Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Warranty and Insurance Claims interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Warranty and Insurance Claims Interview

Q 1. Explain the difference between a warranty and an insurance claim.

The key difference between a warranty and an insurance claim lies in their nature and purpose. A warranty is a guarantee from the manufacturer or seller that a product will function as promised for a specified period. If the product fails within that period due to a manufacturing defect, the warranty covers repair or replacement. Think of it as a promise built into the sale. An insurance claim, on the other hand, is a request for compensation from an insurance company for a loss covered by an insurance policy. This loss is usually due to an unforeseen event, like damage from an accident or theft. It’s a contractual agreement where you pay premiums for protection against specific risks.

Example: Imagine you buy a new washing machine. The manufacturer’s warranty covers mechanical failures for one year. If the motor fails within that year, you submit a warranty claim directly to the manufacturer. However, if your washing machine is damaged in a fire (not due to a manufacturing defect), you would file an insurance claim with your homeowner’s or renter’s insurance provider, assuming you have such coverage.

Q 2. Describe your experience handling high-volume claims.

Throughout my career, I’ve managed high-volume claims in various settings, including a large appliance retailer and a national insurance provider. At the retailer, we processed hundreds of warranty claims weekly, ranging from simple repairs to complex replacements. I developed and implemented a streamlined process involving claim intake, verification, vendor management, and customer communication, significantly improving efficiency and reducing processing times. At the insurance company, I was part of a team that handled thousands of claims annually, utilizing sophisticated claims management software to track and manage claims from initial report to final resolution. We categorized claims based on type, severity and urgency, allowing us to optimize resource allocation. My experience allowed me to successfully manage peaks in claims volume during seasonal events and natural disasters.

For example, during a particularly busy period we faced a surge in claims due to a severe storm. By implementing a triage system based on the type and urgency of the claims, and by coordinating effectively with our adjusters, we ensured that the most urgent cases were addressed promptly and that the customers received timely updates.

Q 3. How do you prioritize claims based on urgency and severity?

Prioritizing claims involves a multi-faceted approach combining urgency and severity. I use a system that considers several factors. Urgency refers to how quickly a claim needs attention – a burst pipe causing water damage is far more urgent than a minor scratch on a car. Severity refers to the extent of the loss – a total vehicle loss is more severe than a small dent. I typically employ a matrix system, where claims are categorized based on both urgency and severity.

- High Urgency, High Severity: Immediate attention, typically involving expedited processing and direct communication with the customer. (e.g., major house fire)

- High Urgency, Low Severity: Prompt attention, though potentially with slightly less expedited processing. (e.g., a minor car accident requiring immediate roadside assistance)

- Low Urgency, High Severity: Requires thorough investigation and documentation but can be addressed in a more structured timeframe. (e.g., a complex insurance claim involving multiple parties)

- Low Urgency, Low Severity: Can be processed according to standard procedures. (e.g., a small dent in a car, minor appliance malfunction covered under warranty)

This system ensures that resources are allocated effectively and that customers receive timely and appropriate attention.

Q 4. What software or systems have you used for claims management?

I’ve worked with several claims management systems throughout my career. These include Guidewire ClaimCenter, a comprehensive platform for property and casualty insurance, and IMS (Insurance Management System), a platform used for various types of claims management. These systems offered features like automated workflow, claim tracking, reporting, and communication modules. In smaller settings, I’ve utilized simpler database solutions coupled with customized software to manage claims effectively. My proficiency in these systems extends to data entry, report generation, data analysis and utilizing these platforms to identify trends and insights for process improvement.

Q 5. Explain your process for investigating a disputed claim.

Investigating a disputed claim involves a structured and thorough approach. My process typically includes:

- Reviewing all documentation: This includes the initial claim, supporting documentation (photos, police reports, etc.), and any communication with the claimant.

- Contacting the claimant: Understanding their perspective and gathering any additional information is crucial.

- Conducting a thorough investigation: This might involve contacting witnesses, experts, or other relevant parties.

- Analyzing the evidence: This step involves objectively assessing the evidence to determine the validity of the claim.

- Applying relevant policies and procedures: I ensure that all decisions are consistent with the applicable insurance policy or warranty terms and conditions.

