Are you ready to stand out in your next interview? Understanding and preparing for Tariff and Non-Tariff Barrier Analysis interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Tariff and Non-Tariff Barrier Analysis Interview

Q 1. Define tariffs and non-tariff barriers. Provide three examples of each.

Tariffs and non-tariff barriers are both trade restrictions imposed by governments, but they operate differently. Tariffs are taxes levied on imported goods, increasing their price and making them less competitive with domestically produced goods. Non-tariff barriers, on the other hand, are restrictions that don’t involve taxes but still limit imports. They can be more subtle and harder to identify than tariffs.

Examples of Tariffs:

- A 10% tax on imported steel.

- A $5 fee per imported tire.

- A variable tariff on agricultural products, adjusted based on market prices.

Examples of Non-Tariff Barriers:

- Quotas: Limiting the quantity of a specific good that can be imported. For example, a country might only allow 10,000 tons of rice to be imported each year.

- Embargoes: Complete bans on the import or export of specific goods. For example, an embargo on arms to a specific country.

- Sanitary and Phytosanitary (SPS) regulations: Standards related to food safety and animal and plant health that may be used to restrict imports (discussed further in a later question).

Q 2. Explain the difference between specific and ad valorem tariffs.

The key difference between specific and ad valorem tariffs lies in how the tax is calculated.

Specific tariffs are fixed amounts of money per unit of imported goods. Imagine it like a flat fee. For example, a specific tariff might be $10 per ton of imported sugar, regardless of the sugar’s market price.

Ad valorem tariffs are percentages of the value of the imported goods. This is like a percentage-based fee. A 20% ad valorem tariff on imported cars means a $20,000 car will have a $4,000 tariff added to its price.

The choice between specific and ad valorem tariffs depends on various factors, including the nature of the good, the goal of the tariff, and the potential impact on domestic industries and consumers.

Q 3. How do tariffs impact domestic industries and consumers?

Tariffs have significant impacts on both domestic industries and consumers.

Impact on Domestic Industries: Tariffs generally protect domestic industries by making imported goods more expensive. This increased price can boost demand for domestically produced goods, leading to increased production, higher profits, and potentially more jobs. However, this protection can also lead to inefficiencies if domestic industries become complacent and lack the incentive to innovate or improve their competitiveness.

Impact on Consumers: Consumers face higher prices for imported goods when tariffs are imposed. This reduces purchasing power and can decrease consumer surplus. The higher prices can particularly affect lower-income households who spend a larger proportion of their income on essential goods. Think about how a tariff on imported clothing might affect consumers’ ability to afford clothes.

Q 4. Describe the impact of non-tariff barriers on international trade.

Non-tariff barriers significantly impact international trade by creating obstacles beyond simple taxation. These barriers can reduce the volume of trade, increase costs for importers and exporters, and distort market competition. They can lead to higher prices for consumers and limit consumer choice.

For example, complex customs procedures, lengthy approval processes for product certifications, or stringent import licensing requirements can all create substantial delays and costs, deterring international trade. These barriers also often benefit domestic producers at the expense of foreign competitors, leading to a less efficient allocation of resources globally.

Q 5. What are sanitary and phytosanitary (SPS) measures, and how do they function as non-tariff barriers?

Sanitary and Phytosanitary (SPS) measures are regulations concerning food safety, animal health, and plant health. While designed to protect human, animal, and plant life from pests and diseases, they can function as significant non-tariff barriers to trade.

For example, a country might have strict regulations on the import of meat, requiring specific treatments or certifications that are costly or difficult for exporting countries to meet. Similarly, strict plant quarantine measures could delay or prevent the import of fruits and vegetables if they don’t meet specific pest-free requirements. These measures, although ostensibly aimed at protecting public health and safety, can effectively limit imports and create trade barriers.

The challenge lies in differentiating legitimate health and safety concerns from protectionist measures disguised as SPS regulations. The World Trade Organization (WTO) plays a crucial role in arbitrating disputes related to SPS measures, ensuring that they are science-based and do not unduly restrict trade.

