The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Understanding of Regional Trade Agreements (e.g., EU, NAFTA, ASEAN) interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Understanding of Regional Trade Agreements (e.g., EU, NAFTA, ASEAN) Interview

Q 1. Explain the key differences between NAFTA and USMCA.

NAFTA (North American Free Trade Agreement) and USMCA (United States-Mexico-Canada Agreement) are both free trade agreements among Canada, Mexico, and the United States, but USMCA is a renegotiated and updated version of NAFTA. The key differences lie in several areas:

Labor and Environmental Standards: USMCA includes stronger provisions on labor rights and environmental protections, aiming to prevent companies from relocating to countries with weaker regulations to gain a competitive advantage. This is a significant departure from NAFTA, which was criticized for its lack of robust enforcement mechanisms in these areas.

Digital Trade: USMCA addresses the growing importance of digital trade, including data flows and e-commerce, which were not comprehensively covered in NAFTA. It establishes rules to promote the free flow of digital information while protecting consumer privacy.

Automobiles: USMCA contains stricter rules of origin for automobiles, requiring a higher percentage of a vehicle to be manufactured in North America to qualify for tariff-free treatment. This is aimed at boosting domestic manufacturing and reducing reliance on foreign parts.

Intellectual Property: USMCA extends copyright protection for certain works and enhances protection for pharmaceutical patents, giving greater protection to intellectual property rights compared to NAFTA.

Dispute Resolution: While both agreements have dispute settlement mechanisms, USMCA changes the process, making it more difficult to challenge national regulations through investor-state dispute settlement (ISDS).

In essence, USMCA aims to modernize NAFTA, addressing concerns about labor practices, environmental sustainability, and the evolving landscape of global trade, particularly in the digital realm. It reflects a shift towards a more balanced and equitable trade relationship among the three countries.

Q 2. Describe the impact of Brexit on EU trade agreements.

Brexit, the United Kingdom’s withdrawal from the European Union, significantly impacted EU trade agreements. Prior to Brexit, the UK benefited from the EU’s extensive network of trade agreements, enjoying tariff-free access to the EU’s single market and preferential access to markets around the world through EU trade deals.

Post-Brexit, the UK had to renegotiate its trade relationships. It now has independent trade agreements with some countries, while in other cases, it relies on World Trade Organization (WTO) rules, which generally mean higher tariffs and less favorable terms than under EU agreements. This has created uncertainty and increased costs for businesses involved in trade between the UK and the EU. The UK has been working to establish new trade partnerships independently, but the process is complex and time-consuming. The overall impact has been a reduction in trade between the UK and the EU, increased administrative burdens, and economic adjustments for both sides.

Q 3. What are the main objectives of the ASEAN Economic Community (AEC)?

The ASEAN Economic Community (AEC) aims to create a single market and production base within Southeast Asia. Its main objectives are:

Free Flow of Goods: Reducing tariffs and non-tariff barriers to trade among member states, leading to a more integrated and efficient regional market.

Free Flow of Services: Liberalizing the services sector, allowing for greater cross-border movement of services and increased competition.

Free Flow of Investment: Facilitating greater foreign and domestic investment within the region, promoting economic growth and development.

Free Flow of Skilled Labor: Increasing mobility of skilled labor across member countries to facilitate skills transfer and economic development. Though still under development.

Free Flow of Capital: Promoting greater financial integration through increased capital mobility, helping to support investment and economic activity.

The AEC strives to achieve economic integration, improve living standards, and enhance competitiveness in the global market. Think of it as a Southeast Asian version of the EU, though with a focus on gradual integration and recognizing the diverse development levels of member states.

Q 4. How do rules of origin impact trade under a regional trade agreement?

Rules of origin are crucial in regional trade agreements. They determine the national content of a product, specifying the origin of the goods to determine whether they qualify for preferential tariff treatment under the agreement. For instance, if a trade agreement stipulates that a certain percentage of a good must originate from within the participating countries to avoid tariffs, this is governed by rules of origin.

The impact is significant; without meeting the criteria, goods may be subject to higher tariffs and duties, negating the benefits of the regional agreement. Rules of origin can be complex, involving various criteria such as value added, processing, and the location of manufacturing. They can be based on a percentage of value or production within the area, or a combination of both. It is important for businesses to understand and comply with these rules to take full advantage of the agreement’s benefits.

For example, an automobile made partially in Mexico and partly in Japan may not qualify for the tariff-free treatment under USMCA if the proportion of North American content is too low, hence these rules are essential to support the objectives of the trade agreement.

Q 5. Explain the concept of tariff preferences within a free trade area.