- Documenting the investigation: A complete record is essential for transparency and accountability.

- Communicating the decision: Providing clear and concise explanations to the claimant regarding the outcome of the investigation.

Example: In a disputed auto insurance claim, where the claimant alleged more damage than the evidence showed, I meticulously reviewed photos, the police report, and the mechanic’s assessment. Through careful analysis and comparison, I identified inconsistencies, leading to a fair resolution based on the actual damage.

Q 6. How do you handle difficult customers or escalated complaints?

Handling difficult customers or escalated complaints requires patience, empathy, and strong communication skills. My approach is built on active listening, demonstrating a genuine understanding of their concerns. I aim to de-escalate the situation by acknowledging their frustration and validating their feelings. I then explain the claims process clearly and transparently, outlining the reasons for any decisions made. If the issue cannot be resolved immediately, I offer a timeline for resolution and maintain consistent communication throughout the process. For highly escalated complaints, I involve a supervisor or manager to ensure a fair and impartial resolution.

For example, I once handled a highly frustrated customer who felt their claim was unfairly denied. By actively listening to their concerns and explaining the reasons for our decision in detail, I was able to build trust and ultimately, find a compromise that satisfied both parties. In another case, involving a severe disagreement, I worked with my supervisor to find a mutually agreeable solution which reduced the customer’s frustration and resolved the claim.

Q 7. Describe your experience with fraud detection and prevention in claims.

Fraud detection and prevention are critical in claims management. My experience involves implementing and utilizing various strategies, including:

- Data analysis: Identifying patterns and anomalies in claim data that might indicate fraudulent activity.

- Verification procedures: Implementing rigorous verification processes to validate claimant information and supporting documentation.

- External database checks: Utilizing databases to cross-reference claimant information and identify potential red flags.

- Special investigation units (SIU): Collaborating with SIU teams to investigate suspected fraud cases.

- Claims adjuster training: Ensuring that adjusters are trained to recognize potential indicators of fraud.

For instance, I noticed a pattern of unusually high claims from a specific geographic area. Further investigation, utilizing data analysis and external database checks, revealed a ring of individuals filing fraudulent claims. Reporting this to the SIU led to a successful investigation and recovery of significant losses.

Q 8. How familiar are you with various types of insurance policies (e.g., liability, property)?

My familiarity with various insurance policies is extensive. I possess a deep understanding of both personal and commercial lines. This includes a strong grasp of liability insurance, which covers financial losses due to third-party injuries or property damage caused by the insured. For example, a homeowner’s liability policy would cover a guest who slips and falls on an icy walkway. Property insurance, another critical area of my expertise, covers damage or loss to the insured’s own assets. This encompasses various types, including homeowner’s insurance (covering dwelling, personal property, and liability), commercial property insurance (covering buildings and their contents), and auto insurance (covering damage to the insured vehicle and liability for accidents). Beyond these core types, I’m also familiar with other lines such as workers’ compensation, professional liability (Errors & Omissions), and various types of specialized commercial insurance like product liability.

I understand the nuances of different policy structures, including deductibles, limits of liability, exclusions, and endorsements. This understanding allows me to accurately assess claims and ensure fair and consistent processing.

Q 9. What is your understanding of subrogation in insurance claims?

Subrogation, in the context of insurance claims, is the right of an insurer, after it has compensated its insured for a loss, to recover the amount paid from a third party who caused the loss. Think of it as the insurer stepping into the shoes of the insured to pursue legal action against the responsible party. For example, if a driver causes an accident and damages another car, the insurer of the damaged car will pay out the claim to their insured. The insurer can then pursue subrogation against the at-fault driver’s insurance company to recoup their payout. This process is crucial for cost control within the insurance industry. It helps keep premiums lower by recovering funds from negligent parties, ensuring that the costs associated with losses are borne by those responsible. Successful subrogation requires careful investigation, documentation of liability, and often, legal action.

Q 10. How do you ensure compliance with regulatory requirements in claims handling?