Q 6. Explain the concept of technical barriers to trade (TBT).

Technical Barriers to Trade (TBT) encompass regulations, standards, testing procedures, and conformity assessment procedures that can restrict trade. These measures often focus on product characteristics, such as safety, quality, environmental performance, or interoperability.

Examples include safety standards for automobiles, energy efficiency regulations for appliances, or labeling requirements for food products. While these regulations are often justifiable on grounds of consumer safety, environmental protection, or preventing fraud, they can be used as protectionist measures if they are overly burdensome or discriminate against foreign products. The WTO’s TBT Agreement aims to ensure that technical regulations are not used as disguised trade barriers.

Q 7. How do anti-dumping duties work?

Anti-dumping duties are tariffs imposed on imported goods when they are believed to be ‘dumped’ into a country’s market. Dumping occurs when a foreign producer sells goods in another country at a price lower than its normal value (typically the price in its home market), often to gain market share quickly or eliminate competition.

The process involves an investigation to determine if dumping has indeed occurred and if it has caused material injury to the domestic industry. If both conditions are met, anti-dumping duties are imposed to offset the price difference and level the playing field for domestic producers. However, anti-dumping duties can also be misused as protectionist measures if they are applied unfairly or without sufficient evidence of actual dumping and injury.

Q 8. What are countervailing duties, and when are they imposed?

Countervailing duties (CVDs) are tariffs imposed by a country on imported goods to offset subsidies provided by the exporting country’s government. Essentially, they level the playing field. Imagine a race where one runner is given a head start – the subsidy. CVDs aim to negate that unfair advantage. They’re imposed when a domestic industry demonstrates material injury or threat of material injury caused by subsidized imports. The investigation usually involves a detailed analysis of the subsidy’s existence, its amount, and the injury caused to the domestic industry.

For example, if Country A heavily subsidizes its steel industry, allowing it to sell steel in Country B at artificially low prices, Country B might impose CVDs on imported steel from Country A to protect its own steel producers. The process typically involves a formal investigation by the importing country’s trade authorities, including a review of evidence from both the domestic industry and the exporting firms.

Q 9. Describe the role of the World Trade Organization (WTO) in addressing trade barriers.

The World Trade Organization (WTO) plays a crucial role in addressing trade barriers by providing a forum for negotiating trade agreements and settling trade disputes. Its core function is to ensure a rules-based multilateral trading system. Think of the WTO as a referee in the global trade game, making sure everyone plays by the rules.

The WTO’s Dispute Settlement Body (DSB) is particularly important. If a country believes another country is violating WTO rules by imposing unfair trade barriers, it can bring a case before the DSB. The DSB then works to find a solution, which might involve the offending country removing the barrier or providing compensation to the complaining country. The rulings of the DSB are generally binding, though enforcement can sometimes be challenging.

The WTO also helps facilitate negotiations for reducing trade barriers. For instance, the WTO’s various rounds of negotiations have led to the reduction of tariffs and non-tariff barriers across a wide range of products.

Q 10. Explain the concept of most-favored-nation (MFN) treatment.

Most-favored-nation (MFN) treatment is a cornerstone of the WTO system. It means that a country must treat all WTO members equally. If a country grants a trade advantage (such as a lower tariff) to one WTO member, it must grant the same advantage to all other WTO members. This prevents countries from playing favorites and ensures fair and nondiscriminatory treatment for all.

Imagine a country giving a special discount on its wine exports to one country but not to another. Under MFN, this is not allowed. All countries should receive the same treatment unless there are specific exceptions allowed under WTO rules, such as preferential treatment for developing countries.

Q 11. What are the different methods for analyzing the impact of tariffs on trade flows?

Analyzing the impact of tariffs on trade flows requires various methods, each offering unique insights. The choice of method depends on the specific context and available data.

- Gravity Models: These models estimate trade flows based on factors like the size of the economies involved, their distance, and common language. Adding tariffs as a variable helps assess their impact on trade volumes.