Tariff preferences within a free trade area mean that member countries grant preferential access to each other’s markets by reducing or eliminating tariffs on goods originating within the area. This contrasts with the Most Favored Nation (MFN) principle of the WTO, which mandates equal treatment for all trading partners.

Essentially, countries within a free trade area benefit from lower or zero tariffs on their exports to each other, while maintaining their ability to set their own tariffs on goods from non-member countries. This creates a preferential treatment among members, stimulating intra-regional trade and fostering economic integration. Imagine it like a members-only club offering discounted prices; only the members get the preferential tariff rates.

Q 6. What are the potential benefits and drawbacks of joining a regional trade agreement?

Joining a regional trade agreement offers both benefits and drawbacks:

Benefits: Increased market access, reduced trade costs, attraction of foreign investment, economic growth, enhanced competitiveness, greater specialization and efficiency, potentially higher consumer welfare.

Drawbacks: Loss of tariff revenue, potential job displacement in certain sectors (though often offset by job creation in others), increased competition for domestic industries, challenges in harmonizing regulations, potentially increased dependence on specific trading partners, and risk of regulatory capture by powerful interests.

Whether the benefits outweigh the drawbacks depends on various factors, including the specific agreement, the country’s economic structure, and its capacity to adapt to the changes brought about by the agreement. Careful assessment and mitigation strategies are essential.

Q 7. Discuss the role of dispute settlement mechanisms in regional trade agreements.

Dispute settlement mechanisms are critical for enforcing the rules and ensuring the smooth functioning of regional trade agreements. They provide a structured process for resolving trade disputes between member countries or investors. These mechanisms typically involve:

Consultation: Initial attempts to resolve the dispute through direct negotiations between the parties involved.

Panels/Arbitration: If consultations fail, the dispute may be referred to an independent panel or arbitration body to make a binding decision.

Appeals: In some cases, the decision of a panel may be subject to appeal.

Effective dispute settlement mechanisms help to maintain trust and confidence among member states, reducing the risk of trade wars or retaliatory measures. They contribute to the stability and predictability of the trade regime. However, the design and effectiveness of these mechanisms can vary significantly among different agreements. For example, the effectiveness of the original NAFTA’s investor-state dispute settlement mechanism was highly controversial, while USMCA modified these mechanisms to try to improve fairness and balance.

Q 8. How does a regional trade agreement affect domestic industries?

Regional trade agreements (RTAs) significantly impact domestic industries, creating both opportunities and challenges. The reduction or elimination of tariffs and other trade barriers under an RTA leads to increased competition from foreign producers. This can benefit consumers through lower prices and greater product choice. However, domestic industries that lack competitiveness may face pressure, potentially leading to job losses or business closures in sectors unable to adapt. For example, the entry of low-cost manufactured goods from China into the ASEAN market led to challenges for some domestic industries in member states.

Conversely, RTAs can also stimulate domestic industries by providing access to larger markets and new export opportunities. Businesses can leverage economies of scale, enhance efficiency, and specialize in areas where they have a comparative advantage. The EU’s single market, for instance, has fostered significant growth for many European companies by eliminating internal trade barriers. The impact on domestic industries therefore depends on a complex interplay of factors, including the industry’s competitiveness, the nature of the RTA, and government policies aimed at mitigating negative consequences, such as retraining programs or support for affected industries.

Q 9. Explain the difference between a free trade area and a customs union.

A free trade area (FTA) is the simplest form of an RTA. It eliminates tariffs and other trade barriers among member countries, but each member retains its own external trade policies. Think of it like a group of neighbors agreeing to not charge each other for borrowing tools, but each still deciding individually whether to lend tools to outsiders.

A customs union goes further. It also eliminates internal tariffs and trade barriers, but it harmonizes external trade policies among its members. This means that all members apply the same tariffs and other regulations to goods from outside the union. This is like the same group of neighbors agreeing not to charge each other for borrowing tools, and agreeing on a single price for lending tools to anyone outside their group.

The key difference lies in the external trade policy: FTAs have independent external tariffs, while customs unions have a unified external tariff.

Q 10. What are some common non-tariff barriers to trade within a regional trade agreement?

While tariffs are the most visible trade barrier, non-tariff barriers (NTBs) can be equally, if not more, significant within an RTA. These are regulations and policies that restrict trade without directly involving tariffs. Some common NTBs include:

- Technical barriers to trade (TBT): These are standards, regulations, and testing procedures related to product quality, safety, and environmental protection. Inconsistencies in these regulations across member countries can create difficulties for businesses seeking to trade across borders. For example, differing food safety standards between EU countries and a newly joined country could create trade delays.

