Development Banks: Regional development banks (e.g., the Asian Development Bank, the Inter-American Development Bank) focus on financing development projects within specific regions, often with a focus on infrastructure and trade facilitation.

These IFIs help manage the complexities of international trade by providing financial resources, technical assistance, and a framework for resolving trade disputes. Their actions affect the global trading environment by promoting stability, facilitating investments, and reducing uncertainty for businesses engaged in international commerce.

Q 20. Discuss the impact of trade on environmental sustainability.

The relationship between trade and environmental sustainability is complex and multifaceted. While trade can drive economic growth and potentially improve environmental outcomes through technology transfer and access to cleaner technologies, it can also exacerbate environmental problems.

- Positive Impacts: Trade can facilitate the diffusion of environmentally friendly technologies and practices. For example, countries might import renewable energy technologies or adopt sustainable agricultural practices through trade agreements.

- Negative Impacts: Increased trade can lead to higher levels of pollution and resource depletion, especially if it involves the production and consumption of goods with high environmental footprints. The transportation of goods also contributes to greenhouse gas emissions. Furthermore, the ‘race to the bottom’ – where companies move production to countries with lax environmental regulations – can undermine environmental protection efforts globally.

- Mitigation Strategies: To address the negative environmental impacts of trade, policies such as carbon tariffs, environmental regulations, and international cooperation are vital. Promoting sustainable consumption patterns is also crucial. The implementation of green trade agreements is growing in importance.

Finding a balance between economic growth and environmental sustainability requires a carefully crafted policy approach that integrates environmental considerations into trade policy and promotes sustainable production and consumption patterns.

Q 21. What are the ethical considerations related to international trade?

International trade raises numerous ethical considerations that go beyond purely economic factors. These include:

- Labor Standards: Concerns exist about the exploitation of workers in developing countries where labor standards are weak. Companies may relocate production to countries with lower wages and less stringent labor laws, leading to sweatshops and unfair labor practices.

- Environmental Concerns: As mentioned earlier, trade can exacerbate environmental damage if not managed responsibly. Companies might prioritize profits over environmental protection, leading to pollution and resource depletion.

- Human Rights: Trade can be linked to human rights abuses in certain contexts. For instance, the sourcing of conflict minerals or the use of forced labor in supply chains raises serious ethical concerns.

- Fair Trade Practices: The question of fair pricing and equitable distribution of benefits arises, particularly in relation to agricultural products. Small farmers in developing countries may receive low prices for their goods, while consumers in developed countries benefit from low prices.

- Cultural Impacts: The globalization of trade can lead to the homogenization of cultures, potentially threatening local traditions and cultural diversity. Protection of cultural heritage in the face of globalization is a complex issue.

Addressing these ethical concerns requires a multi-pronged approach involving corporate social responsibility, stronger international regulations, consumer awareness, and fair trade initiatives. Ultimately, a balance must be found between promoting economic growth and upholding ethical standards in international trade.

Q 22. Describe the different dispute settlement mechanisms under the WTO.

The World Trade Organization (WTO) provides a robust dispute settlement system to resolve trade conflicts between member countries. It’s designed to be a rules-based system, ensuring predictability and fairness in international trade. The process generally follows these steps:

Consultations: The first step involves bilateral consultations between the disputing parties. This is an attempt to resolve the issue amicably before escalating the matter.

Panel Establishment: If consultations fail, a panel of experts is established by the WTO to examine the case and make a ruling. These experts are usually trade law specialists from various countries.

Panel Report: The panel conducts an investigation and issues a report, detailing its findings and recommendations. This report is circulated to all WTO members.

Appellate Body Review: Either party can appeal the panel’s decision to the Appellate Body, the WTO’s highest judicial body. The Appellate Body’s decision is binding.

Implementation: The losing party is expected to implement the ruling. If they fail to do so, the winning party can be authorized to take retaliatory measures, such as imposing tariffs.