- Partial Equilibrium Models: These models focus on specific markets. They analyze how changes in tariffs affect prices, quantities demanded and supplied, and ultimately trade volumes within a particular sector.

- General Equilibrium Models: These more complex models consider the interactions between multiple markets and sectors. They provide a more comprehensive picture of the economy-wide effects of tariffs, capturing things like substitution effects and changes in factor allocation.

- Difference-in-Differences Analysis: This method compares changes in trade flows before and after a tariff change in a treated group (e.g., a country implementing a new tariff) to a control group (a comparable country without the tariff change).

Each of these methods offers different levels of complexity and requires different data sets. The selection of the most appropriate method should be guided by the research question, data availability, and computational resources.

Q 12. How can firms mitigate the impact of tariffs and non-tariff barriers on their operations?

Firms can mitigate the impact of tariffs and non-tariff barriers through several strategies:

- Diversification of Sourcing and Production: Shifting production or sourcing to countries with lower trade barriers can lessen the impact of tariffs.

- Strategic Location Choices: Establishing operations in countries with preferential access to key markets can help avoid or reduce tariffs.

- Lobbying and Advocacy: Engaging in policy advocacy to influence tariff and NTB policies can help shape a more favorable trade environment.

- Product Adaptation: Modifying product characteristics to comply with technical regulations or standards of the import market can overcome non-tariff barriers.

- Negotiation and Dispute Resolution: Firms can try to negotiate directly with importing countries or use WTO dispute settlement mechanisms to challenge unfair trade barriers.

- Tariff Engineering: This involves restructuring a product’s value chain to minimize the tariff burden. For example, some components could be produced in a low-tariff country and assembled in the target market.

The choice of strategy depends on the specific barriers faced and the firm’s resources and capabilities.

Q 13. Discuss the role of trade agreements in reducing trade barriers.

Trade agreements play a vital role in reducing trade barriers by establishing rules and commitments among participating countries. These agreements typically include provisions for tariff reductions, harmonization of technical regulations, and dispute settlement mechanisms.

Examples include the WTO’s agreements, regional trade agreements (like NAFTA/USMCA, the EU single market), and bilateral trade agreements. These agreements often involve a phased reduction of tariffs over a specified period, leading to increased trade and economic integration. By creating a predictable and stable trade environment, they encourage investment and economic growth.

Furthermore, trade agreements often address non-tariff barriers by promoting regulatory cooperation and standardization. This reduces the costs and complexities associated with meeting varying standards in different countries.

Q 14. What are some common challenges in measuring the impact of non-tariff barriers?

Measuring the impact of non-tariff barriers (NTBs) presents significant challenges due to their diverse nature and often opaque implementation. Unlike tariffs, which are readily quantifiable, NTBs are often less transparent and more difficult to capture in quantitative measures.

- Heterogeneity and Complexity: NTBs range from sanitary and phytosanitary regulations to technical barriers to trade and administrative procedures, making standardized measurement difficult.

- Data Availability and Quality: Reliable and consistent data on NTBs are often scarce, especially for developing countries, hindering comprehensive analysis.

- Endogeneity: It’s challenging to isolate the effects of NTBs from other factors that may influence trade flows, such as economic conditions or firm-specific characteristics.

- Measurement Challenges: Quantifying the impact of NTBs requires sophisticated econometric techniques to account for their multiple dimensions and indirect effects.

- Valuation Difficulty: Determining the economic costs of NTBs, like delays caused by complex customs procedures, can be complex.

Researchers often rely on qualitative assessments, surveys, case studies, and detailed analysis of specific regulations, combined with econometric techniques to assess the impact of NTBs, but perfect measurement remains a challenge.

Q 15. How do you identify and assess potential trade barriers for a specific product or industry?

Identifying and assessing trade barriers requires a systematic approach. We start by defining the specific product or industry, then analyze both tariff and non-tariff barriers. For tariffs, we consult official government websites and trade databases to find import duties, taxes, and other levies. This includes examining preferential trade agreements (PTAs) which might lower tariffs for some countries but not others. For non-tariff barriers (NTBs), the process is more complex and often requires qualitative analysis. We look for:

- Technical Barriers to Trade (TBT): These include product standards, testing and certification requirements, and labeling regulations. Imagine exporting machinery – if the importing country requires a specific safety certification not widely available, that’s a NTB.