Compliance with regulatory requirements is paramount in claims handling. My approach involves a multi-faceted strategy. Firstly, I stay abreast of all relevant state and federal regulations, including those related to claim handling timelines, documentation requirements, and consumer protection laws. I achieve this through continuous professional development, subscribing to industry publications, and actively participating in regulatory updates and training sessions. Secondly, I meticulously document every step of the claims process, ensuring that all interactions and decisions are recorded accurately and in compliance with these regulations. This includes maintaining detailed records of communication with claimants, investigators, and other relevant parties. Finally, our claims processing system is designed with compliance built-in, implementing automated checks and alerts to flag potential compliance issues. Regular audits and quality control reviews ensure that our processes remain compliant.

Q 11. What is your experience with claim reserves and estimations?

Claim reserving and estimation is a critical function that impacts the financial stability of an insurance company. My experience in this area involves using various techniques to estimate the ultimate cost of a claim. This process starts with a thorough assessment of the damage and the potential future costs, considering factors like medical expenses, property repairs, and lost wages. I use actuarial models and statistical analysis to analyze historical data to predict claim costs and refine our estimation process. We often employ different reserving methods such as case reserves (based on individual claim evaluation) and bulk reserves (based on aggregated data). The accuracy of these estimations directly impacts the company’s financial solvency, its ability to pay claims, and its overall profitability. Regular review and adjustments of reserves are crucial to account for changing circumstances and newly available information.

Q 12. Describe a time you had to resolve a complex or unusual claim.

One complex claim involved a multi-vehicle accident with conflicting witness statements and significant property damage. The initial investigation pointed to one driver as at-fault, but inconsistencies in the witness statements and evidence created ambiguity. To resolve this, I employed a multi-pronged approach. I conducted thorough interviews with all involved parties, obtained accident reconstruction reports from an expert, and reviewed all available evidence including police reports and dashcam footage. The analysis revealed that although one driver initially appeared at-fault, their actions were a direct result of the negligent driving of another party. This required carefully presenting this revised liability determination to all parties involved, supported by the comprehensive evidence gathered. While challenging, this detailed and impartial investigation resulted in a fair and equitable settlement for all parties, showcasing the importance of meticulous investigation in complex claims.

Q 13. How do you use data analysis to identify trends and improve claim processes?

Data analysis plays a vital role in identifying trends and improving claim processes. We use various analytical tools and techniques to mine claim data to unearth patterns and anomalies. For instance, by analyzing the types of claims, their frequency, and associated costs, we can identify areas where losses are higher than anticipated, such as specific geographic regions or types of property. This analysis helps us refine our underwriting procedures to minimize future losses, and also highlight areas where fraud is more prevalent. We also use data analysis to optimize our claim handling process, identifying bottlenecks and inefficiencies in our workflows. For example, analyzing claim handling times can help us identify areas where automation or process changes can expedite the process, leading to improved customer satisfaction and reduced processing costs.

Q 14. Explain your understanding of indemnity and its application in insurance claims.

Indemnity, in the context of insurance, is the principle of restoring the insured to their pre-loss financial position. It doesn’t aim to make the insured richer; instead, it focuses on compensating for actual losses incurred. For example, if a house burns down, the indemnity principle means the insurance company will pay for the cost of rebuilding the house to its pre-loss condition, not for a more luxurious replacement. This principle is crucial because it prevents the insured from profiting from a loss. It also helps to maintain the integrity of the insurance market by preventing exaggerated or fraudulent claims. In practice, this often involves detailed assessments of damage, obtaining multiple quotes for repairs, and carefully verifying all claimed expenses to ensure that the compensation provided accurately reflects the actual loss suffered by the insured.

Q 15. What is your experience with different types of warranties (e.g., express, implied)?

Warranties are legally binding agreements guaranteeing the quality of a product or service for a specific period. There are two main types: express and implied. Express warranties are explicitly stated by the seller, either orally or in writing (like in a product manual). For example, a manufacturer might state, “This appliance is warranted for one year against defects in materials and workmanship.” Implied warranties are not explicitly stated but are understood to exist under the law. The most common are the implied warranty of merchantability, which guarantees that a product is fit for its ordinary purpose (e.g., a toaster should toast bread), and the implied warranty of fitness for a particular purpose, which guarantees a product’s suitability for a specific purpose the buyer communicated to the seller. For instance, if you tell a salesperson you need a saw to cut through steel, they implicitly warrant it will do so. My experience spans handling claims under both types, requiring careful examination of sales contracts, product documentation, and relevant consumer protection laws to determine warranty coverage.