For example, a dispute might arise if one country claims another is unfairly subsidizing its domestic industry, resulting in an injury to the complaining country’s producers. The WTO dispute settlement system allows for a structured process to address such complaints and hopefully find a solution. It’s important to note that the system isn’t perfect, and there have been instances of delays and challenges in enforcing rulings, particularly related to the Appellate Body’s functionality in recent years.

Q 23. How does trade policy impact developing countries?

Trade policy has a profound and multifaceted impact on developing countries. It can be a powerful engine for growth, but it can also exacerbate existing inequalities if not managed effectively. The effects are complex and depend on many factors, such as the country’s specific economic structure, its trade partners, and the policies it adopts.

Positive Impacts: Opening up to trade can provide access to larger markets for developing countries’ exports, leading to increased economic growth, job creation, and technological advancements. Competition from foreign firms can also incentivize domestic industries to improve efficiency and productivity. Importantly, access to cheaper goods can increase consumer welfare.

Negative Impacts: However, developing countries can also face challenges. They might experience increased competition from more developed economies, potentially leading to job losses in certain sectors. They may also be vulnerable to unfair trade practices, such as dumping (selling goods below cost) and predatory pricing. Additionally, if a developing country’s economy is heavily reliant on a few export commodities, fluctuations in global commodity prices can have significant negative effects.

Consider the case of countries heavily dependent on agricultural exports. Fluctuations in global agricultural prices directly impact their income and economic stability. Similarly, if a developing country lacks the infrastructure or education to adapt to increased global competition, it may experience negative consequences, highlighting the crucial role of supportive domestic policies alongside trade liberalization.

Q 24. Explain the concept of foreign direct investment (FDI).

Foreign Direct Investment (FDI) refers to an investment made by a company or individual in a foreign country to gain control or influence over an existing business or to create a new business. This is distinct from portfolio investment, which involves buying stocks or bonds without gaining managerial control. FDI typically involves long-term commitments and a significant degree of risk, but it also offers potentially higher returns. Examples include building a new factory in a foreign country, acquiring a foreign company, or establishing a joint venture.

Think of it like this: If a US company builds a car manufacturing plant in Mexico, that’s FDI. The US company is directly investing in Mexico’s economy and establishing a physical presence there. It’s not just investing in Mexican stocks; it’s actively participating in Mexican production and employment.

Q 25. What are the benefits and costs of FDI for host countries?

FDI can offer significant benefits and costs for host countries.

Benefits: FDI can bring in capital, technology, and expertise, boosting economic growth. It can also create jobs, improve infrastructure, and increase tax revenues for the government. Furthermore, FDI can enhance competition in the domestic market, leading to lower prices and better quality goods and services for consumers. Increased export capabilities are often a beneficial byproduct of FDI.

Costs: However, FDI can also lead to negative consequences. There’s the risk of exploitation of local resources and labor, particularly if the host country lacks strong environmental regulations or labor laws. Profits earned by foreign firms may be repatriated to their home countries, leading to capital outflow. Moreover, FDI can potentially stifle the growth of local businesses if they are unable to compete effectively with multinational corporations. Dependence on foreign investment can also create vulnerabilities for the host country’s economy.

For instance, a developing country might attract FDI in its mining sector, leading to job creation and increased tax revenue. However, if the mining company doesn’t adhere to strict environmental standards, it could damage the local ecosystem, creating long-term costs. The successful integration of FDI requires careful policy design and regulation to maximize its benefits while mitigating the potential downsides.

Q 26. How does trade affect national security?

International trade has a complex and often overlooked relationship with national security. While trade can promote economic growth and interdependence, which may decrease the likelihood of conflict, it can also create vulnerabilities and dependencies that could be exploited by adversaries.

Positive Impacts: Trade can foster economic interdependence and stronger diplomatic ties, reducing the incentive for conflict between nations. Stronger economies, facilitated by trade, can also strengthen a country’s ability to defend itself.