- Sanitary and Phytosanitary (SPS) Measures: These address food safety, animal, and plant health. Stricter SPS regulations can act as significant hurdles, especially for agricultural products. For example, a ban on certain pesticides could impact agricultural exports.

- Trade policies and regulations: These can include import licensing, quotas, embargoes, and even bureaucratic processes that slow down imports. Lengthy customs procedures, for instance, increase time and cost, acting as a barrier.

- Subsidies and other government support for domestic industries: These create an uneven playing field, making imports less competitive.

We use tools like regression analysis to quantitatively assess the impact of tariffs on price and trade volume. For NTBs, we often rely on qualitative assessments, expert interviews, and case studies to understand their impact on market access.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain the process of tariff classification.

Tariff classification is the process of assigning a specific tariff code to a product. This code determines the applicable import duty rate. It’s crucial for accurate customs valuation and duty calculations. The process typically involves a detailed examination of the product’s physical characteristics, materials, and intended use. Let’s illustrate with an example: imagine importing a leather handbag. You wouldn’t just say ‘handbag’; you need to pinpoint the specifics. Is it made of genuine leather? What type of leather? Does it have metal hardware? Each detail influences the classification, guiding you through a hierarchical system of codes to reach the precise one.

Several sources are consulted during this process including:

- Harmonized System (HS): Provides a six-digit code that forms the basis of classification.

- National tariff schedules: Expand on the HS codes with additional digits to refine classification and specify duties for particular countries.

- Binding rulings: Official interpretations from customs authorities on specific product classifications.

Errors in tariff classification can lead to significant financial penalties, delays, and legal disputes, highlighting the importance of accurate classification.

Q 17. Describe the Harmonized System (HS) and its importance in international trade.

The Harmonized System (HS) is a standardized system of names and numbers used to classify traded products. It’s a globally recognized nomenclature, maintained by the World Customs Organization (WCO). The HS is fundamental to international trade because it:

- Provides a common language: Allows for consistent classification of goods regardless of country, simplifying international trade.

- Facilitates customs procedures: Streamlines customs processing by providing a standard classification system, making it faster and easier to clear goods.

- Forms the basis for national tariffs: Countries use the HS as a foundation for their national tariff schedules, simplifying tariff analysis and comparison across nations.

- Helps gather trade statistics: Enables consistent data collection, making it easier to track and analyze global trade flows.

Think of it as the global dictionary for trade. Without the HS, every country would have its own classification system, leading to chaos and making international commerce incredibly difficult.

Q 18. How do rules of origin impact trade flows?

Rules of origin (ROO) determine the national or regional origin of a product. These rules are critical because they determine whether a product qualifies for preferential tariff treatments under trade agreements. For example, under a free trade agreement (FTA), goods originating in a member country might enter another member country duty-free. However, if only part of a product’s value was added within the FTA zone, it might not qualify for preferential treatment. ROO often look at where the product was manufactured and the percentage of its value added in a specific country or region.

The impact on trade flows is significant. Strict ROO can hinder trade by increasing the cost and complexity of verifying origin. Conversely, flexible ROO can stimulate trade by reducing administrative burden and allowing more goods to qualify for preferential treatment. They can also affect the location of production, influencing firms’ decisions on where to manufacture to take advantage of tariff preferences.

Q 19. What are the implications of trade sanctions?

Trade sanctions are trade penalties imposed by one country or group of countries on another. These penalties aim to influence the target country’s behavior by restricting trade, typically through tariffs, embargoes, or other restrictions. The implications are multifaceted:

- Economic impact: Sanctions can severely damage the target country’s economy, reducing exports and disrupting supply chains. They might lead to job losses and decreased economic growth.