- Sanitary and phytosanitary (SPS) measures: These are regulations related to food safety, animal and plant health, and disease prevention. These measures are vital for protecting human, animal, and plant health, but overly stringent or inconsistently applied SPS measures can be a significant NTB. Imagine different countries having very different standards for the level of pesticide residue allowed on imported produce.

- Rules of origin: These rules determine the criteria for classifying goods as originating in a particular member country and thus eligible for preferential tariff treatment under the RTA. Complex and burdensome rules of origin can hinder trade flows and increase compliance costs for businesses.

- Administrative procedures: Cumbersome customs procedures, excessive documentation requirements, and lengthy border delays can add significant costs and delays to cross-border trade.

Addressing NTBs is critical for achieving the full potential of an RTA.

Q 11. How do sanitary and phytosanitary measures impact trade?

Sanitary and phytosanitary (SPS) measures are regulations designed to protect human, animal, and plant life or health from risks arising from pests, diseases, or contaminants. While crucial for public safety, they can significantly impact trade if not carefully managed. Overly stringent or discriminatory SPS measures can be used as a form of protectionism, limiting imports from other countries.

For instance, a country might ban the import of certain fruits due to concerns about a specific pest, even if the risk is low. Disputes over SPS measures are frequent in international trade, often necessitating negotiations and scientific evidence to demonstrate the legitimacy and non-discriminatory nature of the regulations. The WTO’s SPS Agreement provides a framework for resolving such disputes by emphasizing risk assessment and scientific justification for such measures.

Q 12. Describe the role of the World Trade Organization (WTO) in relation to regional trade agreements.

The World Trade Organization (WTO) plays a crucial role in relation to regional trade agreements. While RTAs are negotiated and implemented by their member countries, the WTO provides a framework and ensures that these agreements are consistent with its rules. Specifically:

- Most-favored-nation (MFN) principle: The WTO’s MFN principle generally requires members to treat all trading partners equally. RTAs are an exception to this rule; however, they must not discriminate against non-member countries. This means that any preferential tariff treatment given to members of an RTA must not be extended to non-members if there is a trade impediment.

- National treatment: Once goods are imported into a country, they must be treated no less favorably than domestically produced goods under the WTO’s national treatment principle.

- Transparency: The WTO requires that RTAs be notified to and reviewed by the WTO, ensuring transparency and accountability. This process allows other WTO members to assess the potential impact of the agreement on their trade interests.

- Dispute settlement: The WTO’s dispute settlement mechanism can be used to resolve disputes arising from RTAs, ensuring that they are implemented in a fair and consistent manner.

Essentially, the WTO acts as an oversight body, ensuring that RTAs do not undermine the broader multilateral trading system.

Q 13. Explain the concept of trade diversion within a customs union.

Trade diversion occurs within a customs union when the creation of a common external tariff leads to a shift in trade patterns away from more efficient, non-member producers towards less efficient, member producers. Imagine a scenario where Country A imports widgets from Country C (the most efficient producer) at a low cost. When Country A joins a customs union with Country B, which also produces widgets but at a higher cost, the union imposes a common external tariff on imports from Country C. This makes Country C’s widgets more expensive than Country B’s, leading Country A to switch to purchasing widgets from Country B. This shift benefits Country B but harms Country C and reduces overall efficiency. The trade is ‘diverted’ from a more efficient producer to a less efficient one solely due to the customs union’s structure.

The cost of this trade diversion is a net loss of economic efficiency. While the customs union may experience certain benefits from increased trade amongst members, the cost of this inefficiency can outweigh the benefits.

Q 14. How do regional trade agreements impact foreign direct investment (FDI)?

Regional trade agreements significantly impact foreign direct investment (FDI). RTAs typically increase FDI flows by creating larger, more integrated markets. The removal of trade barriers reduces transaction costs and risks, making it more attractive for foreign firms to invest within the RTA. Larger markets provide opportunities for economies of scale, facilitating increased production and efficiency, and attracting FDI.

For example, the EU’s single market has attracted massive FDI by providing a stable, predictable, and large market for businesses to operate in. Likewise, NAFTA (now USMCA) also fostered significant FDI among its members. The increased market access, regulatory harmonization, and reduced uncertainty under RTAs encourages firms to establish production facilities and distribution networks within the RTA, ultimately increasing FDI.

However, the impact of RTAs on FDI is not always uniform. Certain industries might benefit more than others, and the impact also depends on the specific provisions of the agreement and the investment climate in the member countries. For example, attracting FDI requires a business-friendly environment beyond just lower tariffs, encompassing effective infrastructure and regulatory certainty.