I’ve also dealt with more nuanced warranty situations, such as extended warranties purchased separately, which often have their own specific terms and conditions, and pro-rata vs. full-replacement warranties. Understanding these nuances is critical for accurate claim assessment.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle claims involving multiple parties or conflicting information?

Claims involving multiple parties or conflicting information require a methodical approach. I always start by clearly identifying all involved parties—manufacturer, retailer, consumer, insurance provider, etc.—and documenting each party’s version of events. This involves gathering and meticulously reviewing all available evidence, such as purchase receipts, repair orders, photos, expert reports, and witness statements. I create a detailed timeline of events to identify inconsistencies or discrepancies. When information conflicts, I employ techniques such as cross-referencing documents, interviewing witnesses independently, and sometimes, engaging independent experts to obtain unbiased opinions. For instance, in a case where a damaged product had been shipped through multiple carriers, I’d contact each carrier to determine which is responsible. A key aspect is maintaining neutrality and objectively evaluating all evidence before forming a conclusion.

Q 17. Describe your experience with claim documentation and record-keeping.

Comprehensive claim documentation is paramount. My experience involves establishing and adhering to rigorous record-keeping procedures. This includes utilizing a robust claims management system to store all relevant documents—from initial claim submissions to final settlement agreements. I follow a strict system of indexing and filing using standardized naming conventions for easy retrieval. All communications (emails, phone calls, letters) are logged and documented. This systematic approach ensures traceability, facilitating audits and simplifying claim processing, especially during legal disputes. It’s crucial to maintain confidentiality and comply with data protection regulations. In several instances, meticulous record-keeping has been instrumental in substantiating our position and successfully resolving complex claims.

Q 18. What is your approach to negotiating settlements in insurance claims?

Negotiating insurance claim settlements requires a balanced approach, combining empathy with firmness. I begin by fully understanding the claimant’s perspective and their needs. This involves active listening and clearly explaining the applicable policy terms and coverage limits. I analyze the claim thoroughly to assess the validity of the claim, considering factors like liability, damages, and applicable laws. The goal is a fair and equitable settlement. I utilize various negotiation techniques such as compromise, concessions, and mediation to reach a mutually acceptable outcome. For example, if a claimant seeks a high settlement amount that is not justified, I explain why and propose a reasonable counteroffer supported by evidence. It’s crucial to maintain transparency and professionalism throughout the process, preserving the relationship with the claimant even while advocating for the insurer’s interests.

Q 19. How do you maintain accurate and up-to-date knowledge of relevant laws and regulations?

Keeping up-to-date with relevant laws and regulations is a continuous process. I subscribe to legal journals, attend industry conferences and webinars, and participate in professional development programs to maintain my expertise. I regularly review changes in consumer protection laws, insurance regulations, and case law. My professional associations and networks also provide valuable resources and insights. Utilizing online legal databases and government websites ensures I have access to the most current legal information. This continuous learning approach is vital for accurate claim assessment and to avoid legal pitfalls. For instance, recent changes in data privacy legislation have significantly impacted how we handle sensitive claimant information.

Q 20. Explain your experience with claims lifecycle management.

Claims lifecycle management involves a structured approach to handling a claim from inception to resolution. My experience covers all stages: 1. First Notice of Loss (FNOL): Receiving and recording the initial claim. 2. Investigation: Gathering evidence and assessing the validity of the claim. 3. Evaluation: Determining liability and the amount of compensation. 4. Negotiation: Reaching a settlement with the claimant. 5. Payment: Disbursing the agreed-upon compensation. 6. Closure: Archiving the claim documentation. Throughout this process, I ensure consistent communication with all parties involved. Utilizing a case management system helps track progress, manage deadlines, and facilitate efficient workflow. A well-managed claims lifecycle minimizes processing time, improves customer satisfaction, and reduces the risk of errors and disputes.

Q 21. How familiar are you with different types of claim denials and appeals processes?