- Geopolitical consequences: Sanctions are often used as a tool of foreign policy to express disapproval or to pressure a country to change its policies. However, they may not always achieve their intended outcome and could escalate tensions.

- Humanitarian concerns: Sanctions can have unintended negative consequences for ordinary citizens in the target country, impacting access to essential goods and services.

- Legal challenges: Sanctions often face legal challenges in international courts or through dispute settlement mechanisms.

The effectiveness of trade sanctions is often debated, with their impact varying depending on the target country, the nature of the sanctions, and the broader geopolitical context.

Q 20. Explain the difference between quotas and tariffs.

Both quotas and tariffs are trade restrictions, but they work differently:

- Tariff: A tariff is a tax imposed on imported goods. It increases the price of the imported product, making it less competitive compared to domestically produced goods. The amount of revenue generated by tariffs goes to the government.

- Quota: A quota is a quantitative restriction on the amount of a specific good that can be imported during a particular period. Once the quota is filled, no more imports are allowed. This artificially limits supply and often increases prices. The revenue generated by a quota may go to the government through auctioning import licenses or may accrue to importers who have secured licenses.

Imagine a country limiting the number of cars imported (quota) versus increasing the tax on imported cars (tariff). Both restrict imports, but the quota creates scarcity while the tariff increases price. The choice between the two often depends on policy goals; tariffs raise revenue, while quotas directly control quantity.

Q 21. How do subsidies affect international trade?

Subsidies are government payments or other forms of support that provide an advantage to domestic producers. These can significantly affect international trade by creating an uneven playing field. Subsidies allow domestic firms to sell their goods at lower prices than they otherwise could, undercutting foreign competitors and increasing their market share. This can lead to:

- Increased domestic production: Subsidies encourage domestic industries to produce more, sometimes leading to overproduction and market distortions.

- Reduced imports: Cheaper domestically produced goods reduce demand for imports.

- Trade disputes: Subsidies are often considered unfair trade practices, leading to disputes and retaliatory measures from other countries. The WTO has rules against certain types of subsidies.

- Job creation (potentially): While subsidies can support domestic jobs, this is often at the expense of other countries and industries.

Agricultural subsidies are a common example. Governments often provide financial support to farmers, allowing them to produce and sell goods at lower prices than farmers in countries without similar subsidies. This can lead to trade conflicts and distortions in global agricultural markets.

Q 22. Discuss the impact of trade barriers on global supply chains.

Trade barriers, encompassing tariffs and non-tariff measures, significantly disrupt global supply chains. Think of a global supply chain as a complex network of interconnected nodes – manufacturers, suppliers, distributors, and consumers – spread across countries. Trade barriers act as obstacles within this network, increasing costs and reducing efficiency.

Increased Costs: Tariffs directly raise the price of imported goods, making them less competitive. Non-tariff barriers, such as quotas, lengthy customs procedures, and stringent regulations, add extra layers of cost and complexity. This translates to higher prices for consumers and increased production costs for businesses.

Supply Chain Disruptions: Restrictions on imports can lead to shortages of vital inputs, halting or slowing production. Imagine a car manufacturer reliant on imported parts; a sudden tariff increase on these parts could bring production to a standstill. Similarly, complex regulatory hurdles can delay shipments, impacting just-in-time inventory systems.

Restructuring of Supply Chains: Faced with trade barriers, businesses are forced to re-evaluate their sourcing strategies. This might involve shifting production to other countries, diversifying suppliers, or relying more on domestic sources, which can be costly and time-consuming. This restructuring adds uncertainty and potential inefficiencies to the supply chain.

Reduced Trade Volume: The very purpose of trade barriers is to reduce the volume of imports. This leads to a smaller global market, hindering the overall efficiency and growth of international trade.

For example, the US-China trade war, characterized by significant tariffs on various goods, led to disruptions in global supply chains of electronics and other manufactured products, impacting businesses and consumers worldwide.

Q 23. Describe the role of trade remedy investigations in addressing unfair trade practices.