Q 15. Analyze the impact of a specific regional trade agreement on a particular industry.

Analyzing the impact of a regional trade agreement (RTA) on a specific industry requires a nuanced approach. We need to consider the industry’s specific characteristics, its position in the global value chain, and the provisions of the RTA itself. For example, let’s consider the impact of the USMCA (United States-Mexico-Canada Agreement) on the North American automotive industry. Before USMCA, NAFTA had facilitated cross-border auto production, creating integrated supply chains. USMCA retained this, but added stricter rules of origin, meaning a larger percentage of vehicle content must originate within North America to qualify for tariff-free treatment. This impacted the industry by incentivizing domestic production and potentially increasing costs for some automakers who relied on cheaper parts from outside the region. It also led to negotiations and adjustments in supply chains to meet the new rules. On the other hand, industries with lower tariffs or less stringent rules of origin under the new agreement might have seen increased competition and lower prices for consumers.

To effectively analyze such an impact, we need to examine:

- Tariff reductions or eliminations: Did the agreement reduce or eliminate tariffs on products in this industry? How significant were these changes?

- Rules of origin: How strict are the rules of origin? Do they make it easier or harder for companies to source inputs from outside the region while still benefiting from the agreement’s preferences?

- Investment provisions: Does the agreement encourage foreign direct investment (FDI) in this industry? This could lead to increased production, jobs, or technology transfer.

- Regulatory harmonization: Does the agreement lead to a convergence of regulations related to the industry? This could simplify trade and reduce compliance costs.

- Dispute settlement mechanisms: Does the agreement provide effective mechanisms for resolving trade disputes? This is crucial for protecting the interests of businesses within the industry.

Ultimately, the impact of an RTA on an industry is complex and can vary depending on a multitude of factors. A thorough analysis needs to consider all these elements.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the key provisions of the EU’s Common Agricultural Policy (CAP)?

The EU’s Common Agricultural Policy (CAP) is a complex system aimed at supporting European farmers and ensuring food security. Its key provisions can be summarized as follows:

- Direct Payments: Farmers receive direct income support, decoupled from production levels in many cases. This aims to provide a safety net and ensure the economic viability of farms, even if market prices fluctuate.

- Market Interventions: The CAP includes mechanisms to manage market fluctuations. This might include intervention buying of surplus products to stabilize prices or export subsidies to help farmers sell their goods in international markets.

- Rural Development Programs: Significant funding is allocated to rural development projects, aimed at improving the environment, infrastructure, and competitiveness of rural areas. This fosters sustainable agriculture and economic diversification.

- Environmental and Climate Measures: Recent reforms have increasingly emphasized environmental protection and climate change mitigation. Payments are now linked to environmentally friendly practices, promoting biodiversity, reducing pesticide use, and improving animal welfare.

- Quality Schemes: The CAP supports schemes that promote high-quality agricultural products, such as Protected Designation of Origin (PDO) and Protected Geographical Indication (PGI) designations, enhancing the value of certain regional products.

The CAP has been subject to much debate, with criticisms regarding its budget size, environmental impact, and potential distortions of agricultural markets. However, it remains a cornerstone of EU policy, reflecting the importance of agriculture in the Union’s economy and social fabric.

Q 17. Discuss the challenges of negotiating and implementing regional trade agreements.

Negotiating and implementing regional trade agreements (RTAs) present numerous challenges. Think of it like orchestrating a complex symphony – each instrument (country) has its own unique part, and they must all harmonize perfectly for success.

- Diverse Interests: Countries involved often have vastly different economic structures, priorities, and levels of development. Reaching consensus on issues like tariff reductions, rules of origin, and regulatory convergence can be extremely difficult.

- Political Will and Domestic Opposition: Successfully negotiating an RTA requires sustained political will from all participating governments. However, domestic industries that fear increased competition often lobby against agreements, creating political hurdles.

- Asymmetrical Bargaining Power: Larger, more economically powerful countries may exert undue influence in negotiations, leading to unfair outcomes for smaller partners. Ensuring a level playing field is vital.

- Implementation Challenges: Even after an agreement is signed, implementation can be complex and costly. This involves adapting national laws and regulations, creating new administrative procedures, and ensuring effective enforcement.

- Non-Trade Issues: RTAs often grapple with non-trade issues, such as labor standards, environmental protection, and intellectual property rights. These can be contentious and difficult to incorporate into an agreement without hindering trade objectives.

- Enforcement Mechanisms: Effective dispute settlement mechanisms are essential for ensuring compliance and resolving conflicts between member countries. However, agreeing on these mechanisms can be challenging.