Negative Impacts: Over-reliance on foreign suppliers for critical goods (e.g., essential medicines, semiconductors, or rare earth minerals) can create vulnerabilities during times of geopolitical tension or conflict. This can be especially true if these imports come from potentially hostile nations. A sudden disruption in trade flows could cripple crucial sectors. Trade deficits can also create economic dependence, undermining national sovereignty.

For example, a nation heavily reliant on a single foreign supplier for a critical military component may be at a disadvantage if relations with that supplier deteriorate. A balanced approach to trade is crucial, aiming to leverage its economic benefits while mitigating potential security risks through diversification of supply chains and investing in domestic capabilities.

Q 27. Discuss the impact of Brexit on international trade.

Brexit, the United Kingdom’s withdrawal from the European Union, has had a significant impact on international trade. The UK and EU established a new trade agreement to avoid tariffs and quotas on most goods but this agreement introduced new customs procedures and non-tariff barriers.

Increased Trade Costs: Brexit has led to increased trade costs and administrative burdens for businesses trading between the UK and the EU. New customs checks, declarations, and inspections have added complexity and time delays, affecting supply chains and increasing prices for consumers.

Reduced Trade Volumes: Trade volumes between the UK and EU have decreased since Brexit, although it is difficult to isolate the impact of Brexit from other factors such as the global pandemic. This reduction has been particularly noticeable in certain sectors.

New Trade Relationships: The UK has been seeking to establish new trade deals with countries outside the EU, although the scope and impact of these agreements are still developing. The UK is aiming to establish itself as a significant player in global trade, independent of the EU’s trade policy.

Brexit serves as a cautionary tale of the potential complexities and unforeseen consequences of leaving a large and well-integrated trading bloc. The long-term impacts are still unfolding, and their full extent remains to be seen.

Q 28. Explain the concept of trade sanctions.

Trade sanctions are restrictions imposed by one or more countries on another country’s trade, typically as a form of economic punishment or pressure. They aim to achieve certain political or economic objectives by limiting or prohibiting trade, investment, or financial transactions. Sanctions can range from targeted measures against specific individuals or entities to broader restrictions on entire sectors or the country’s economy as a whole.

Types of Sanctions: Sanctions can take many forms, including:

- Embargoes: A complete ban on trade with a specific country.

- Tariffs: Taxes on imported goods, making them more expensive.

- Quotas: Limits on the quantity of goods that can be imported.

- Financial Sanctions: Restrictions on financial transactions, such as freezing assets or prohibiting lending.

- Export Controls: Restrictions on the export of certain goods or technologies.

Objectives: Trade sanctions are often used to:

- Pressure a country to change its behavior on issues like human rights, nuclear proliferation, or terrorism.

- Punish a country for violating international law or agreements.

- Promote specific policy changes within a target country.

The effectiveness of trade sanctions is often debated. While they can put pressure on targeted countries, they can also harm innocent civilians and potentially backfire, leading to unintended negative consequences, including impacting relations between the imposing and affected countries. The sanctions imposed on Russia following its invasion of Ukraine serve as a recent and high-profile example of the use, and complexities, of trade sanctions in international relations.

Key Topics to Learn for Knowledge of International Economics and Trade Law Interview

- International Trade Theory: Understand models like comparative advantage, Heckscher-Ohlin, and gravity models. Be prepared to discuss their implications for trade patterns and policy.

- Trade Policy Instruments: Familiarize yourself with tariffs, quotas, subsidies, anti-dumping measures, and safeguards. Know how these tools are used and their economic effects.

- World Trade Organization (WTO): Master the core principles of the WTO, including its dispute settlement mechanism and key agreements like GATT, GATS, and TRIPS. Be ready to analyze case studies.

- Regional Trade Agreements (RTAs): Understand the dynamics of RTAs like the EU, NAFTA/USMCA, and others. Compare and contrast their structures and impacts on global trade.

- International Investment Law: Explore the legal framework governing foreign direct investment, including dispute resolution mechanisms and investor-state arbitration.

- Trade and Development: Analyze the relationship between international trade and economic development, considering issues like trade liberalization, poverty reduction, and sustainable development goals.