Trade remedy investigations are crucial mechanisms for addressing unfair trade practices, such as dumping (selling goods below cost) and subsidies (government support giving an unfair advantage). These investigations aim to level the playing field and ensure fair competition.

Initiation: Investigations are typically initiated by domestic industries claiming injury due to unfair imports. They present evidence of dumping or subsidization, demonstrating significant harm to their business.

Investigation Process: An independent body (e.g., the International Trade Commission in the US) conducts a thorough investigation, analyzing import volumes, pricing, and the impact on the domestic industry. This process involves gathering extensive data, interviewing stakeholders, and applying specific legal criteria.

Remedies: If unfair trade practices are confirmed, the investigating body can recommend remedies such as anti-dumping duties (tariffs levied specifically to offset the unfair pricing) or countervailing duties (tariffs to neutralize the effects of subsidies). These remedies aim to counter the negative effects of the unfair trade practices.

Dispute Settlement: International trade agreements often provide dispute settlement mechanisms to address concerns about the fairness and consistency of trade remedy investigations. If a country believes a remedy is unwarranted, it can challenge it through these mechanisms.

For instance, the EU has frequently used anti-dumping measures against imports of steel from certain countries, claiming that those countries engaged in dumping and caused material injury to EU steel producers.

Q 24. Explain the concept of trade diversion.

Trade diversion occurs when a trade agreement causes imports to shift from a more efficient, lower-cost supplier to a less efficient, higher-cost supplier simply because the latter enjoys preferential treatment under the agreement. Imagine it like this: you normally buy groceries from a cheaper store, but a new, closer store offers a discount only to its members. You might switch to the closer store, even though it’s slightly more expensive, due to the membership discount. This is essentially trade diversion.

It happens because trade agreements often grant preferential access (reduced tariffs or other benefits) to goods from certain countries. This preferential treatment can artificially boost the competitiveness of less efficient producers within the agreement, diverting trade away from more competitive but excluded suppliers.

The effect can be a net loss of economic efficiency, as resources are allocated to less productive uses. Regional trade agreements, like NAFTA (now USMCA) and the EU, have been subject to analyses concerning their potential for trade diversion. While these agreements aim to foster trade and economic growth, they may also inadvertently lead to this form of inefficiency.

Q 25. How do you evaluate the effectiveness of different trade policies?

Evaluating trade policy effectiveness requires a multi-faceted approach, combining quantitative and qualitative methods. We should look beyond simply measuring trade volumes. We need to consider several key aspects:

Economic Impacts: Analyze the effects on GDP growth, employment, consumer prices, and industry competitiveness. Did the policy achieve its intended economic goals? Quantitative data such as import and export statistics, price indices, and employment figures are crucial here. Econometric modeling can help assess the causal relationships.

Distributional Effects: Who benefits and who loses from the policy? Does it exacerbate income inequality or create new opportunities for certain groups? This requires analysis of income distribution, employment patterns across different sectors, and potentially surveys to understand the lived experiences.

Social Impacts: Consider the policy’s impacts on environmental sustainability, labor standards, and social equity. For example, a trade policy that leads to significant job losses in a specific region needs to be assessed for its social consequences.

Political Impacts: How has the policy affected diplomatic relations and international cooperation? A trade war, for instance, can have significant negative geopolitical consequences.

Comparison with Alternatives: What would have happened if a different policy had been adopted? This requires counterfactual analysis, which can be challenging but essential for evaluating the net effect of a specific policy choice.

A comprehensive evaluation needs to combine rigorous data analysis with a nuanced understanding of the socio-political context. It’s not just about numbers; it’s about understanding the impact on people and the environment.

Q 26. What are some common challenges in implementing trade agreements?

Implementing trade agreements presents numerous challenges, often stemming from the complex interplay of national interests and domestic politics:

Domestic Opposition: Certain industries or workers may face increased competition due to trade liberalization, leading to resistance and lobbying efforts to block or modify the agreement.

Regulatory Compliance: Ensuring compliance with the agreement’s rules and regulations can be difficult, particularly in complex areas such as sanitary and phytosanitary standards (SPS) or technical barriers to trade (TBT).