Navigating these challenges requires skillful diplomacy, strategic compromises, and a commitment to mutual benefit. It’s not just about lowering tariffs; it’s about building trust and fostering long-term economic cooperation.

Q 18. How do regional trade agreements address issues of intellectual property rights?

Regional trade agreements (RTAs) play a crucial role in addressing intellectual property rights (IPR). Strong IPR protection encourages innovation, as creators and businesses are assured that their inventions, creations, and brands will be protected. RTAs typically include provisions that harmonize IPR standards across member countries. Think of it as creating a unified set of rules for protecting intellectual property across the region.

Common provisions in RTAs related to IPR include:

- Copyright Protection: Guaranteeing protection for literary and artistic works, including books, music, and software.

- Patent Protection: Protecting inventions for a specified period, allowing inventors to exclusively exploit their creations.

- Trademark Protection: Protecting brand names and logos, preventing unauthorized use.

- Trade Secrets Protection: Protecting confidential business information that gives companies a competitive edge.

- Enforcement Mechanisms: Establishing clear procedures for enforcing IPR rights, including measures to combat counterfeiting and piracy.

However, the level of protection and enforcement can vary across different RTAs. Some agreements may have stronger provisions than others, reflecting the priorities and bargaining power of the participating countries. Negotiating and balancing IPR protection with other trade objectives is a key challenge in the process.

Q 19. Explain the impact of regional trade agreements on labor standards.

The impact of regional trade agreements (RTAs) on labor standards is a complex and often debated topic. Some argue that RTAs can lead to a “race to the bottom,” where countries lower their labor standards to attract foreign investment. Others argue that RTAs can actually improve labor standards by promoting higher wages, better working conditions, and greater worker protections.

The actual impact depends on several factors, including:

- Specific Provisions of the Agreement: Some RTAs include explicit provisions on labor standards, such as clauses requiring member countries to uphold core ILO (International Labour Organization) conventions. Others may focus more on trade liberalization, with less emphasis on labor issues.

- Enforcement Mechanisms: Effective enforcement mechanisms are crucial for ensuring that countries comply with labor standards provisions in the agreement. Weak enforcement can undermine the positive impact of such provisions.

- Domestic Policies and Institutions: A country’s domestic policies and institutions play a key role in shaping labor outcomes. Even with a strong RTA, countries with weak labor institutions might not see significant improvements in labor standards.

- Type of Industry: The impact on labor standards can vary depending on the type of industry. Labor-intensive industries might be more susceptible to downward pressure on wages and working conditions.

In practice, the effect of RTAs on labor standards is often mixed and context-specific. It’s not simply a case of improvement or decline. It’s a delicate balance requiring careful consideration of the agreement’s design, its enforcement mechanisms, and the broader economic and political context.

Q 20. Describe the role of trade facilitation in reducing trade costs.

Trade facilitation refers to measures that streamline and simplify the process of moving goods across borders. Think of it as removing obstacles and reducing friction in international trade, making it easier and cheaper to conduct business. This significantly reduces trade costs.

Key aspects of trade facilitation that reduce trade costs include:

- Customs Procedures: Simplifying customs procedures, such as implementing electronic customs systems, reducing paperwork, and harmonizing customs regulations across borders.

- Border Infrastructure: Improving border infrastructure, including roads, ports, and railways, to facilitate faster and more efficient movement of goods.

- Port Efficiency: Modernizing port infrastructure and operations to reduce waiting times and improve overall efficiency.

- Information Technology: Utilizing information technology (IT) to improve transparency and efficiency in customs procedures and communication between businesses and government agencies.

- Standards and Regulations: Harmonizing standards and regulations across countries to reduce the need for costly compliance measures.

- Single Window Systems: Implementing single window systems that allow businesses to submit all necessary customs and other trade-related documents through a single platform.

By reducing administrative burdens, simplifying procedures, and improving infrastructure, trade facilitation significantly reduces delays, lowers transaction costs, and enhances the overall efficiency of cross-border trade. This ultimately makes goods and services cheaper and more readily available to consumers, benefiting businesses and consumers alike.

Q 21. How does a regional trade agreement affect a country’s balance of payments?

Regional trade agreements (RTAs) can significantly affect a country’s balance of payments, which is a record of all economic transactions between residents of a country and the rest of the world. The impact is multifaceted and depends on various factors, including the country’s position in the global value chain, the specific provisions of the agreement, and the overall global economic environment.

Potential impacts on the balance of payments include:

- Increased Exports: RTAs can lead to increased exports due to reduced tariffs and non-tariff barriers. This improves the current account balance (a component of the balance of payments).