I’m highly familiar with various types of claim denials and the associated appeals processes. Denials can stem from various reasons, including lack of coverage, insufficient evidence, policy violations, or fraud. Understanding the grounds for denial and the specific policy language is crucial. If a claim is denied, I explain the reason clearly to the claimant, providing all supporting documentation. If the claimant wishes to appeal, I guide them through the appeals process, outlining the required steps and documentation. This often involves submitting additional evidence, such as medical reports or expert opinions, and responding to the insurer’s requests for clarification. I’m experienced in navigating internal appeals processes and, if necessary, external dispute resolution mechanisms such as arbitration or litigation. Each appeal is treated carefully and thoroughly to ensure fairness and due process.

Q 22. Describe your proficiency in using claims management software.

My proficiency in claims management software spans several leading platforms, including Guidewire ClaimCenter, ClaimsPro, and Adjuster. I’m adept at utilizing their features for various tasks: from initial claim intake and documentation to investigation, assessment, and final settlement. I’m comfortable navigating complex workflows, configuring reporting dashboards, and integrating with other systems like CRM and accounting software. For instance, in my previous role, I leveraged Guidewire ClaimCenter’s automation features to significantly reduce processing times for simple claims, freeing up more time to focus on complex cases. I’m also proficient in using the reporting functionalities to analyze claim trends and identify areas for process improvement. My experience extends to both the technical aspects of software operation and the strategic utilization of these tools to optimize the claims handling process.

Q 23. What metrics do you use to track and measure your performance in claims handling?

Tracking and measuring performance in claims handling requires a multi-faceted approach. I utilize a range of key performance indicators (KPIs) including:

- Average Claim Settlement Time (ACST): This metric measures the efficiency of the claims process from intake to resolution. A lower ACST indicates faster and more efficient handling.

- Claim Cycle Time: This measures the total time taken to process a claim, from the date of reporting to the final payment.

- Claim Handling Cost per Claim: This helps track expenses related to each claim, including investigation costs, legal fees, and personnel expenses. Lower costs are generally more desirable, balanced against appropriate claim handling.

- First Report of Injury (FRI) to Closure Time: This specifically tracks the speed of resolution for injury-related claims.

- Customer Satisfaction (CSAT) Scores: This crucial metric evaluates customer experiences with the claims process. High CSAT scores indicate a positive and efficient process.

- Claim Accuracy Rate: Measures the percentage of claims processed without errors or needing rework. This helps identify areas for training and process improvements.

Regularly monitoring these KPIs allows me to identify bottlenecks, implement process improvements, and demonstrate a consistent commitment to improving the efficiency and effectiveness of the claims department. For example, if the ACST is consistently high, I would investigate the root cause—possibly insufficient staffing, complex claim types, or inefficiencies in the workflow—and implement solutions like improved workflow automation or additional training.

Q 24. How do you manage stress and pressure during peak claim periods?

Peak claim periods inevitably bring increased pressure. My approach to managing stress involves a combination of proactive strategies and coping mechanisms. These include:

- Prioritization and Time Management: I utilize techniques like time blocking and prioritization matrices to focus on the most critical claims first, ensuring timely processing of urgent cases.

- Effective Delegation: When feasible, I delegate tasks to qualified team members to distribute the workload effectively.

- Process Optimization: Identifying and eliminating bottlenecks in the claims process through automation and workflow improvements helps reduce overall workload during peak times.

- Self-Care: Maintaining a healthy work-life balance through exercise, sufficient sleep, and mindful relaxation techniques is essential for managing stress levels sustainably.

- Teamwork & Communication: Open communication with my team is crucial. Collaborating and supporting each other creates a positive and supportive environment during periods of high pressure.

For example, during a recent hurricane season, we proactively increased staffing and automated certain aspects of the claim intake process, allowing us to manage the surge in claims effectively while maintaining a high level of customer service.

Q 25. Describe your experience with communicating effectively with customers, insurers, and other stakeholders.

Effective communication is the cornerstone of successful claims handling. I’ve consistently demonstrated the ability to communicate clearly and empathetically with customers, insurers, and other stakeholders. I adapt my communication style to suit the audience and the context, utilizing various channels such as phone calls, emails, letters, and video conferencing.