Enforcement Mechanisms: Effective enforcement mechanisms are vital to deter violations and ensure that all parties adhere to the agreement. Weak enforcement can undermine the agreement’s effectiveness.

Asymmetrical Impacts: The benefits and costs of trade agreements are often not distributed evenly across different countries or sectors. Addressing these asymmetries and ensuring fair outcomes is a key challenge.

Geopolitical Factors: International political tensions and changing geopolitical landscapes can influence the implementation and effectiveness of trade agreements.

The implementation of the Trans-Pacific Partnership (TPP) illustrates these challenges. While aiming to lower trade barriers among participating nations, it faced significant domestic opposition in some countries, ultimately leading to the withdrawal of the United States.

Q 27. Describe the role of data analytics in trade policy analysis.

Data analytics plays an increasingly vital role in trade policy analysis. The sheer volume of data available – from trade statistics to consumer preferences, production costs, and supply chain information – requires sophisticated analytical tools to identify trends, patterns, and potential policy implications.

Trade Data Analysis: Analyzing trade flows, tariffs, non-tariff barriers, and their impact on various economic indicators helps identify areas for improvement or potential challenges.

Supply Chain Mapping: Data analytics can be used to map global supply chains, identifying vulnerabilities and potential disruptions. This aids in developing strategies to mitigate risks.

Predictive Modeling: Using statistical models and machine learning techniques, analysts can predict the likely effects of policy changes on different economic sectors and stakeholders.

Impact Assessment: Data analytics tools help to quantify the economic, social, and environmental impacts of various trade policies, enabling evidence-based decision-making.

Monitoring and Evaluation: Track the effectiveness of implemented trade policies by continuously analyzing relevant data to assess progress and identify areas needing adjustment.

For instance, using machine learning algorithms, trade analysts could predict the potential impact of a new tariff on specific industries by analyzing past trade patterns, pricing data, and other relevant factors. This allows for a more data-driven and accurate assessment of policy impacts.

Q 28. How do you stay current with changes in international trade regulations?

Staying current with changes in international trade regulations requires a multi-pronged approach:

Monitoring International Organizations: Regularly follow publications and updates from the World Trade Organization (WTO), the International Monetary Fund (IMF), the World Bank, and other relevant international organizations.

Following Governmental Agencies: Stay informed about trade policy developments and regulatory changes announced by national and regional government agencies responsible for trade.

Utilizing Specialized Databases and Publications: Access specialized trade databases and subscription services providing comprehensive information on trade laws, regulations, and case studies.

Networking and Attending Conferences: Participate in trade-related conferences and workshops, networking with experts and professionals in the field.

Following Academic Research and Publications: Keep up with current academic research in international trade, which provides insights into emerging trends and issues.

By combining these methods, I maintain an up-to-date understanding of the rapidly evolving landscape of international trade regulations.

Key Topics to Learn for Tariff and Non-Tariff Barrier Analysis Interview

- Understanding Tariffs: Types of tariffs (specific, ad valorem, compound), tariff escalation, and the impact of tariffs on prices, trade volumes, and consumer welfare. Consider practical examples of how different tariff structures affect specific industries.

- Analyzing Non-Tariff Barriers: Identifying and classifying various NTBs (e.g., quotas, sanitary and phytosanitary measures, technical barriers to trade, trade remedies). Explore the methods used to quantify the impact of these barriers on trade flows.

- Trade Models and Simulations: Familiarity with gravity models, partial equilibrium models, and general equilibrium models used to analyze the effects of tariffs and NTBs. Practice applying these models to hypothetical scenarios.

- Data Analysis and Interpretation: Mastering data collection, cleaning, and analysis techniques relevant to trade data. Practice interpreting trade statistics and identifying trends related to tariff and non-tariff barriers.

- Policy Implications and Recommendations: Develop skills in formulating policy recommendations based on your analysis. Think critically about the economic, social, and political consequences of different trade policies.