- Trade Remedies and Dispute Resolution: Understand the procedures and legal basis for various trade remedies, and how disputes are resolved within the WTO framework. Consider practical applications of these processes.

- Current Trade Issues: Stay updated on contemporary issues such as trade wars, digital trade, climate change and trade, and the future of the multilateral trading system. Be prepared to discuss your perspective on these challenges.

Next Steps

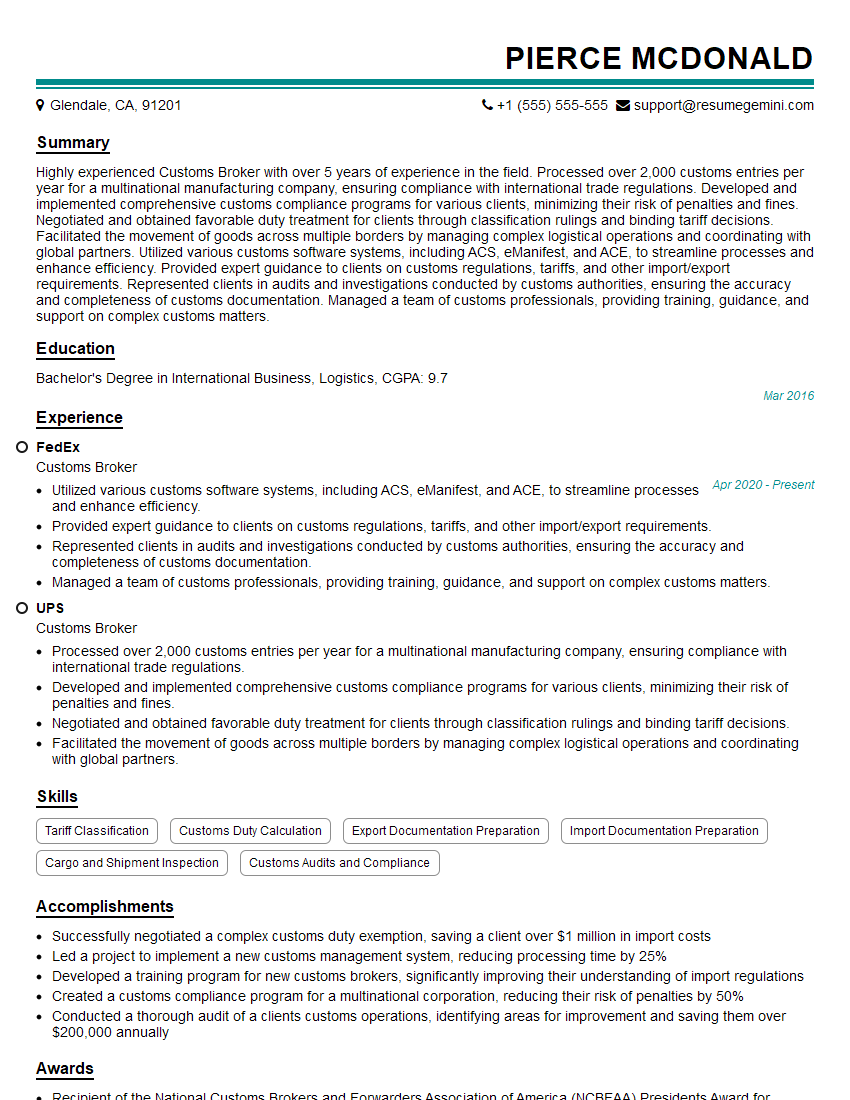

Mastering Knowledge of International Economics and Trade Law is crucial for a successful career in international relations, trade policy, law, and related fields. A strong understanding of these concepts opens doors to exciting opportunities and positions you as a valuable asset in a globalized world. To enhance your job prospects, it’s vital to create a compelling and ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. Leverage its tools and resources to craft a resume that showcases your expertise in Knowledge of International Economics and Trade Law. Examples of resumes tailored to this field are available to further guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.