- Increased Imports: The same tariff reductions also lead to increased imports. This puts downward pressure on the current account.

- Foreign Direct Investment (FDI): RTAs can attract foreign direct investment, which increases capital inflows and improves the financial account balance (another component of the balance of payments).

- Changes in Prices: Tariff reductions can lead to lower prices for both imported and domestically produced goods, affecting the value of imports and exports.

- Shift in Production: Production may shift to take advantage of the RTA’s provisions. This can improve a country’s export competitiveness but might also displace domestic industries.

The net effect on a country’s balance of payments is difficult to predict with certainty. It depends on the interplay between increased exports, increased imports, changes in FDI, and the overall impact of the agreement on prices and production patterns. A thorough assessment requires a detailed analysis of the specific industry impacts and macro-economic factors.

Q 22. What are some common criticisms of regional trade agreements?

Regional Trade Agreements (RTAs), while aiming to boost economic growth, often face criticism. A common concern is the potential for job displacement in certain sectors as businesses relocate to countries with lower labor costs or less stringent regulations. For example, some argue that NAFTA (now USMCA) led to job losses in the US manufacturing sector. Another criticism is that RTAs can exacerbate income inequality, benefiting larger corporations more than small businesses or low-income workers. Furthermore, RTAs can sometimes harm developing countries by creating unfair competition or undermining their local industries. Environmental concerns, discussed later, are also frequently raised. Finally, some criticize the lack of transparency and democratic accountability in the negotiation and implementation of these agreements.

Q 23. Explain the concept of regional value content in a free trade agreement.

Regional Value Content (RVC) is a crucial element in many free trade agreements (FTAs). It refers to the percentage of a product’s value that originates within the participating countries of the agreement. This is important because it determines whether a product qualifies for preferential tariff treatment under the FTA. For instance, if an FTA stipulates a 40% RVC rule, a product must have at least 40% of its value added within the member countries to benefit from reduced or eliminated tariffs. Calculating RVC can be complex, involving tracking the value of materials, labor, and other inputs at each stage of production. Different FTAs have different methodologies for calculating RVC, which can be a source of dispute and complexity for businesses.

Q 24. How can businesses leverage regional trade agreements to their advantage?

Businesses can significantly benefit from RTAs. Reduced or eliminated tariffs offer immediate cost savings on imports and exports, increasing profitability and competitiveness. Expanded market access opens up new opportunities to reach a broader customer base. Businesses can establish production facilities or sourcing arrangements in other member countries, optimizing their supply chains and taking advantage of comparative advantages (e.g., cheaper labor or raw materials). For example, a company operating within the EU can easily sell its products across the 27 member states without facing significant trade barriers. RTAs also foster greater regulatory harmonization, streamlining processes and reducing compliance costs. However, businesses need to understand the specific rules of origin and other regulations within the RTA to fully benefit. Proper legal and logistical planning is vital to avoid penalties or delays.

Q 25. Discuss the environmental implications of regional trade agreements.

The environmental implications of RTAs are a subject of intense debate. While RTAs can promote trade in environmentally friendly goods and technologies, they can also lead to negative environmental consequences. Increased production and consumption can drive up pollution and resource depletion. The ‘race to the bottom’ phenomenon, where countries lower environmental standards to attract investment, is a significant concern. For instance, critics argue that some RTAs incentivize deforestation or unsustainable agricultural practices. However, many modern RTAs include provisions aimed at addressing these concerns, such as incorporating environmental standards into the agreement or promoting sustainable development. The effectiveness of these provisions remains a subject of ongoing scrutiny and debate.

Q 26. What are the key differences between the EU’s single market and a typical free trade area?

The EU’s single market is significantly different from a typical free trade area (FTA). While both eliminate tariffs and reduce trade barriers, the EU goes much further. A typical FTA primarily focuses on reducing or eliminating tariffs on goods traded between member countries. The EU’s single market goes beyond that by encompassing the free movement of goods, services, capital, and people (the ‘four freedoms’). This also includes harmonization of regulations across a vast range of sectors, fostering a level playing field and reducing non-tariff barriers. In contrast, an FTA generally leaves national regulations relatively untouched, potentially leading to more non-tariff barriers. This deeper integration within the EU results in a much more unified and integrated economic area than a typical FTA.

Q 27. Analyze the impact of sanctions on regional trade agreements.

Sanctions imposed on a country can severely disrupt regional trade agreements. If sanctions target a member country, it can restrict that country’s ability to participate fully in the RTA, limiting its trade with other members. This can lead to shortages of goods or services, increased prices, and economic hardship for the sanctioned country and its trading partners. For instance, sanctions imposed on a country could disrupt supply chains, forcing other member states to seek alternative suppliers, potentially impacting the overall competitiveness of the RTA. The impact can vary widely depending on the scope and nature of the sanctions, the importance of the sanctioned country within the RTA, and the resilience of the RTA’s members to adapt to the disruptions.