- Case Studies and Real-World Applications: Study successful and unsuccessful examples of tariff and non-tariff barrier implementation and removal. Be prepared to discuss the lessons learned from these case studies.

- International Trade Agreements: Understand the role of international organizations (WTO) in regulating tariffs and NTBs. Analyze the implications of various trade agreements on specific industries.

Next Steps

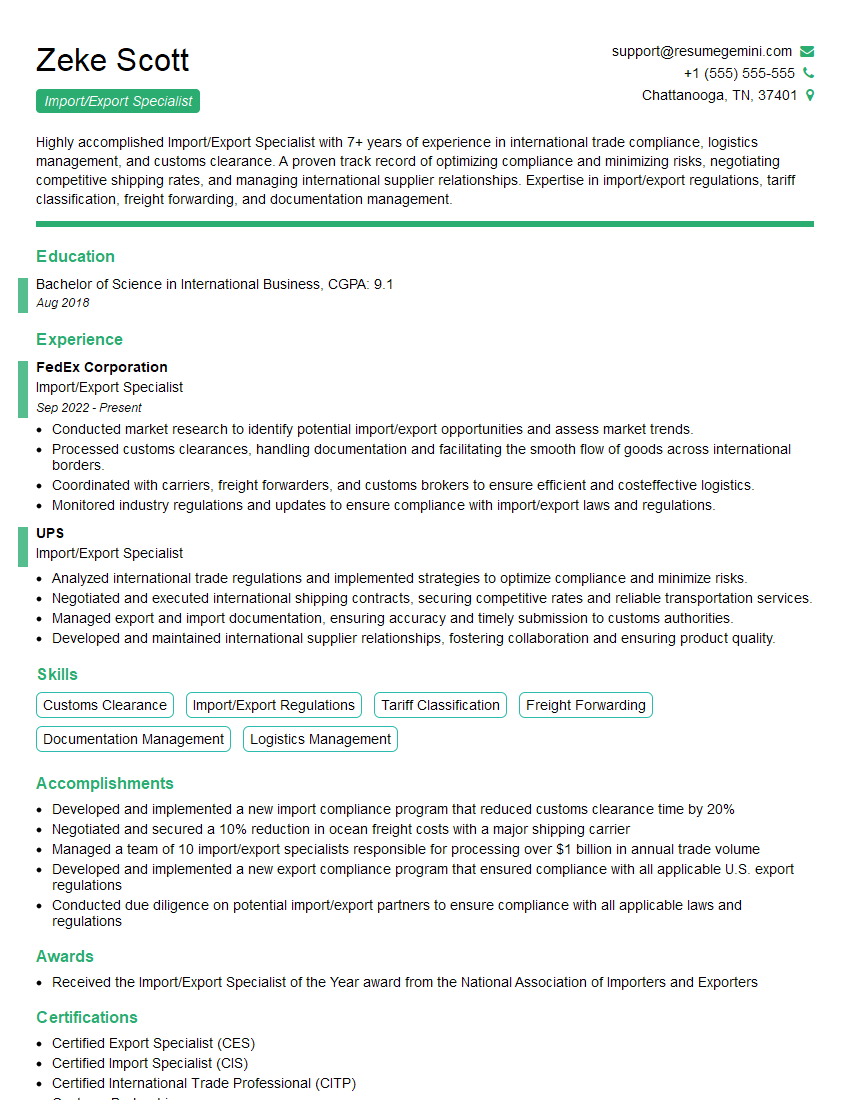

Mastering Tariff and Non-Tariff Barrier Analysis is crucial for career advancement in international trade, economics, and policy analysis. A strong understanding of these concepts will significantly enhance your job prospects and allow you to contribute meaningfully to your future workplace. To further improve your chances, crafting an ATS-friendly resume is essential for getting your application noticed. ResumeGemini is a trusted resource that can help you build a professional and effective resume, maximizing your chances of landing your dream job. Examples of resumes tailored specifically to Tariff and Non-Tariff Barrier Analysis are available to help guide you. Invest time in building a compelling resume – it’s your first impression!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.