- Customers: I prioritize empathy and understanding, acknowledging their distress and providing clear, concise explanations throughout the process. I use plain language, avoiding jargon, and keep them updated regularly on the claim status.

- Insurers: I maintain professional and respectful communication, providing accurate and well-documented information to support the claim. I’m adept at negotiating settlements and resolving disputes effectively.

- Other Stakeholders: This could include legal representatives, appraisers, or expert witnesses. I maintain clear, concise, and professional communication with these stakeholders, ensuring they have the necessary information to fulfill their roles.

For instance, when dealing with a particularly upset customer, I used active listening to understand their concerns before explaining the process and timeline for resolution. This approach resulted in a more positive outcome than a purely transactional approach.

Q 26. What is your understanding of the legal aspects of warranty and insurance claims?

My understanding of the legal aspects of warranty and insurance claims is comprehensive. I’m familiar with various legal principles, including contract law, tort law, and the specific regulations governing insurance policies in relevant jurisdictions. This includes:

- Contract Interpretation: I understand how to interpret policy wording, terms and conditions, and exclusions to determine coverage accurately.

- Statutory Requirements: I’m aware of the legal requirements related to claim notification, investigation, and settlement, as outlined by regulatory bodies.

- Evidence and Documentation: I know the importance of gathering and preserving relevant evidence and documentation to support claims and defend against potential disputes.

- Legal Precedents: I am familiar with relevant case law and precedents, helping in assessing the likelihood of success or challenges in claims handling.

- Dispute Resolution: I’m knowledgeable about various dispute resolution methods, including negotiation, mediation, arbitration, and litigation.

This legal knowledge ensures I handle claims accurately, minimizing legal risks and protecting the interests of both the claimant and the insurer. For example, understanding the principle of ‘proximate cause’ helps to determine whether a loss is covered under the policy’s terms.

Q 27. How would you handle a claim that exceeds the policy limits?

Handling a claim exceeding policy limits requires a structured approach focused on transparency and communication. The process would typically involve:

- Confirming the Claim Exceeds Limits: A thorough review of the claim and the policy documentation is crucial to definitively determine that the claim amount surpasses the policy’s coverage limits.

- Notifying the Claimant: Open and honest communication with the claimant is essential. They must be clearly informed that the claim exceeds the coverage limits and the extent of the shortfall.

- Exploring Additional Coverage: Investigate whether there are any other applicable insurance policies (e.g., umbrella liability, secondary insurance) that might cover the excess amount.

- Negotiating a Settlement: Explore options to negotiate a partial settlement within the policy limits, potentially coupled with alternative dispute resolution methods.

- Documenting All Communication and Actions: Maintaining clear and detailed records of all communication, actions, and decisions related to the claim is critical for transparency and potential legal recourse.

- Seeking Legal Counsel if Necessary: In complex cases or situations involving significant disputes, seeking legal counsel is advisable.

For instance, if a customer had a claim for $150,000, but their policy only covered $100,000, we would clearly explain this to them and explore options such as making a partial payment within the policy limits and exploring any secondary insurance coverage. Open communication and a clear explanation of the process is key to maintaining a positive customer relationship even in challenging situations.

Key Topics to Learn for Warranty and Insurance Claims Interview

- Understanding Warranty Types: Explore different warranty structures (e.g., manufacturer’s warranty, extended warranty, service contracts) and their implications for claims processing.

- Claims Assessment & Investigation: Learn how to effectively assess the validity of a claim, gather necessary documentation, and conduct thorough investigations to determine liability.

- Insurance Policy Interpretation: Develop a strong understanding of insurance policy language, exclusions, and coverage limits to accurately assess claims within policy parameters.

- Claims Processing & Documentation: Master the steps involved in processing a claim, from initial intake to final resolution, emphasizing meticulous record-keeping and adherence to company procedures.

- Fraud Detection & Prevention: Understand common fraud schemes and techniques used in warranty and insurance claims, and learn how to identify and mitigate potential risks.

- Customer Communication & Negotiation: Practice effective communication skills for interacting with claimants, explaining claim decisions, and potentially negotiating settlements.

- Regulatory Compliance: Familiarize yourself with relevant regulations and legal frameworks governing warranty and insurance claims in your area of operation.