Q 28. Explain the role of technical barriers to trade in regional trade agreements.

Technical barriers to trade (TBTs) are non-tariff barriers that hinder trade through regulations, standards, or testing procedures. RTAs often address TBTs by aiming to harmonize standards and regulations among member countries. Harmonization simplifies trade by reducing the need for businesses to adapt their products or processes to meet multiple, conflicting requirements. However, achieving harmonization can be challenging due to differing national interests and priorities. RTAs can also establish mechanisms for mutual recognition of standards or testing procedures, allowing products that meet the standards of one member country to be accepted in others without additional testing. Efficient mechanisms for addressing TBTs are crucial for maximizing the benefits of RTAs, fostering a level playing field, and promoting trade among members.

Key Topics to Learn for Understanding of Regional Trade Agreements (e.g., EU, NAFTA, ASEAN) Interview

- Fundamentals of Regional Trade Agreements: Definition, objectives, and types of RTAs (e.g., free trade areas, customs unions, common markets).

- Specific RTA Analysis: In-depth understanding of at least one major RTA (EU, NAFTA/USMCA, ASEAN) including its history, member states, and key provisions.

- Tariff and Non-Tariff Barriers: How RTAs impact tariffs, quotas, subsidies, and other trade barriers. Analyze the effects on domestic industries and consumers.

- Rules of Origin: Understanding the criteria for determining the origin of goods under different RTAs and their implications for trade.

- Dispute Settlement Mechanisms: How disputes are resolved within the framework of specific RTAs. Understanding the processes and potential outcomes.

- Impact on Investment and Foreign Direct Investment (FDI): How RTAs stimulate or restrict FDI flows and their impact on economic development.

- Regional Value Chains and Supply Chains: Analyze how RTAs influence the organization and efficiency of regional production networks.

- Economic Impacts: Understanding the theoretical and empirical evidence on the economic effects of RTAs (e.g., trade creation, trade diversion, welfare impacts).

- Political and Social Implications: Explore the political and social consequences of RTAs, including potential impacts on national sovereignty and social equity.

- Comparative Analysis of RTAs: Ability to compare and contrast different RTAs, highlighting their strengths, weaknesses, and unique characteristics.

Next Steps

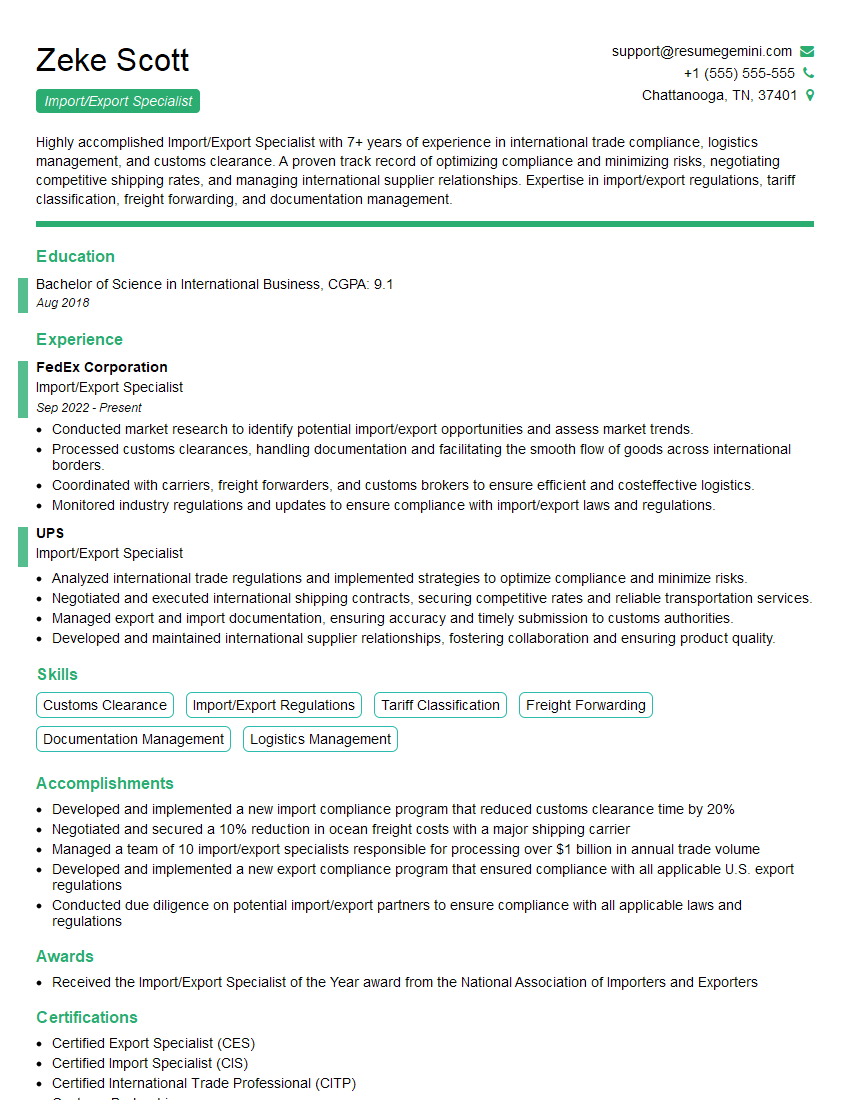

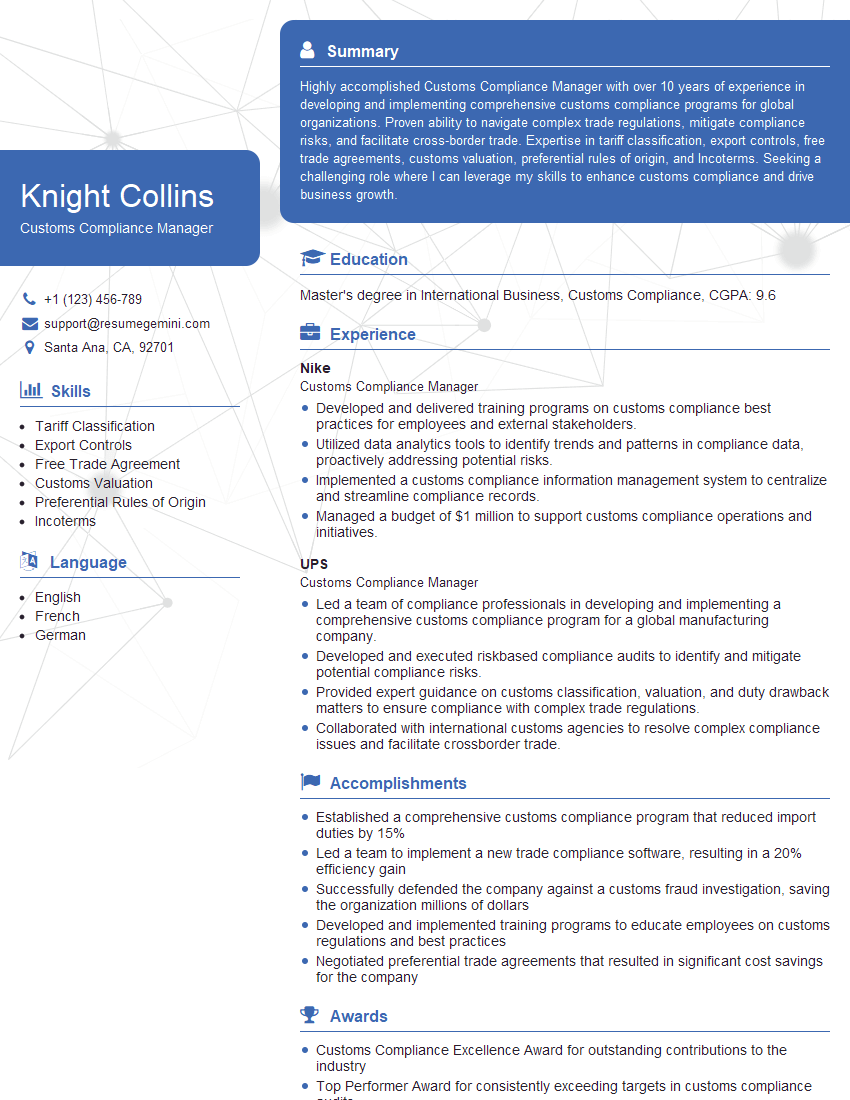

Mastering the intricacies of Regional Trade Agreements is crucial for career advancement in international trade, economics, and policy. A strong understanding of these agreements demonstrates valuable analytical and problem-solving skills highly sought after by employers. To maximize your job prospects, crafting an ATS-friendly resume is essential. ResumeGemini is a trusted resource that can help you build a professional and effective resume that highlights your expertise in RTAs. Examples of resumes tailored to Understanding of Regional Trade Agreements (e.g., EU, NAFTA, ASEAN) are available to help you get started.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.