- Technical Aspects (if applicable): Depending on the role, you may need to demonstrate understanding of specific software or systems used in claims processing, data analysis, or related areas.

- Problem-solving and Decision-making: Develop your ability to analyze complex scenarios, identify key issues, and make informed decisions based on available information and policy guidelines.

Next Steps

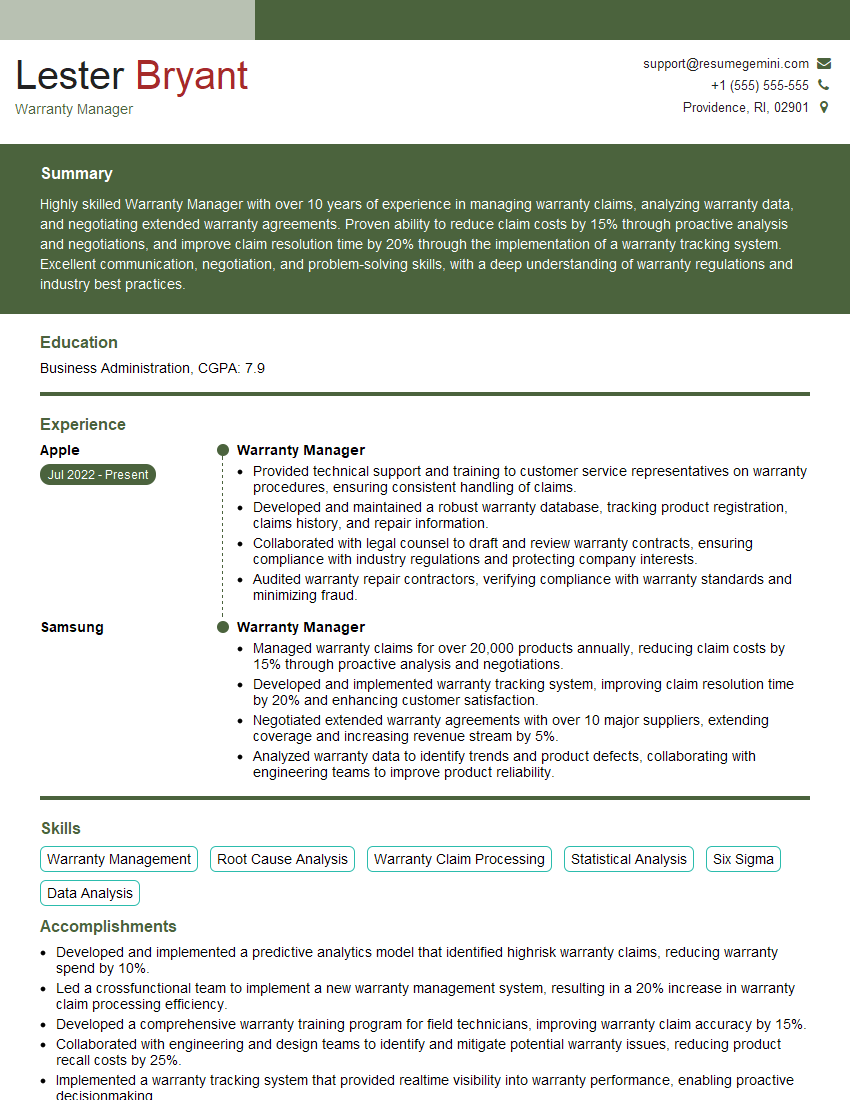

Mastering Warranty and Insurance Claims opens doors to rewarding career opportunities with excellent growth potential. To significantly boost your job prospects, focus on building a compelling and ATS-friendly resume that highlights your skills and experience in this field. ResumeGemini is a trusted resource that can help you craft a professional resume tailored to the specific requirements of Warranty and Insurance Claims roles. Examples of resumes tailored to this field are available through ResumeGemini, making the process of creating a strong application significantly easier. Invest the time in creating a top-notch resume; it’s your first impression and a key factor in securing interviews.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

This was kind of a unique content I found around the specialized skills. Very helpful questions and good detailed answers.

Very Helpful blog, thank you Interviewgemini team.